Silver Linings and Fresh Starts for 2023

By: Tim Hoyle, CFA, Chief Investment Officer

January 3, 2023 marked the one-year anniversary of the S&P 500’s peak value. 2022’s market upheaval was not unique to equities: for the first time in history both stocks and bonds fell more than 10% in the same year. The year also saw the doubling of both mortgage rates and energy prices. Thankfully, the price of retail gasoline has since declined significantly and is now lower than before Russia’s war in Ukraine.

There is a silver lining to last year’s market declines, investors today can purchase assets at more attractive valuations and with a higher expected rate of return. The prospect of higher expected rates of return after just enduring a year of negative returns may feel like a mediocre consolation prize, but it’s an important part of investing.

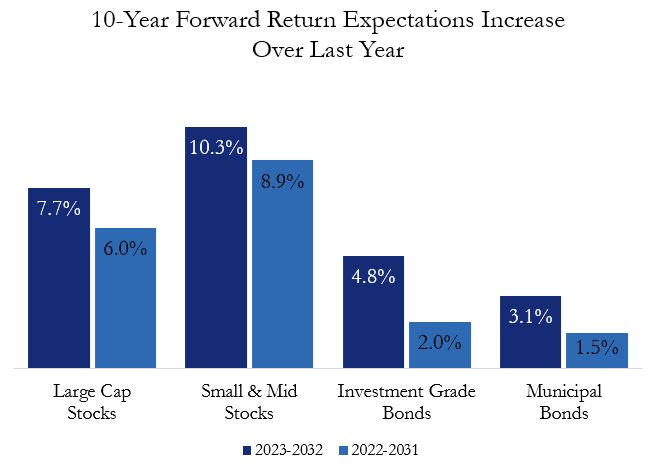

A snapshot of our recently updated capital market assumptions highlights the change in forward expectations this year versus the start of last year. These figures do not represent a projection for what will happen in the year-ahead, rather the annualized return we expect to realize over a 10-year time frame.

Forward returns for large cap stocks (i.e., the S&P 500) increased from 6.0% last year, to 7.7%, while our expected return on the small and mid-capitalization market is greater than 10%. It is worth noting that investors in small cap companies should expect to experience significantly more volatility in return for the prospect of higher returns.

Source: Haverford

Beyond the equity markets, for the first time in a decade, interest rates are quite compelling. Our 10-year fixed income return expectations have more than doubled over last year, with an even higher near-term outlook. The yield on the Bloomberg Aggregate Bond Index is 4.68% as of December 31st compared to 1.75% at year-end 2021. Higher yields translate to an improved ability to meet cash flow needs, while actively managing portfolio exposures can generate even more income. As an example, Intermediate Corporate bonds currently yield 5.42%, which would enable a nonprofit to meet a 5% spending target solely using Investment Grade corporate bonds with maturities between 1 and 10 years. These higher yields also offer far better protection against future inflation. In November, core inflation[1] was 4.7% and the inflation expectation for the next 5-10 years was only 2.9%. This is one of the very few times in the past decade when current bond yields offer an ability to meet spending needs and protect against inflation.

The journey to higher return expectations has been unpleasant, to say the least, but investors should not ignore the opportunity a new year and a “fresh start” offer to reassess their portfolio, investment, and financial plan.

[1] Core Personal Consumption Expenditure Index

The opinions expressed in this presentation are those of Haverford as of 01/03/2023. Views and security holdings are subject to change at any time based on market and other conditions. This presentation is for informational purposes only and should not be construed as investment advice or recommendations with respect to the information or specific securities presented. No forecasts are guaranteed, and past performance is no guarantee of future results.

Projections and estimates are hypothetical in nature and do not reflect actual investment returns or information.