Maxine Cuffe, CFA, Senior Research Analyst

mcuffe@haverfordquality.com

Tim Hoyle, CFA, Co-Chief Investment Officer

thoyle@haverfordquality.com

Fear Contagion

News this weekend of emerging outbreaks of COVID-19 (“coronavirus”) in South Korea, Italy, and Iran sparked fears that the virus could turn into a global pandemic. Governments have responded quickly to contain the virus, but it is impossible to contain the fear contagion.

Monday’s decline of close to 1,000 points on Dow Jones Average is in-line with other global markets. This weekend, the media was flooded with stories of panic buying in supermarkets, tens of thousands in lockdown, travel warnings, border closures, and the wide-spread cancellation of conferences and sporting events. Economic disruption is now likely to get worse before it gets better.

Market volatility is not an unexpected reaction to these unusual headlines and may lead to a correction in equity markets. However, we see this as a very typical pullback in an ongoing bull market. Equities will continue to be supported by low interest rates and the strength of the U.S. consumer – neither of which is likely to be thrown off course by the coronavirus. With the strong response from governments, investors will be looking for any signs of a slowing spread or containment of the virus. Until then, markets will remain volatile as investors digest these headlines.

While there is still much uncertainty about how the virus will play out over the coming weeks, it is clear the economic impact is worsening. Last week, we estimated that the disruption would knock 200 basis points off Q1 2020 Global GDP growth. In light of the escalation in global cases and concurrent responses over the weekend, these initial expectations will likely prove too optimistic. This economic disruption will now almost certainly bleed into the second quarter, and any hope of a short V-shaped rebound now has to be pushed into the future.

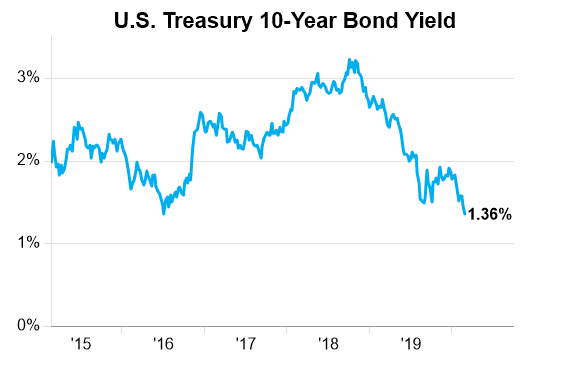

The bond market is pricing in a deteriorating outlook with more aggressive expectations for another Fed rate cut in the middle of this year. The flight to quality is depressing bond yields, with the 10-year retreating to 1.37% and the 30-year treasury reaching an all-time low of 1.83%.

With history as our guide, we anticipate that by this time next year coronavirus will no longer be the global health emergency it is today. We anticipate the equity markets, which are now trading flat for the year, will rebound well before the economic data does. Generally, markets have long since bottomed by the time the positive news stories have been written.

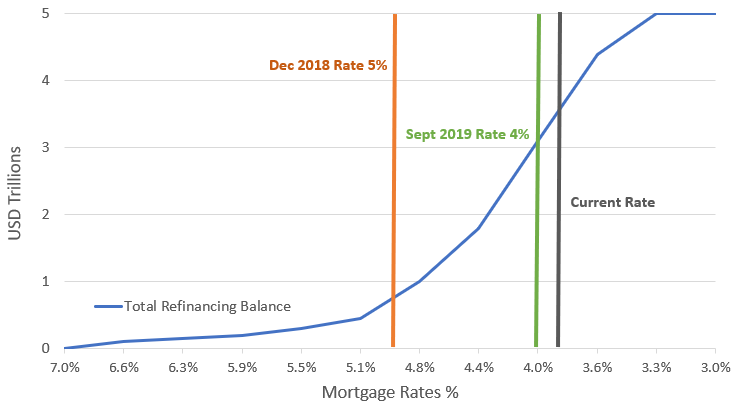

The silver lining for U.S. investors: mortgage rates, which tend to follow the 10-year treasury yield, have sunk below 4%, close to record lows. This is spurring demand for home buying and refinancing. New home construction has popped in recent quarters, while the National Association of Home Builders (NAHB) Home Builder Sentiment Index hit all-time highs. The 100 basis point decline in mortgage rates since December 2018 has the potential to generate $3.5 trillion in refinancing, seven times the level of a year ago. This refi wave helps not just the home building sector but consumer spending overall.

Falling bond yields reflect a flight to safety.

Source: FactSet Research Systems

Refinancing potential rises as rates fall.

Source: Bloomberg and Mortgage Bankers Association

Investors will get an update on the health of the consumer this week, when Home Depot, Lowes, and TJX report earnings. The home improvement industry has been strong in recent years, driven by higher wages, growing confidence in the housing sector, and the aging of the housing stock which has fueled a remodeling boom.