Tim Hoyle, Chief Investment Officer

Thoyle@haverfordquality.com

Realpolitik and Populism Set the Stage for 2026

President Trump went to Davos Switzerland this week to promote his economic agenda and double-down on his desire to acquire Greenland. Markets responded positively as the Greenland narrative morphed in a matter of days from threats of military action, increased tariffs and the need for "immediate negotiations" before finally settling on a "framework for a future deal." However, even as the discourse turns more positive, global leaders remain uneasy and have not been shy to share their negative opinions of Trump's aggressive negotiating tactics while at Davos.

Trumpian realpolitik, defined as transactional, America-first, and bluntly pragmatic bordering on bullying, appears to be proving successful on many fronts. However, the long-term costs of this approach to global affairs could prove problematic. Setting aside the merits of acquiring Greenland, which the President articulated in his Davos speech, these tactics risk undermining global confidence in the stability and predictability of American economic leadership. The United States has been the global magnet for capital and talent for the past 80 years, reinforcing a competitive advantage relative to other economies.

Strategas' Dan Clifton notes that past disagreements between NATO countries were surpassed by their shared experiences of WWII. However, no world leader alive today experienced the shared bond and trust stemming from the US-European alliance in World War II. As trust erodes, disagreements can become amplified, and capital markets take note. The "Sell America" trend, born out of the last years' tariff wars, has accelerated in recent days and weeks. Billionaire investor and hedge fund founder Ray Dalio warned of a breakdown in the global monetary order as even allied nations are becoming increasingly unwilling to hold each other's debt -due to geopolitical friction. The rising price of gold and its rising place on foreign central bank balance sheets relative to U.S. Treasury assets highlight these risks.

Picture1

Source: Strategas. Dec 31 2025

We are optimistic that many of the President’s policies will ultimately succeed in reinvigorating the U.S. economy and increasing national security. Changes to the tax code, encouraging direct foreign investment, financial deregulation and innovation are all showing signs of adding to the economy’s momentum in 2026.

In the President’s Davos speech, he focused on the domestic agenda, laying forth a list of populist goals such as capping credit-card interest rates, eliminating defense company stock buybacks, ending corporate purchases of single-family homes, drug-price reductions, and direct payments to consumers to cover health insurance. As the President jokingly commented, you might expect to hear some of these proposals from Mayor Zohran Mamdani of New York. In his populist shift, the President even went so far as to call Massachusetts Senator Elizabeth Warren to discuss credit card rates!

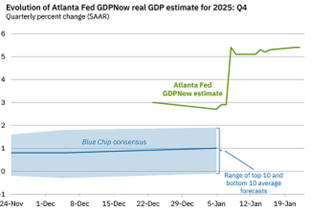

Given the combination of global policy and domestic populism, investors will likely be quick to take profits in 2026 and be wary of taking on more risk. All the ingredients for increased market volatility are present, but so long as the economic and earnings outlook remain promising, we believe any market pullbacks will be short-lived. The Atlanta Fed’s GDPNow model currently estimates Q4 2025 annualized growth of 5.4% and the December jobs report showed unemployment at just 4.4% with healthy wage growth. The latest inflation data showed prices increased 2.7% year over year. According to FactSet, 2026 earnings growth is estimated to be 14%. All the evidence points to a strengthening economy in 2026. Let’s hope policy overreach doesn’t pull defeat out of the jaws of victory.

Picture2

Source: Atlanta Fed GDPNow. Jan 22 2026

Media Inquiries

Veronica McKee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value