Halie O’Shea, Vice President, Director of Research

hoshea@haverfordquality.com

Economic Resilience and Market Trends

The stock market continues to trade near all-time highs in conjunction with strength in the U.S. economy. Despite persistent concerns about inflation pressures and slowing growth (i.e. stagflation), the data continues to tell a more constructive story— one of cautious optimism and a consumer that remains engaged.

Economic indicators released over the past few weeks paint a picture of improving strength. Retail sales exceeded expectations by rising 0.6% month-over-month in June, and 3.9% on a year-over-year basis. This was an improvement from May when month-over-month sales declined. The uptick is encouraging and suggests that households remain confident, supporting consumer spending in the face of some potential tariff related price increases.

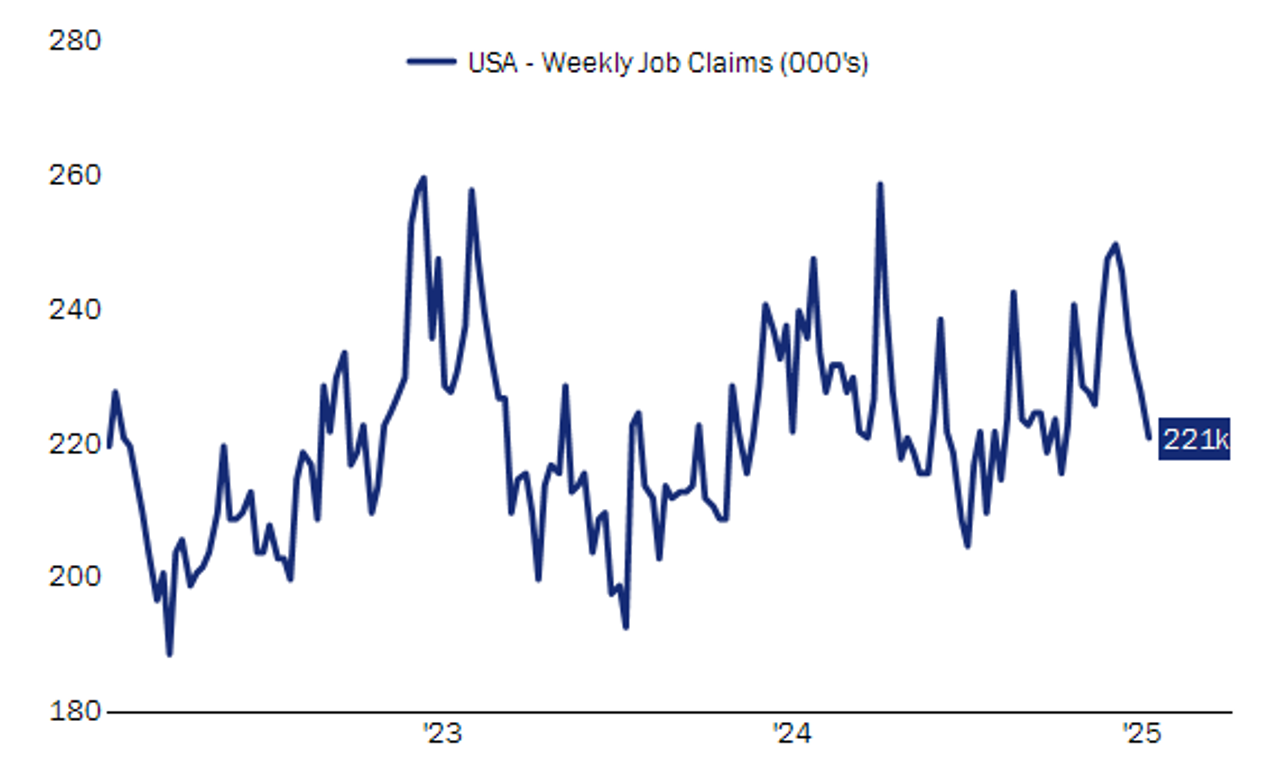

The labor market remains healthy with unemployment still at historically low levels. Initial jobless claims fell to 221,000 for the week ending July 12, below consensus estimates and reversing the modest uptick seen in prior weeks. The four-week moving average declined as well, reinforcing the view that employers are still reluctant to part with workers.

U.S. Weekly Jobless Claims

Source: FactSet

The S&P Global U.S. Manufacturing Purchasing Managers’ Index for June came in at 52.9, indicating a solid rate of expansion, and an improvement from 52.0 in May. It was the sixth consecutive month above 50.0, which marks an expansion.

On the inflation front, the most recent Consumer Price Index (CPI) data showed a slight uptick. Headline CPI rose 0.3% in June, bringing the annual inflation rate to 2.7%, up from 2.4% in May. While this was a touch higher than expected, it does not yet suggest a reacceleration of inflation. Rather, it reflects the ongoing push and pull between disinflationary trends and price pressures in select categories.

Still, not everyone is convinced that the inflation threat has passed. A recent article in Barron’s warns that the inflationary effects of tariffs may still be building beneath the surface and their cumulative impact—particularly in sectors like manufacturing and consumer goods—could re-emerge in future data releases. For now, however, markets appear to be taking the data in stride and the Federal Reserve is likely to maintain a cautious stance.

In summary, while inflation may still be lurking in the background, it’s not yet showing signs of a resurgence. The data continues to suggest a narrative of economic resilience, supporting our constructive outlook for the second half of 2025.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value