What’s Next for the Markets After a 5-Week Winning Streak?

Tim Hoyle, CFA, Chief Investment Officer

The S&P 500 has advanced 11% year-to-date, while the Dow has recently crossed 40,000, following a 5-week winning streak. This surge to all-time highs is driven by various factors, including jobs and inflation data, interest rates, and notably the enthusiasm surrounding artificial intelligence (AI).

Recent product demonstrations from industry leaders such as Google, Meta, Nvidia, and Microsoft’s partner OpenAI have captured the attention of consumers and professionals across various sectors, as well as futurists and sci-fi enthusiasts. While the near-term effects of AI may be overstated, the long-term impact on productivity and economic activity is likely underestimated. Investor excitement about AI, coupled with a supportive economic backdrop, continues to propel market gains.

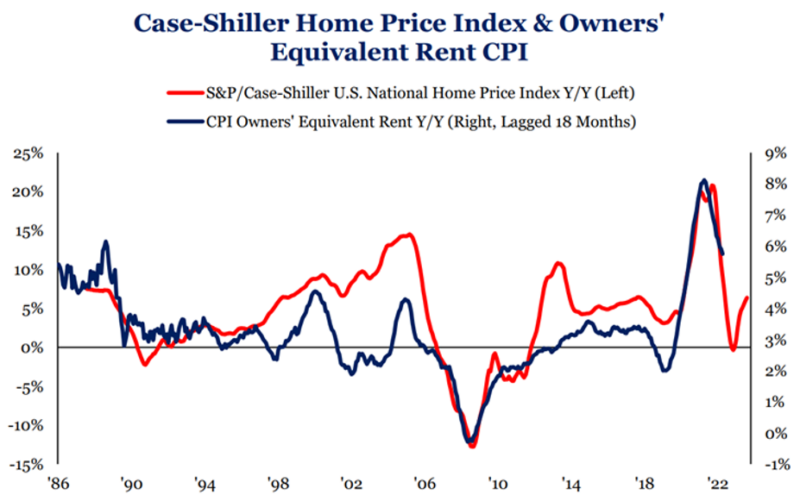

Despite elevated inflation levels, Federal Reserve officials currently maintain a dovish stance, downplaying the likelihood of rate hikes even if inflation remains high. We anticipate inflation rates will trend lower through the remainder of 2024 due to slowing housing price data that has not yet worked its way into the CPI data. The accompanying chart shows that based on recent Case-Shiller home price data, a decline in the CPI’s housing component is imminent. We continue to expect only one rate cut in 2024.

Case-Shiller Home Price Index & Owners’ Equivalent Rent CPI

Source: Strategas

Employment data remains balanced, with the economy continuing to add jobs while wage gains have moderated, and job openings have decreased. Although consumer sentiment has recently declined and spending has slowed, we do not believe this indicates an imminent spending downturn. Consumer credit conditions are softening but are not yet at alarming levels, and corporate credit conditions remain strong with stable yield spreads.

Corporate earnings have also been good enough to keep the rally going. After a flat year of earnings growth in 2023, growth is projected to accelerate 10% in 2024. Unlike the narrowness of 2023, all major segments of the market are expected to contribute to this year’s earnings growth.

S&P 500 Earnings Growth

Source: Haverford, Factset

While global politics remain highly uncertain, history has shown that investors should not fear the upcoming U.S. Presidential elections. Markets tend to do just fine in Presidential election years, and while White House policies can have outsized effects on specific industries in their focus, the overall market will likely take the election in stride.

Happy Memorial Day!

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value