Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

Theirs is Not to Reason Why

During the past several weeks, investors have experienced an extraordinary volume of substantial information coming from economic, corporate, and health data points. I have found myself paraphrasing Alfred Lord Tennyson, “As investors, ours is not to reason why, ours is to invest and thrive.” A far more uplifting opportunity than the subject of his fatalistic 1854 poem, this version is a reminder to investors to lay aside their opinion of the data or news and focus on the investment implications.

In aggregate, the news flow continues to be supportive of stock prices, fuel inflation concerns, and support the narrative of an economic boom unlike we have experienced in generations.

Last Wednesday, Federal Open Market Committee (FOMC) Chairman Jay Powell held a press conference where he once again signaled the central bank is not looking to raise interest rates any time soon. He also stated that the FOMC is not close to even discussing a paring back of its $120 billion a month bond-buying program. It doesn’t matter if one believes that the Fed is being too complacent regarding inflation risks or fueling asset prices via its rhetoric. The fact is, the FOMC has stated they will tolerate higher inflation figures, and investors can hopefully profit by taking the Fed at their word.

Also on Wednesday, President Biden announced $1.8 trillion in new spending and tax cuts for workers, families, and children. This, combined with the $2.3 trillion infrastructure plan announced at the end of March, is the most aggressive Federal spending proposal in history. The New York Times graph below helps explain its vast reach. While not everything in the President’s plan will make it into law, it is safe to assume that a large portion will. This level of Federal stimulus, investment, and spending will almost surely increase economic growth. While pundits are debating the wisdom of so much federal spending, investors should be looking for investable trends (e.g., 5G broadband, a greener grid, and healthcare spending).

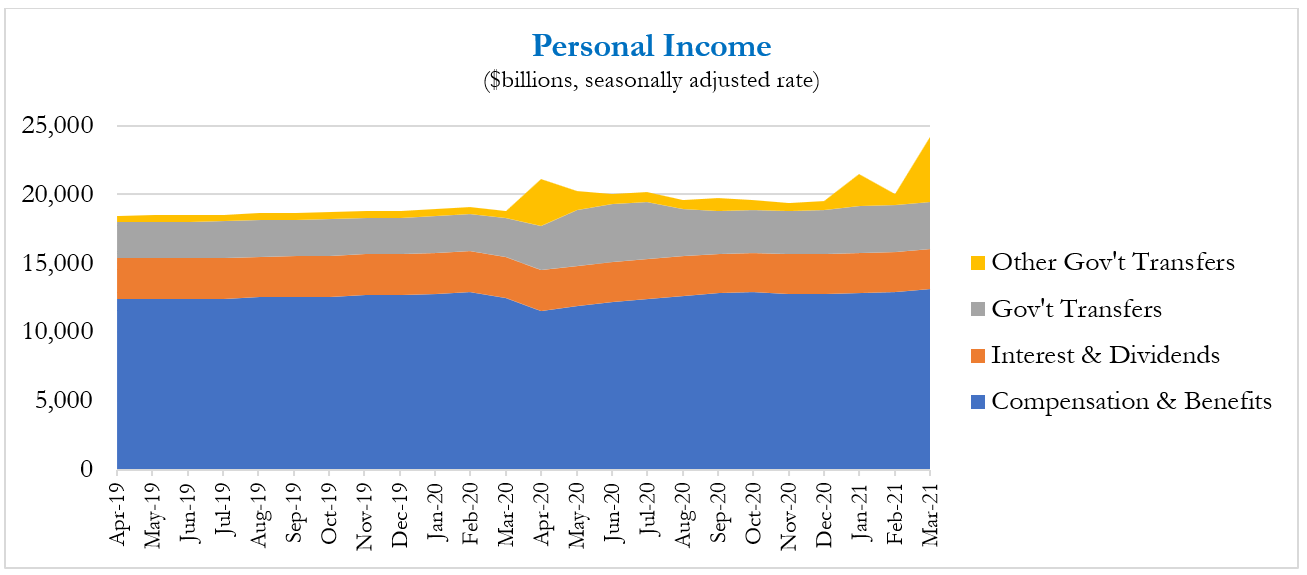

On Friday, the Bureau of Economic Analysis announced that disposable personal income, that which is available to spend after taxes, increased over $4 trillion (seasonally adjusted at an annual rate) in March. The spike in income is the result of direct payments made via the American Rescue Plan passed earlier this year. The report also showed that total salaries and benefits has recovered back to pre-Covid levels. As one looks at the aggregate data, government stimulus checks will first find their way into the savings rate but will eventually support more consumer spending and GDP growth. Investors in retailers, payment processors, and assets such as real estate are likely to continue to benefit from these trends. As I mentioned at the beginning, regardless of your opinion of these announcements, a focus on the investment opportunity is our opportunity to “invest and thrive.”

Source: Bureau of Economic Analysis

Biden’s $4 Trillion Economic Plan