Tim Hoyle, CFA, Co-Chief Investment Officer

Maxine Cuffe, CFA, Senior Research Analyst

We will get through this. It is not a question of if, but when.

Last week we stated our opinion that a recession was not inevitable. Technically, a recession is defined by two consecutive quarters of GDP decline and while we may not have a technical recession, we are now in a practical recession; it will likely be sharp and deep, and hopefully, followed by an equally sharp increase.

With the S&P 500 down 25% from its high, the market is already pricing in a typical recession. Our base case remains, as trite as it may sound, that the coronavirus is an exogenous event that will dissipate in the medium-term. We have no visibility into the near-term; we didn’t expect the massive call to self-quarantine, and we didn’t anticipate the market’s sell-off. But we are not investing for the near term. Investing is by necessity a long-term endeavor. In the long-term, we are confident the companies we own will persist and even thrive, that their earnings power will remain intact and strengthen with time, and that they will continue to pay dividends, with many likely increasing their payout in the year ahead.

We, both as investors and Americans, have faced extraordinary times before; we got through them and we will get through this as well. The cause of each bear market is unique, and the situation always appears dire, with no end in sight. We have experienced this type of unknown risk twice before during the past 20 years. The markets, our leaders, and policy makers have learned from both 9/11 and the financial crisis. We are a financially strong and dynamic country; we anticipate the Treasury and the Federal Reserve will ensure the liquidity and continuity of our system. This will ideally provide time for a health solution. We continue to believe that the dynamics of this economy were very strong before the illness, and we will rebound from this as we have from every other catastrophe. It is important to remember that this is not like 2008; our financial system is strong, banks are extremely solvent, and we do not find ourselves in this position because of profligate spending or financial contagion.

We fully expect swift and decisive action from government to ensure that individuals, small businesses, and corporations are not bankrupted due to these events, which was no fault of their own. The companies we own have very strong balance sheets and cash positions. A corporation’s cash generation, credit position, and debt structure are all important considerations when finding Quality companies.

We are as confident as can be expected during these difficult times that no company we own has credit problems. Permanent impairment of capital (e.g. losing your investment due to leverage or bankrupting a company because of too much debt) is the ultimate risk. We believe our portfolio holdings are well insulated against this risk. This is an important truth to remember over the next several weeks. We also reiterate Joe and Binney’s message: Haverford Trust has staying power and will be here for our clients.

As we look to the future, we know we will get through this. It is not a question of if, but when. We can learn from the experiences of other countries and do our part to flatten the curve of infection of COVID-19.

What has been China’s experience following the quarantine of Hubei Province?

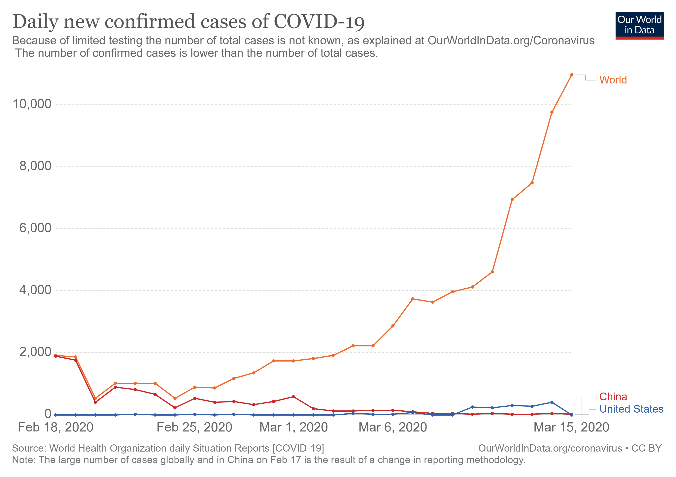

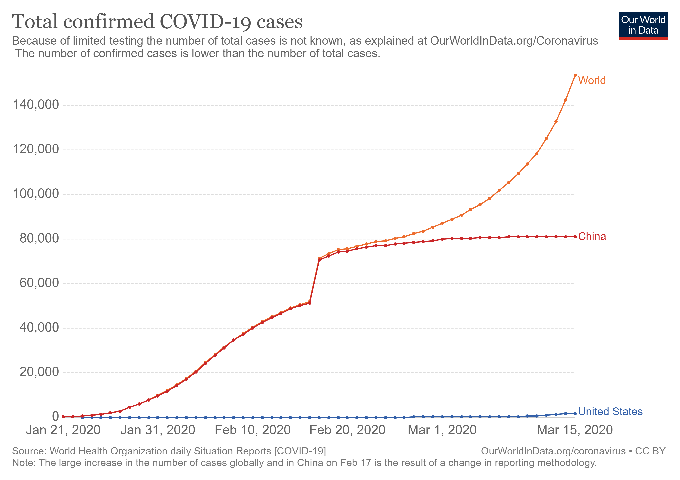

As the number of coronavirus cases increases globally, a modest recovery is underway in China, perhaps giving us a blueprint of how this situation will unfold over the coming weeks. China’s peak coronavirus rate occurred the week of March 1st, and the infection curve continues to trend downwards. The total number of active cases has fallen to 18,000, confined mostly to the Wuhan region, while infections have been fairly well contained across the rest of the country. There is recent evidence of shops and factories re-opening, with both Apple and Starbucks announcing the reopening of most of their stores after being closed for a month. Recent data also shows a pickup in property sales and power consumption, albeit from depressed levels, but clearly business activity is slowly returning to normal. This sharp contrast between the improving Chinese environment with the situation unfolding globally, helps to explain the outperformance of Chinese equity markets, which hit multi-year highs in recent weeks.

Chinese authorities took early action to support the economy, a response which appears to be working. Authorities have focused on providing liquidity to support credit and bank lending. On the fiscal side, China is providing financial support to small and medium businesses in order to stabilize employment and pledging direct subsidies to consumers via tax cuts and reductions in rent and utility costs. The State Council has also announced new investment projects in areas like 5G infrastructure and high-speed transportation. In total these measures account for roughly 6% of 2020 GDP. We expect to see developed markets follow this same pattern. The sharp decline in oil price is another tailwind for their economy, as China is the largest oil importer globally.

The most important takeaway from the Chinese experience is that the impact of the outbreak was confined mostly to one quarter. In fact, that has been the pattern with previous viral outbreaks throughout history. Investors should focus on the steps being taken to stop the spread of the virus, while understanding that economic losses will be a by-product of these measures in the short term. At some point over the next couple of months, Haverford is hopeful that the worst should be behind us.