Halie O’Shea, Senior Research Analyst

hoshea@haverfordquality.com

Tim Hoyle, Co-Chief Investment Officer

thoyle@haverfordquality.com

First Quarter in Quarantine

The coronavirus, now named COVID-19, has shut down the Chinese economy. The case count and death toll has been rising with latest estimates of about 73,000 infected and nearly 1,900 deaths, mostly in China. According to Lawrence Gostin, director of the World Health Organization Collaborating Center on Public Health Law & Human Rights, the number of coronavirus cases may be much higher than China is reporting. That may not be a deliberate effort to downplay the outbreak but could signal problems “with China’s capacity for testing and surveillance,” he said. “They are just not picking up all the cases and deaths. An even greater problem is that there is no independent verification.”

We still believe that the hypervigilance being displayed in China and around the world will save human lives and prove to be a warranted course of action in the end. In the short-run, the cost of the “cure” to economic activity and corporate profits is piling up. But history indicates such hits should be transitory.

Apple was one of the first major U.S. companies to issue a report saying that it will miss its first quarter revenue guidance due to the coronavirus outbreak. Store closures in China plus low store traffic in those that have remained open and manufacturing interruptions will negatively impact sales for the quarter ending in March. iPhone manufacturing partner facilities have reopened but they are ramping up more slowly than anticipated. Apple did not quantify the impact, as the situation is evolving, but said sales will fall below its initial $63 billion to $67 billion forecast. Greater China accounts for about 17% of Apple’s revenue, and an estimated 70% of Apple’s revenue is tied to products manufactured there.

We expect other companies to follow. China has become an increasingly important market for global companies. Luxury goods, cosmetics, and other consumer goods companies have come to rely on strong demand from Chinese consumers shopping at home and abroad. Companies like Starbucks discussed the potential impact of coronavirus on its earnings call in January. At the time Starbucks said that China accounted for about 10% of its sales and the company was closing 50% of its stores there. December quarter trends were strong for the company but Starbucks chose to not raise guidance at the time due to uncertainty around coronavirus.

Others are likely to discuss impact to supply chain due to factory closures and travel restrictions. While reports indicate that many facilities are resuming operations in China, they are operating with lower than normal staffing levels with many facing labor shortages. Over the last few decades global supply chains have become more intricately linked, especially with China, and in the short-term the virus could have far-reaching effects on businesses globally. According to a research report by Dun & Bradstreet, “the affected areas with 100 or more confirmed cases, are home to 90% of all active businesses in China.” The researchers found that “at least 51,000 companies worldwide, 163 of which are in the Fortune 1000, have one or more direct or “tier 1” supplier in the impacted region, while at least 5 million — and 938 in the Fortune 1000 — have one or more “tier 2″ suppliers.”

Even though we anticipate more negative news and earnings preannouncements, we expect the impact of coronavirus to be transitory on these companies. We have seen time and again that the impact of health epidemics and other crisis on the stock market has been short-lived and we will not over-react by selling. Quality companies have enduring brands and business models that stand the test of time. We are confident that Chinese consumers will return to Starbucks stores that are temporarily closed and they will replace their iPhones.

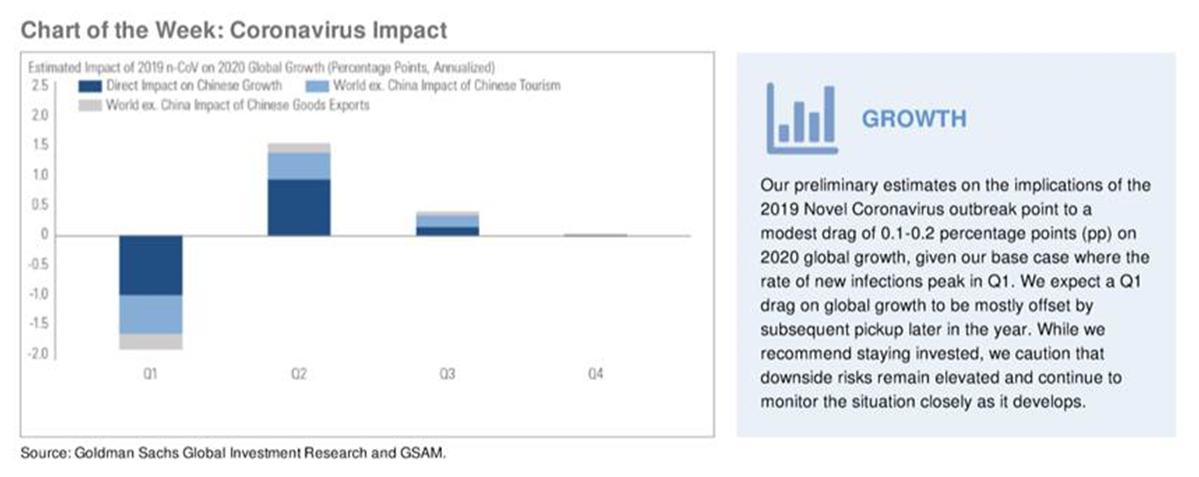

Goldman Sachs economists expect COVID-19 to reduce global GDP by 2%.