The “Wealth Effect”

Maxine Cuffe, CFA, Vice President & Director of Global Strategies

As the stock market continued to reach new highs last week, the Federal Reserve is facing a new challenge in their fight to rein in inflation. The “Wealth Effect” is an economic theory that says consumers feel more confident and tend to spend more freely when their assets are rising in value, despite no increase in real income. This concept gained particular attention in the years before the Great Recession, when booming housing prices led homeowners to withdraw equity from their homes like ATMs.

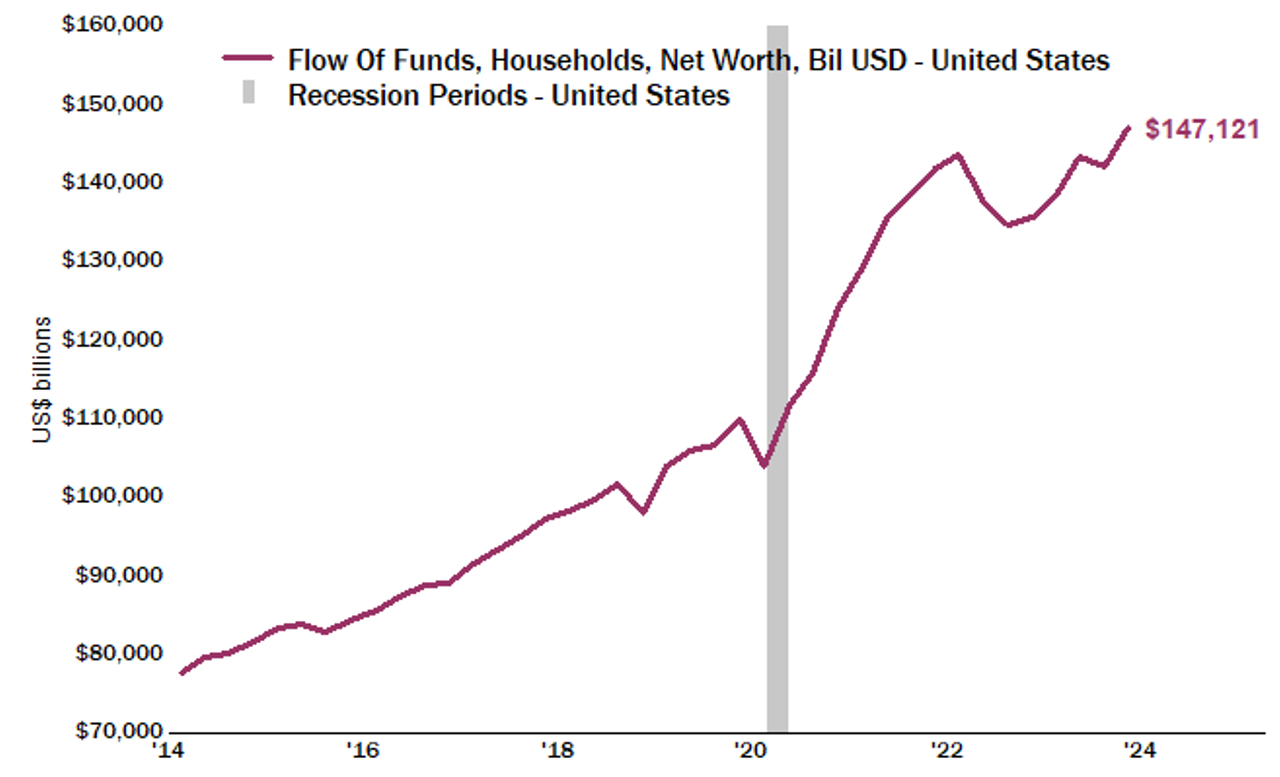

Today we are witnessing similar circumstances. Recent Fed data showed that collectively, household net worth surged to a new record in Q4 2023. The average retirement account rose 14% last year, boosted by strong stock market returns, while the percentage of income that workers are adding to 401(k)s also increased. Despite the monetary headwinds, home prices in most regions of the country have been relatively stable, driving home equity to near record levels, up more than 50% compared to pre-pandemic. And the gains have been spread across all segments, with the bottom 50% of households seeing the largest increases. While most of these gains remain on paper only, the wealth effect is one of the key reasons that the U.S. economy has been so resilient through this period of higher interest rates, and a big factor in keeping the U.S. out of recession.

Source: Factset, Federal Reserve System, Flow of Funds data. Dec 31, 2023

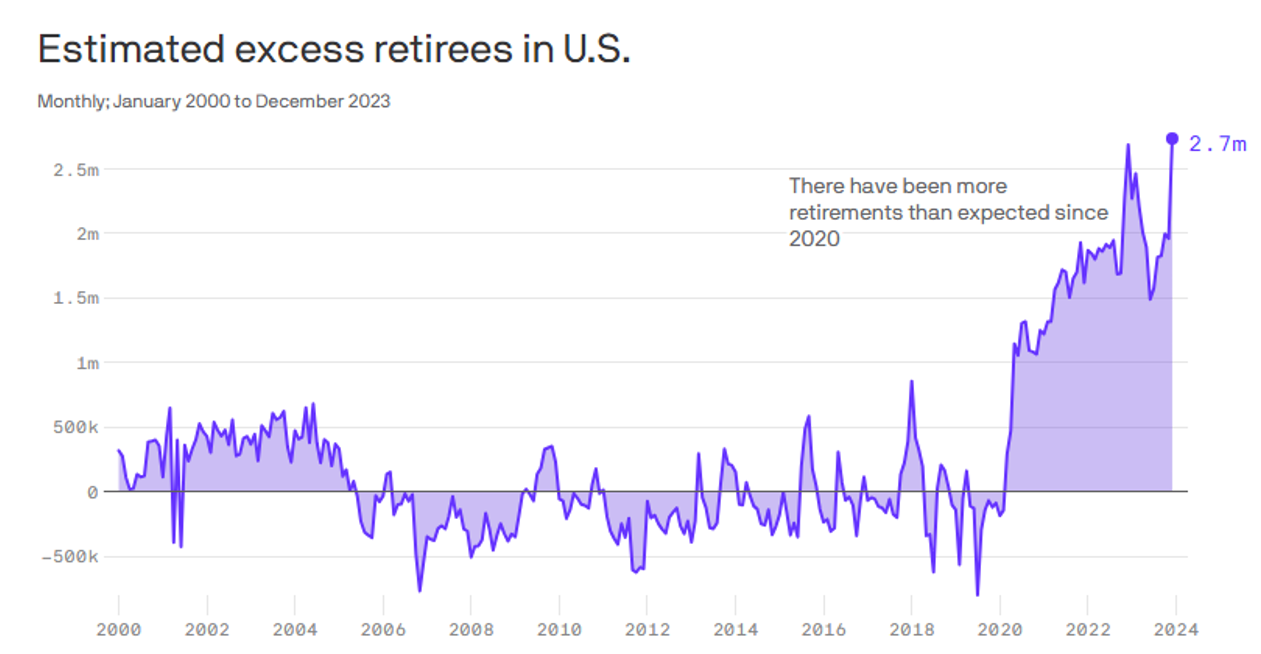

In addition to stimulating consumers to purchase more goods and services, this time around the wealth effect is having an unexpected consequence, one that is further fueling inflation – the Great Retirement. On the back of surging 401(k) balances, vast numbers of American workers are taking this opportunity to retire much earlier than expected. According to the St. Louis Federal Reserve, since 2020, 2.7 million more workers have retired than economic models would have suggested. The workforce was aging anyway with a record-breaking number of Americans turning 65 this year, but the increase in excess retirements puts additional pressure on the labor force with no easy fix. It’s highly unlikely these workers are coming back; labor shortages are here to stay and with it, higher wages. This is why the Fed is so focused on core services inflation, i.e. prices that are heavily dependent on wages. Therefore, the Fed isn’t rushing to lower rates at anywhere near the pace of market expectations. We continue to expect 2-3 rate cuts in 2024, yet only if there is no resurgence in the monthly inflation data.

Source: St. Louis Federal Reserve. Chart: Axios Visuals

It bears remembering that the wealth effect didn’t end well in 2008. However, research has shown the wealth effect is usually asymmetrical. While rising asset prices support increased household spending, in periods when asset values fell, typically there was no significant impact on overall consumption. A prudent partner to the wealth effect is a long-term perspective rooted in wealth planning, coupled with a cautious approach to taking on excessive debt.