Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

Sanil Jagtiani, Research Analyst Intern

sjagtiani@haverfordquality.com

Vital Actions and Harebrained Ideas

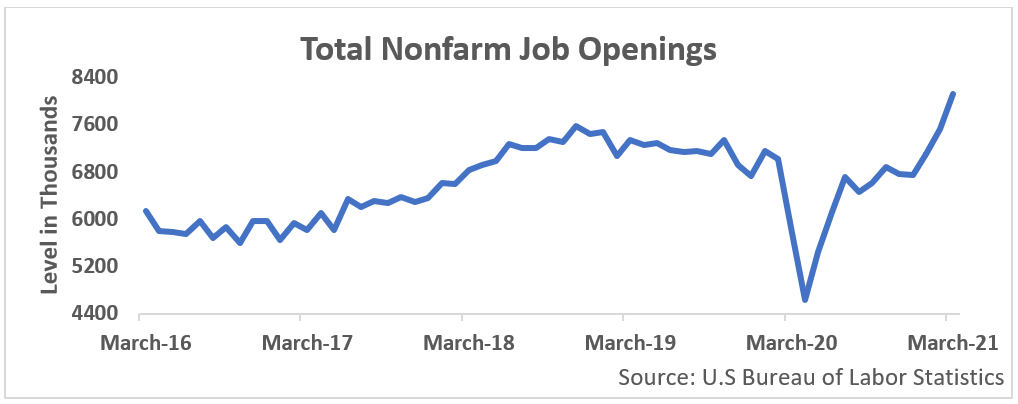

U.S. employers posted a record number of job openings in March, according to the data released by the Bureau of Labor Statistics on Tuesday. Employers of all sizes are desperately trying to find workers ahead of what is expected to be a very busy summer. Help Wanted signs are juxtaposed with Friday’s weak jobs numbers and the nearly 8.5 million jobs gap between now and February of last year, providing enough “support” for everyone to argue for their political, social, and economic ideas.

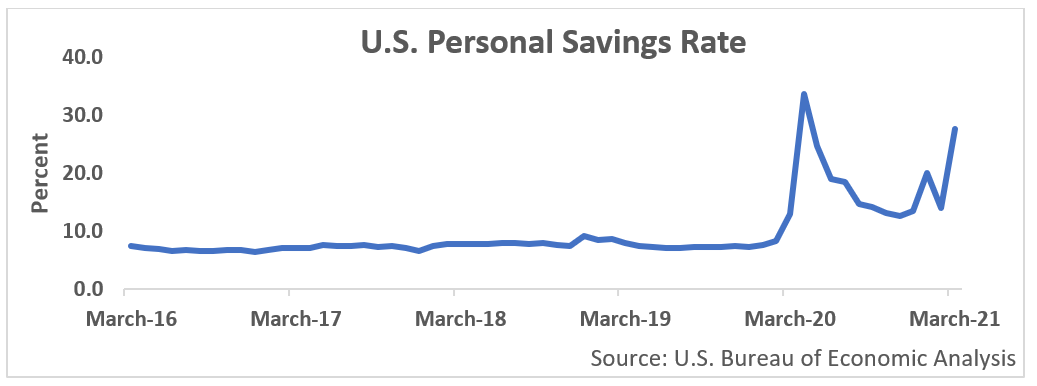

Following the disappointing Jobs data (the U.S. added only 266,000 jobs last month versus expectations for over one million), President Biden reiterated how “vital the actions we’re taking are.” The U.S. Chamber of Commerce has called for a repeal of extended Federal unemployment insurance, which is slated to expire this September. The Fed’s vow to vigorously pursue full employment provides rationale to keep interest rates low. Labor shortages will lead to higher wages and higher inflation. The Savings Rate recently increased to 27.1%, which is likely to fuel greater consumption and inflation. Universal pre-K and increased immigration will allow for a larger workforce, but at what cost? The Federal Government is on the cusp of sending over $350 billion to state and local governments, a “harebrained idea,” according to Senator Mitt Romney since states like California are awash in budget surpluses. We haven’t seen anyone argue that schools should stay closed (yet), but the path forward always appears disappointingly partisan.

There are three sides to every story: yours, mine, and the real story. The stock and bond markets are desperately trying to find the real story. The past few days of market volatility is evidence of a shifting landscape. The market’s two-day selloff has been credited to concerns over rising inflation, which in turn will lead to higher interest rates. Higher interest rates are expected to lead to lower earnings multiples in the future, hence sell today. Selling equities solely due to inflation concerns may prove to be myopic. As we have highlighted previously, a little bit of Goldilocks inflation – not too hot and not too cold – can propel corporate profits without having other negative effects on the country.

Investors and politicians alike are increasingly wary of the potentially contrary side-effects of fiscal stimulus: work disincentives and more inflation. We expect the recent economic data will further reduce the size of the President’s Build Back Better tax and spending proposals. As of now, it looks like it will be mid-June before these proposals are debated on the floors of Congress.

Source: U.S. Bureau of Labor Statistics