Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

Escaping the Inflation Scare

Everywhere we turn, inflation is being depicted as the paramount concern for savers, spenders, investors, businesses, politicians, voters, and even dog lovers[1]. Prices are rising as the economic reopening and booming demand reveals bottlenecks in complex, worldwide supply chains for everything from semiconductors to neckties. Bottlenecks will eventually be broken, which supports the “transitory inflation” crowd, but the increases in the cost of labor is a compelling case for a rise in systemic inflation. It has become a full-time job just keeping track of the number of press releases announcing pay increases (Maybe a pay increase is in order!).

At Haverford, our base case assumption remains that inflation will be transitory, not systemic. We expect prices to rise, in some cases significantly, but believe these price changes will be mostly contained to 2021 and 2022. Subsequently, we expect the inflation rate to revert to the low single digits in early 2023. Just because it is transitory, doesn’t mean it won’t be significant.

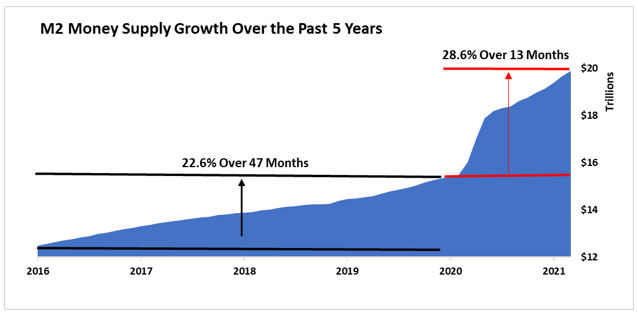

Wharton finance professor and author of Stocks for the Long Run, Jeremy Siegel, believes that the rate of inflation could more than double over the next three years before reverting back to typical levels. His analysis is based on the unprecedented increase in money supply over the past year. We have long been fans of the professor’s work and we find his analysis logical and persuasive. We also agree with his opinion that equities are the best hedge against inflation in the long run. “The only place to get inflation protected yield is stocks.” Real estate may also prove to be valuable in their ability to outpace inflation, but in most cases lack liquidity, are not easily diversified, and carry much high transaction costs than do stocks. Inflation will not ultimately be the death of this bull market, but trigger a rotation in market leadership away from stay-at-home tech names and into companies that dominate the value indexes.

Source: fred.stlouisfed.org

This line of reasoning highlights to me what makes an inflation scare so scary: There is no relevant playbook. For many, inflation is as hard to imagine as rotary phones. It is hard to believe that during the last bout of systemic inflation, the rotary phone was still a ubiquitous feature of American kitchens. This weekend, a Barron’s article[2] highlighted stocks that performed well in the 1970s. The list included great American companies such as John Deere, Caterpillar, and Honeywell. But what was most striking in this article, was what was left unsaid. Of the ten highest valued stocks on the S&P 500, only three existed during the 1970s.

The investment implication: Uncertainty is high and most of us haven’t been here before. But uncertainty is always high. This epistemic state is the one constant for investors. The #1 key to dealing with uncertainty is focusing on the things you can control. We have controls over our own budgets, our rainy-day funds, and liquidity. We control our financial plan that has been designed (at least Haverford’s have) with statistically conservative real-return assumptions. And lastly, we can control our reactions. It is in the media’s interest to create scary stories. It is in our interest to remain methodical, with a long-term focus, making investment decisions incrementally and in a disciplined manner.

[1]“Prices for puppies in the U.S. rose by 36% after the pandemic began compared with the previous year, and are still at roughly those levels, according to PuppySpot, an online listing site for breeders. Goldendoodles were the most popular breed, the site says, and for the priciest breed—English Sheepadoodles—prices have soared by almost 90%.” – https://fortune.com/longform/puppy-boom-covid-pandemic-people-buying-dogs-lockdown/

[2] Stocks That Beat Inflation Before Are a Good Bet Now. https://www.barrons.com/articles/deere-stock-inflation-winners-51621617489