Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

Economic Data and Earnings Support the Market’s Rise

Last week’s economic data releases underscore the continued resiliency of the U.S. economy. Quarterly GDP rose 2.9% on an annualized basis, while weekly jobless claims remain very low, and inflationary data points continue to ebb. Corporate earnings have thus far come in better than feared. These positive data points have helped to fuel the S&P 500’s 6% rally so far this year.

While these data points are worth celebrating, the economy is not out of the woods yet and the elusive soft landing is still not guaranteed. A recession in the year ahead remains probable, in our opinion. However, we expect it will be shallow; buttressed by a supply-constrained labor market and conservatively positioned balance sheets given the overwhelming expectation that a recession is coming. Click here to watch our recent Havercast about this subject here.

Chairman Powell and the Federal Open Market Committee are widely expected to raise interest rates by an additional 25 basis points on Wednesday, taking the upper-bound of the Fed Fund’s target range to 4.75%. Given the positive inflation data of the past several months, we anticipate only one or two additional increases of this size over the next several months before the Fed pauses on rate hikes for the remainder of the year.

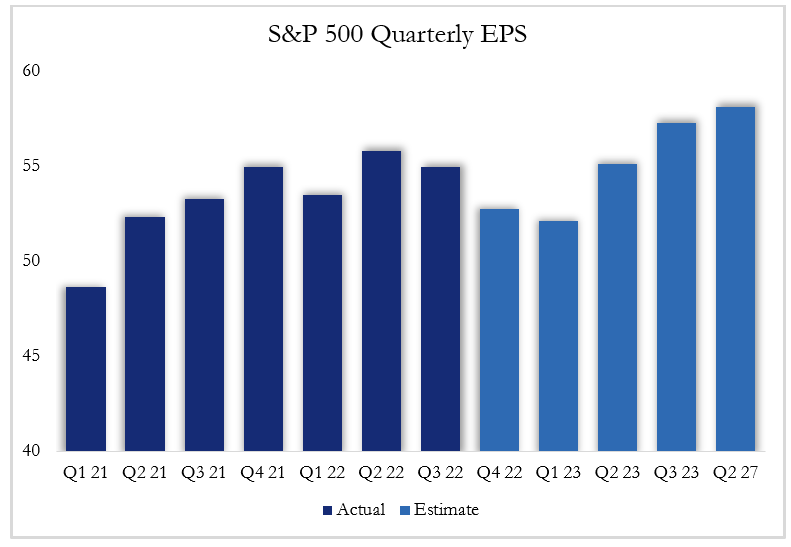

How these economic crosscurrents eventually effect stock prices will ultimately come down to earnings. We continue to believe stocks can provide positive returns in the year ahead even as economic conditions wane. Prices were greatly de-risked in 2022 as interest rates rose and earnings expectations fell.

Corporate earnings have been under slight pressure, but until now have largely withstood the margin pressures brought on by rising wages and softer demand. With 30% of S&P 500 companies reporting actual results so far, 4th quarter earnings are anticipated to 5% year-over-year, according to FactSet. This level of decline and managements’ accompanying commentary falls into the “better than feared” category. We will learn much more and be able to provide a clearer earnings picture next week, as more than one hundred S&P 500 companies, representing close to 35% of the index’s market value, report in the coming days.