Tim Hoyle, Chief Investment Officer

thoyle@haverfordquality.com

Takeaways from our Investors Forum

The news last week included numerous market-moving events, which appears to be the norm at present. In the midst of this activity we held our 2025 Investors Forum featuring D.C. policy research expert Dan Clifton, Head of Washington Policy Research from Strategas. Dan clarified recent news while sharing his views on the current state of the policy debate in D.C.

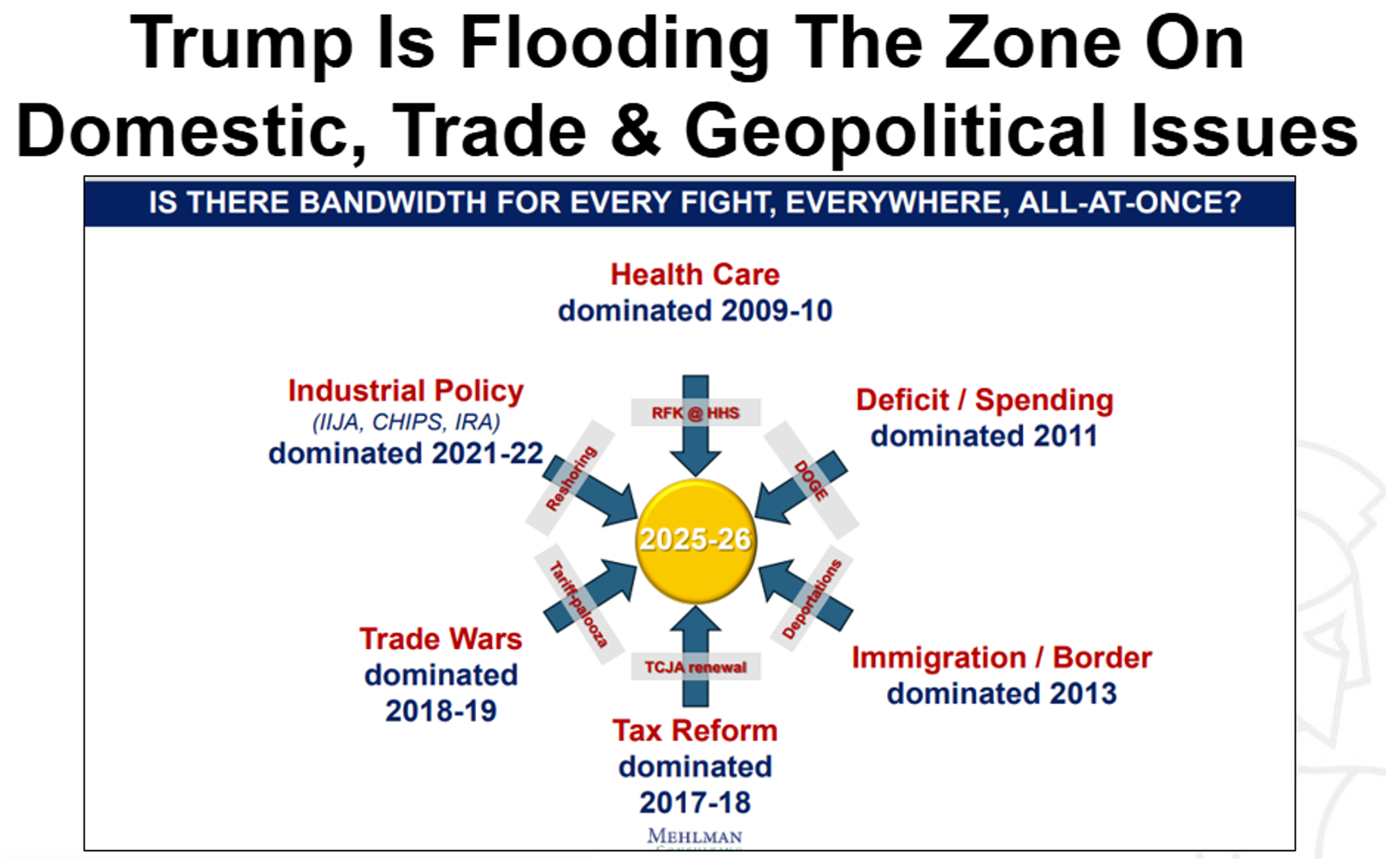

One key takeaway was Dan’s insight about the Presidential administration’s “everything, everywhere, all at once” approach to policy making it difficult to keep up and even more difficult to comment on. As illustrated in this graphics, the President has concurrently taken on six major policy goals, where a typical administration will tackle one or two. Trump’s grandiloquent approach to both domestic and foreign policy creates the potential for massive market moves based on social media posts. It most definitely reinforces our belief that you can’t time the market – especially this market with this many moving pieces.

Trump is flooding the zone on domestic, trade & geopolitical issues

Source: Mehlman Consulting and Strategas

Among the news events last week, Federal Reserve Chairman Jerome Powell spoke following the committee’s decision to keep rates unchanged; he believes there is upside risk to both inflation and unemployment, a potentially nasty combination. Meanwhile, the Trump administration announced a trade deal with the U.K. and then this week has announced an agreement with China to a significant reduction in tariffs. Tariffs for U.S. goods sold into China will decrease to 10%, while tariffs for Chinese goods have dropped to a 30% rate. Both rates are significantly decreased from their more than 100% rate over the past several weeks. Equally important, as part of the 90-day truce between the two countries, China has agreed to suspend certain non-tariff measures, including export restrictions on rare earth elements. This is significant because rare earths are critical for U.S. industries such as defense, electronics, and renewable energy.

Also last week, the administration rescinded the AI Diffusion Rule days before it was set to go into effect, with the promise to replace it with a much simpler rule designed to ensure American innovation and AI dominance. We have seen this news in tandem with the Chinese tariff issues move the markets, in particular in the technology and computer chip industries.

The announced trade deal with one of our closest friends and ally, the United Kingdom, is telling insomuch as the baseline 10% tariff will remain on most goods. Applying this rate to all imported goods, including the recently announced 30% tariff rate on China, results in a roughly $250 billion annual consumption tax. There are so many moving parts including carve-outs, exceptions, and consumer substitution that a precise estimate of tariff costs is impossible.

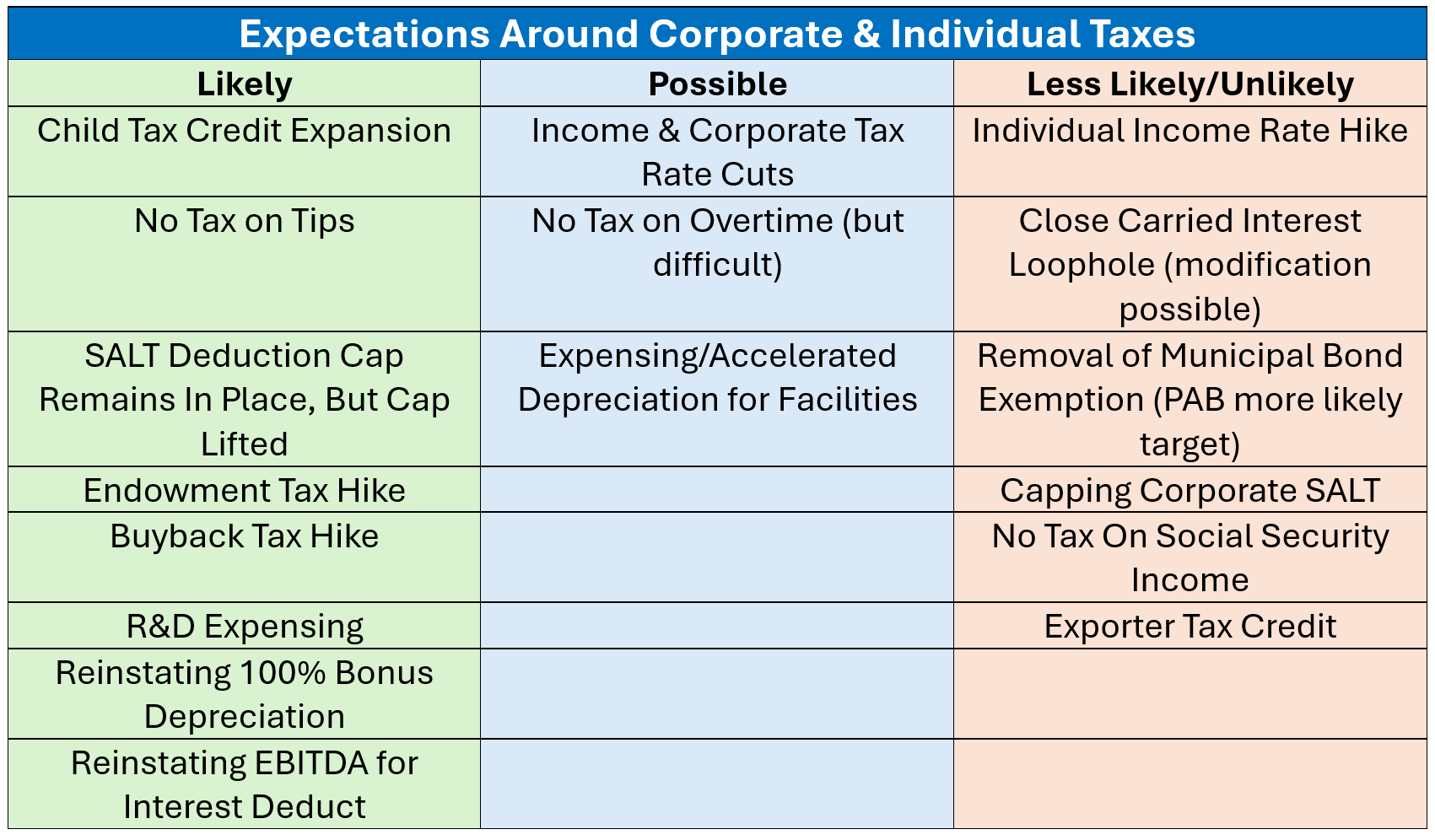

President Trump is making a huge bet that he can make the deals necessary to neutralize the negative effects of tariffs. At our Investors Forum, Clifton shared his view that it is also possible for pro-growth tax legislation to offset tariffs. He expects the final bill to include incentives for business investment and manufacturing onshoring. These will likely include: 1) Allowing companies to write off 100% of their capital equipment purchases; 2) Allowing R&D costs to be expensed; 3) Expanding the amount of interest that can be deducted. The tax provisions would provide a “carrot” to compliment the tariff “stick.”

While tariff deals dominate the current narrative, we believe the most important deal of the year sits in Congress. Investors too will soon shift focus to the tax reconciliation bill. With nearly every individual tax provision set to expire at year end, Congress must act just to keep the status quo. We anticipate broad extensions of all the expiring provisions in the Tax Cuts and Jobs Act (TCJA). Congress provided the first hints of a budget reconciliation bill last week while the President said he was OK with raising the top marginal income tax rate.

In more news on the individual tax side, Clifton stated that he expects the limit on State and Local Tax (SALT) deductions to rise to between $35k – $40k. With such narrow majorities in Congress, there are whose votes will be needed to get any tax bill over the goal line. Given the President’s willingness to see a higher top marginal rate, he expects the issue to remain on the table as the reconciliation process unfolds. While no tax on tips has a high probability of happening due to its lack of significant impact to the government budget, the campaign promises of no tax on overtime and Social Security are less likely as they are more costly. Lastly, the capital gains tax on foundations and endowments could rise from 2% to upwards of 14%.

Clifton and his colleagues at Strategas further break down the expectations around corporate and individual taxes in the accompanying table. Given the number of initiatives undertaken by the Trump administration and the rapidity of the news cycle, as well as developments in each of these policy goals, it might be helpful to keep this ‘score sheet’ handy to stay abreast of the impact of each in real time.

Expectations around corporate & individual taxes

Source: Strategas

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value