Haverford Insights 2020: The Internet Fulfills its Promise

It is hard to believe the World Wide Web is only 30 years old. In November of 1989, Tim Berners-Lee implemented the first successful communication between a Hypertext Transfer Protocol (HTTP) client and server via the internet. Netscape (NSCP) went public six years later at a value of $2.9 billion and the rest, as they say, is history.

During the early days of the internet, many did not know what to make of it. Only a few visionaries foresaw its true potential. Robert Metcalfe, founder of 3Com, stated “I predict the Internet will soon go spectacularly supernova and in 1996 catastrophically collapse.” Indeed, internet and technology companies offered much promise in the 1990s, but many failed to deliver life-changing products using dial-up modem technology. 3Com no longer exists. But the internet is no longer a novelty— in the last decade, it has grown to encompass everything we do, changed our lives and created fortunes.

A confluence of broadband wireless infrastructure investment, the smart phone, and three decades of the internet did produce life-changing products. The latest series of the Apple Watch may even come to be a life-saving product, as its potential uses go far beyond heart monitoring. We often lament the lack of infrastructure spending in the United States. Our highways have potholes and our airports are relics. We have no hard data to support our next statement, but we believe that investment in internet infrastructure has produced one of the greatest return on investment of all-time, comparable to the Roman aqueducts and Eisenhower’s highway system.

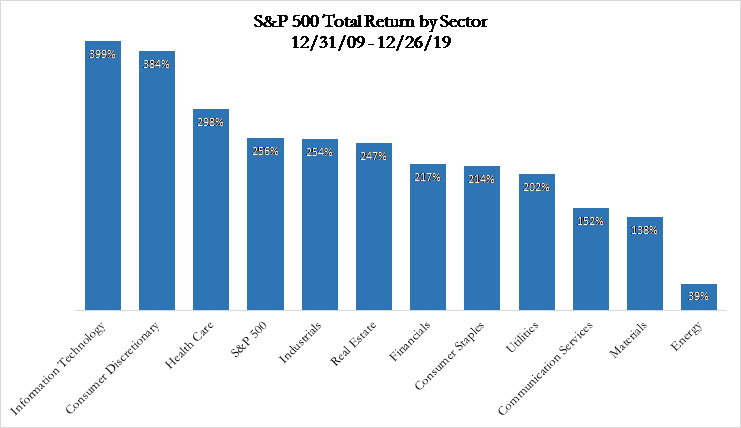

Technology stocks outperformed as the internet pervaded all aspects of commerce.

Source: Strategas Research Partners

Index returns are provided for illustrative purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

The Wall Street Journal recently reported on the Apps That Changed It Alli. Below is a graphic of apps and companies that were started, or came into their own, during the past ten years. While it took decades for the land-line telephone to find its way into a majority of U.S. households, according to CNN, wireless devices outnumbered the U.S. population by 2011ii. Ride sharing such as Uber have become ubiquitous, 40 million watched The Irishman on Netflix (bypassing theaters altogether), and more than 10 million people downloaded Disney+ on the first day it was offered.

Implications for the Next Decade

The internet has pervaded all aspects of our lives. The ability for a visionary, entrepreneurial software developer to change the world overnight has drastically increased the pace of disruption. Creative destruction is positive for the economy, but it now happens at a frighteningly fast speed. Investors need to be aware that companies that once had competitive advantages due to scale, information, and locality are now at risk. History has taught us that today’s disruptors will soon be at risk themselves. Companies like McDonald’s (MCD), Starbucks (SBUX), and Honeywell (HON) have adapted and driven sales utilizing new platforms. Others, like FedEx (FDX), have struggled to adjust to the changes this past decade brought.

Investing in dividend-paying, blue-chip companies often means buying companies that have stood the test of time and successfully navigated past transitions. The shifts of the next decade will likely occur more quickly and with greater frequency. As investors, we need to heed the power the internet, mobile computing, and wireless technology has created. The next decade will likely bring innovation at an even faster pace, forcing investors to stay nimble for whatever disruption comes next.

Uber |

Instagram |

Facetime |

Tinder |

Waze |

Netflix |

Spotify |