Tim Hoyle, Chief Investment Officer

thoyle@haverfordquality.com

The Impact of Policy Changes on Consumer Confidence

The S&P 500 closed Friday down for the week, but remains just 3% off its all-time high set only nine days prior. However, it may feel worse. Keeping pace of headlines during the past month has been difficult and discerning the news from the noise even more so. The news cycle and markets are moving so quickly, it’s like listening to an audio book set at 2x read-back speed; as hard as you try to follow the narrator, it’s just too fast to keep up.

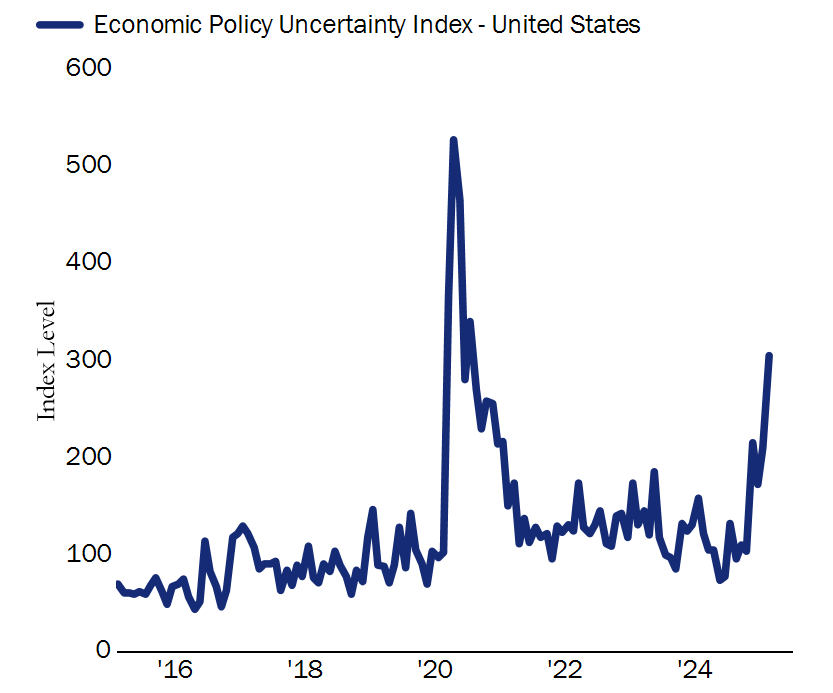

In general, the news of the past several weeks has skewed to the negative. Inflation data is raising some red flags, while consumer confidence is under pressure from the constantly shifting sands in Washington D.C, under the new administration. Tariffs on Mexico and Canada are set to commence this week and remain the focal point of investor concern. The Policy Uncertainty Index has risen significantly as the White House continues to act on fronts both economic and geopolitical. There is a palpable fear that politics are seeping into economic activity. Real consumer spending declined 0.5% month over month in January.

Economic Policy Uncertainty Index

Source: Factset. February 25th, 2025. The Economic Policy Uncertainty Index measures the frequency of articles in major newspapers that contain terms related to the economy, policy, and uncertainty. The index is used to track uncertainty over time and across different countries. The U.S. index measures U.S. newspapers. Higher values of index indicate greater uncertainty, which can affect investment, employment, and overall economic performance.

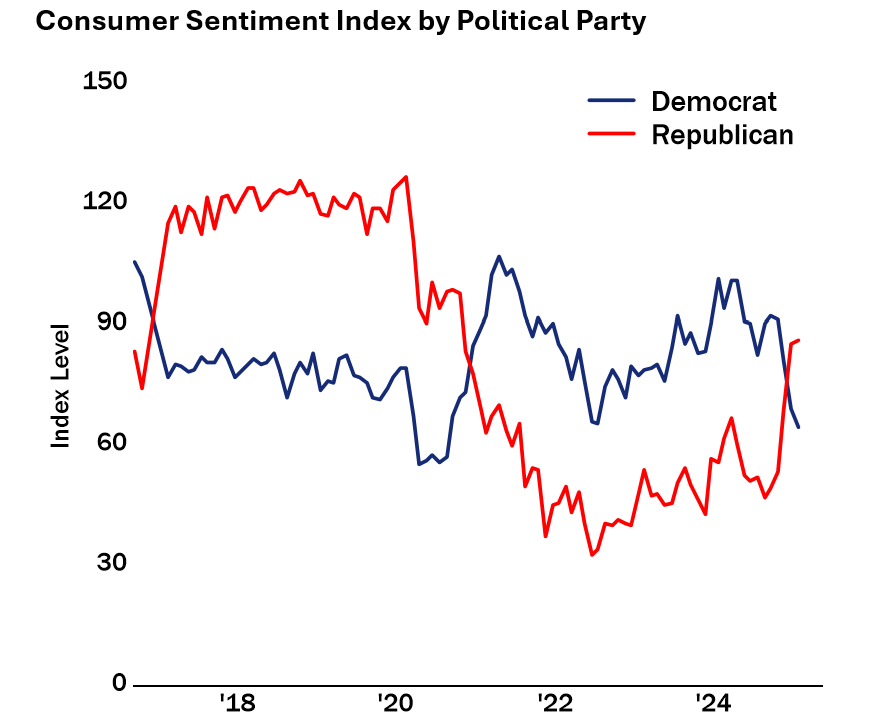

The market’s post-election enthusiasm is giving way to a “growth scare” on weak January retail sales and slipping sentiment indicators. We don’t believe the economy is on the precipice of a significant decline. Rather, we see people adjusting to the speed and tenor of the new administration. Sentiment indicators seem to be measuring political preferences more than economic expectations. The accompanying chart on Consumer Sentiment shows the polarity of opinion by political party, moving inversely based on election outcomes.

There are still many supports to this economy. Corporate profit growth is expected to be strong and business optimism is high. We believe wage growth and a steady jobs market will allow consumers to continue to spend. The Fed has been on pause, but their next move will likely be a rate cut. Later this year we expect to see more boosts to the consumer including tax cut extensions and lower energy prices.

While the last few weeks have been uncomfortable, the S&P 500 is currently trading about 3% higher than before election day and the yield on the 10-year Treasury is essentially in line with early November. We continue to evaluate the positions in our portfolios and remain committed and confident in staying the course during this dynamic environment.

Consumer Sentiment Index by Political Party

Source: February 25, 2025. The University of Michigan Consumer Sentiment Survey measures how optimistic or pessimistic consumers are about the economy.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value