Halie W. O’Shea, Vice President & Director of Research

hoshea@haverfordquality.com

Tough Second Quarter Earnings Should Mark the Trough

During earnings season, we look to companies to provide an update on how the year is progressing and provide an outlook into the balance of the year. But like so much else during these unprecedented times, this is not a normal earnings season. Expectations are lower due to the negative impact of coronavirus and companies have less visibility into the how the back half of 2020 will play out.

We are entering one of the most important weeks of the earnings season with 36% of companies in the S&P 500 scheduled to report. We will hear from Technology bellwethers, including Apple, Amazon, and Google, and leading Consumer companies, including McDonald’s and Starbucks.

Investors understand the challenges companies have faced over the past few months and will look through weak trends over the April, May, June period. They will instead focus on commentary on current trends and the outlook. The big question is whether companies are a seeing sequential improvement in trends. Based on earnings estimates, the second quarter should mark the trough for earnings. According to FactSet, analysts estimate that earnings in aggregate will fall by 42% in the second quarter, followed by a 24% drop in the third quarter, a drop of 12% in the fourth quarter, and a return to earnings growth in the first quarter of 2021 at 12.7%.

Source: FactSet Research Systems

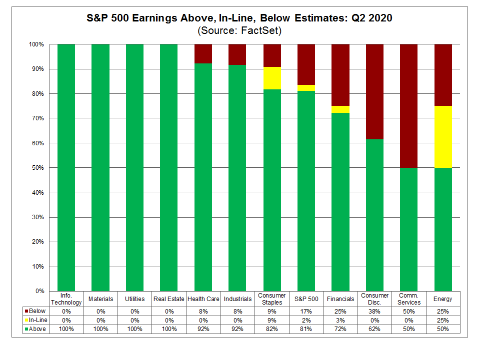

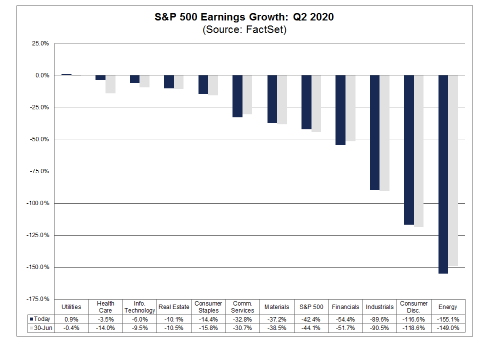

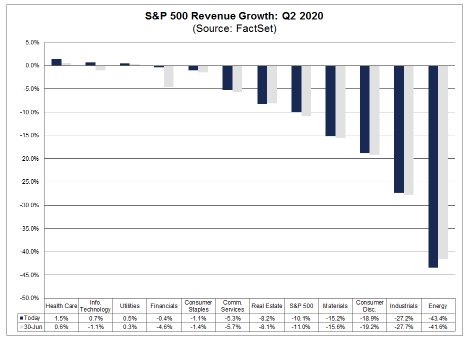

As of Friday, about a quarter of companies in the S&P 500 had reported earnings. The majority, 81% according to FactSet, have beaten earnings estimates for the second quarter. Reported earnings are on average 11% above estimates and reported sales are on average 3% above estimates. Although encouraging, estimates are for sales and earnings to decline. The 42% decline in earnings expected this quarter would be the largest year-over-year quarterly drop since the fourth quarter of 2008, when EPS declined 69%. This quarter the Utilities sector is expected to report an increase in earnings, while all other sectors are expected to report average year-over-year declines with Energy, Consumer Discretionary, Industrials, and Financials expected to report the greatest declines, according to FactSet. Reported sales are also forecast to decline, down 10.1%, the largest decline since the third quarter of 2009. This quarter Health Care, Technology, and Utilities are expected to report an increase in sales, while all other sectors are expected to be lower, led by declines in Energy, Industrials, and Consumer Discretionary.

Source: FactSet Research Systems

Source: FactSet Research Systems

Investors will also look to earnings reports to see if earnings visibility is improving. During the first quarter earnings season, many companies withdrew or did not provide annual EPS guidance. So far in this earnings period, of the 128 S&P 500 companies that have reported as of Friday, July 24, 60 have commented on EPS guidance for the year, according to FactSet. Of the 60, 53% or 32 of them, stated that they were not providing EPS guidance or confirmed a prior withdrawal of EPS guidance and almost all of them said it was due to uncertainty related to COVID-19. The remaining 28 did provide fiscal 2020 guidance. That implies an improvement in visibility from this time in the first quarter earnings period, April 20, when only 20 companies provided EPS guidance, according to FactSet.