Tim Hoyle, CFA, Co-Chief Investment Officer

thoyle@haverfordquality.com

I’ll See Your $2 Trillion and Raise you $2 Trillion

Congress goes back to D.C. this week, and while the Republicans have expressed a desire to keep the next round of COVID stimulus to $1 trillion, news reports indicate it will be much closer to $2 trillion. As cases rise, states are slowing and, in some cases, reversing re-opening plans, and the outlook for school re-openings is in doubt, Congress will be under immense pressure to act quick and act big. Jobs data has plateaued – New applications for unemployment benefits held steady at 1.3 million last week and approximately 25 million workers are receiving $600 a week in federal unemployment benefits that are set to expire at the end of July.

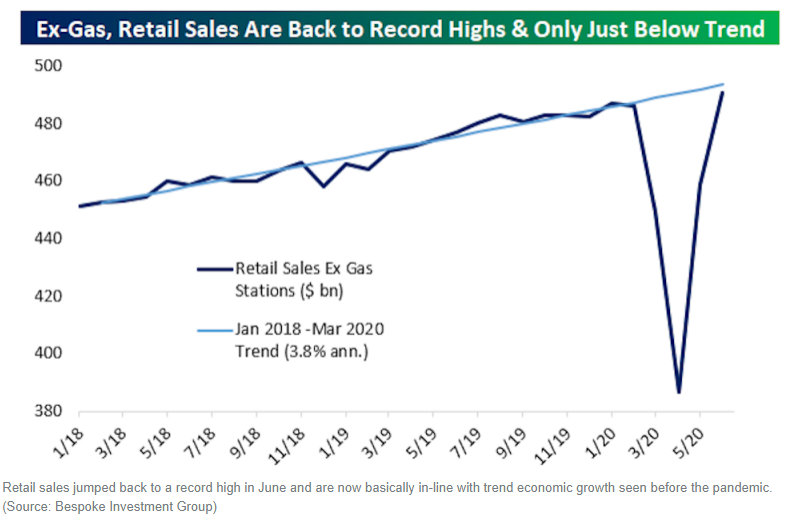

This benefit totals about $15 billion per week and, combined with the one-time $1,200 stimulus checks, has greatly softened the effect of the pandemic on consumers. In fact, consumer spending excluding gasoline sales is back to pre-pandemic levels.

With the added unemployment benefits coming to an end, a great fiscal cliff looms, one that Congress is beginning to attempt to bridge. Dan Clifton of Strategas Research Partners expects the bill to be completed no later than August 8 and include the following:

- Liability Protections: Businesses, schools, and non-profits will have a safe harbor from COVID-19 lawsuits if they meet certain health and safety requirements. It’s hard to see the Republicans supporting any legislation if these liability protections are not included.

- State and Local Aid: Local governments may receive direct aid in three ways: 1) More flexibility over the use of previously appropriated CARES Act funding; 2) Additional Medicaid Funding; and 3) Additional aid for their operating budgets. This is viewed as a must-pass for Democrats to agree to the package.

- Refund Checks: Consumers will likely receive another round of payments via direct deposit payments. These payments will be smaller and more targeted than the previous installment.

- Unemployment Benefits: Clifton believes the federal benefit will be reduced to about $200 to $300 per week. He is skeptical on the concept of a “get back to work bonus.” The states are warning their computer systems are not equipped to implement such payments.

- School Aid: Re-opening schools is viewed as critical to the recovery, but it is uncertain how many students and teachers will actually return to school. There is also a growing concern that if teachers are required to go back to school, they may strike. On school funding, there will likely be a compromise making money available for schools that open under the CDC guidelines.

- Health Care Funding: There will be significant funding for COVID-19 tests and supplies.

- Food Stamp Increase: Speaker Pelosi has been trying to increase the Food Stamp benefit by 15 percent.

- PPP Re-Extension: The Paycheck Protection Program will be likely be repurposed and more targeted.

- Specific Industry Relief: The airline and hospitality industry have been lobbying Congress for direct aid. Most of the major airlines have announced significant layoffs starting in October if no government aid is forthcoming.

Unlike the previous stimulus bills, including the $2 trillion CARES Act, this piece of legislation will be hotly debated despite Congress’ universal desire to do more. If past is prologue, the financial markets could likely ignore any political infighting knowing a massive bill will eventually pass. It is also our belief that the markets are pricing in a workable vaccine being approved around New Years and shortly thereafter in production and distribution. Today, July 20, The Lancet will publish phase one clinical trial data on the AstraZeneca/Oxford COVID vaccine candidate, whose prospects were highly touted in a recent Bloomberg Business Week cover article.