There is Value in Dividend Growers

Dividend paying stocks significantly underperformed the broader markets in 2023. The S&P Dividend Growers Index[1] returned a respectable 14% on an absolute basis, which paled in comparison to the S&P 500’s 26% return.

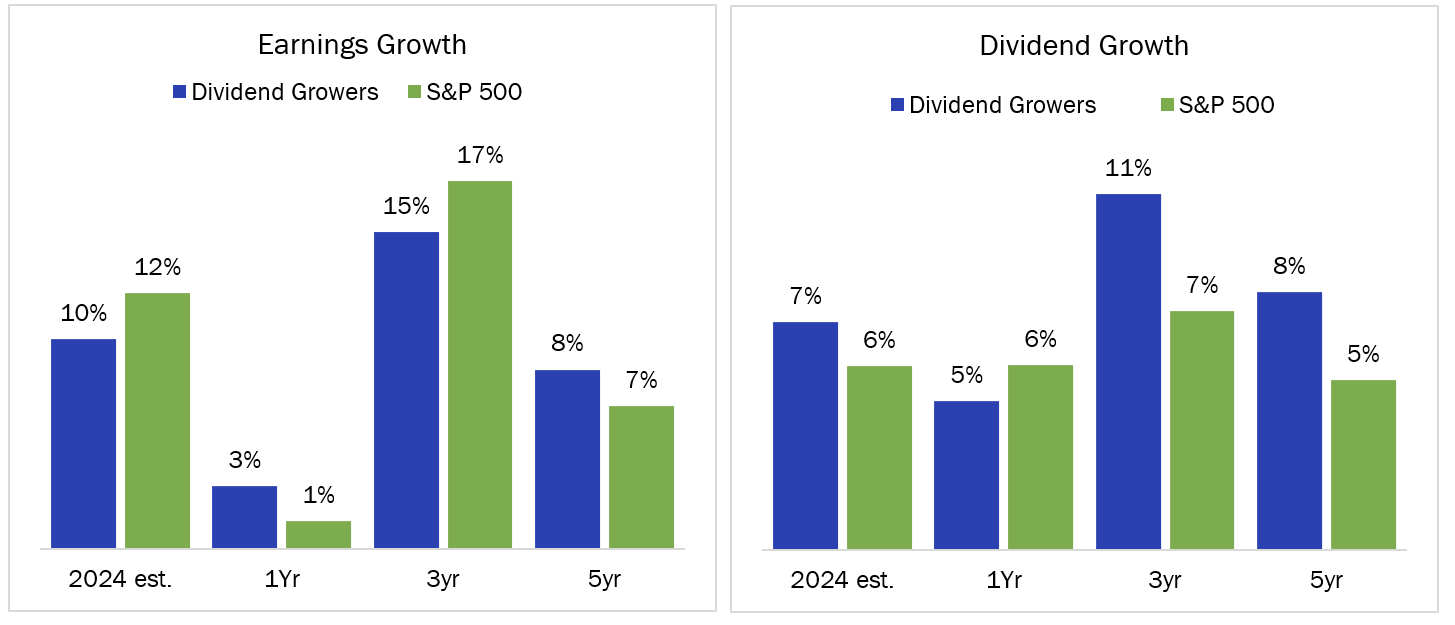

Based on these returns, you may have expected to see a large fundamental divide between dividend growers and the rest of the market. However, a look at the fundamentals does not support the divergent returns. Stocks in the dividend growers index have exhibited earnings and dividend growth comparable with the overall S&P 500.

During the past five years, the 8% earnings growth of Dividend Growers has slightly outpaced the overall market’s 7% growth. True to their namesake index, Dividend Growers’ 8% payout growth far outpaced the market’s 5%. According to recent estimates, the S&P 500’s estimated 2024 12% EPS growth is expected to outpace dividend growers.

012224 1

Source: Haverford; FactSet

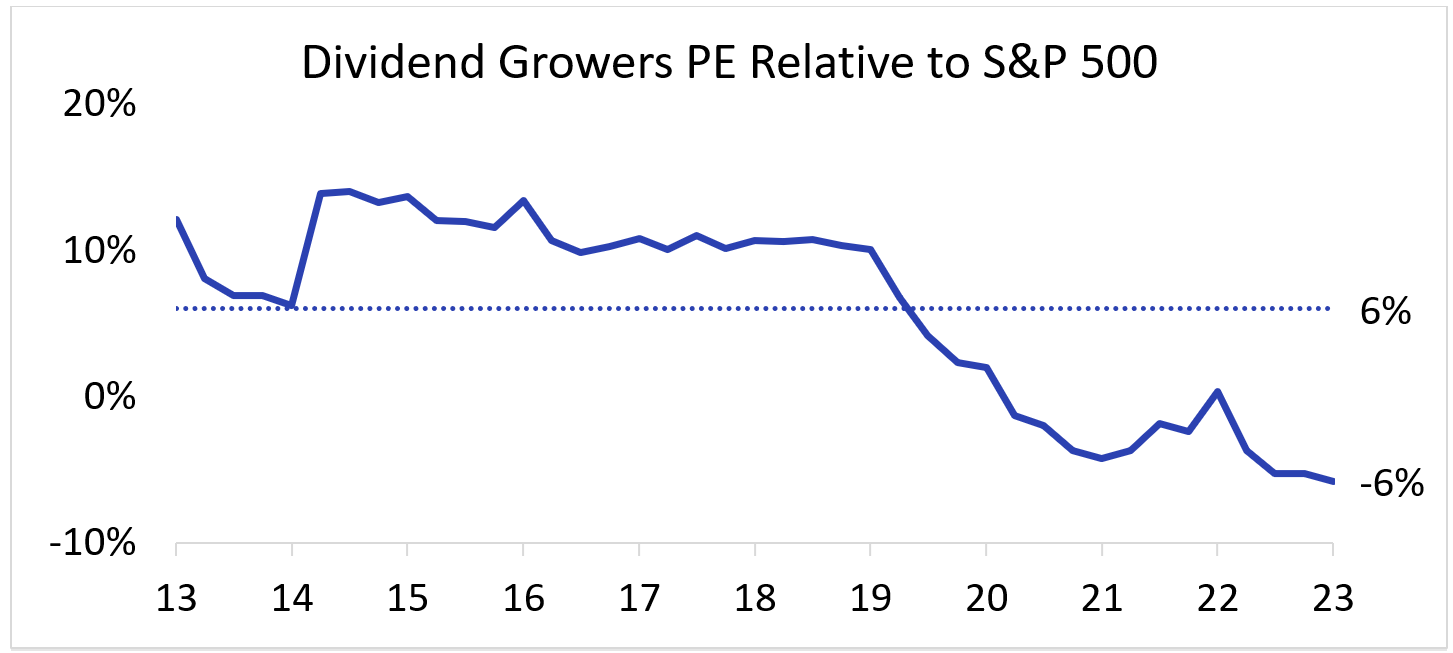

The driver of last year’s underperformance lies mostly in the change of relative price-to-earnings multiples. To start 2023, stocks of Dividend Growers and the S&P 500 traded in parity, but as of the beginning of 2024, this cohort of stocks trades at a 6% discount to the market. As the accompanying chart illustrates, this is the largest discount of the past 10 years.

We expect to see a convergence of multiples in the future and investors holding these dividend growth stocks should experience strong future relative performance. The current valuation discount also means dividend stocks, which tend to exhibit better risk metrics than the overall market, are further de-risked for when valuations next come under pressure. This risk and return profile is very positive news for investors in Haverford’s portfolios, who should feel confident that our steady and disciplined approach will allow investors to meet their long-term goals.

012224 2

Source: FactSet

[1] The S&P U.S. Dividend Growers Index is designed to measure the performance of U.S. companies that have followed a policy of consistently increasing dividends every year for at least 10 consecutive years. The index excludes the top 25% highest-yielding eligible companies from the index.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value