Happy Thanksgiving

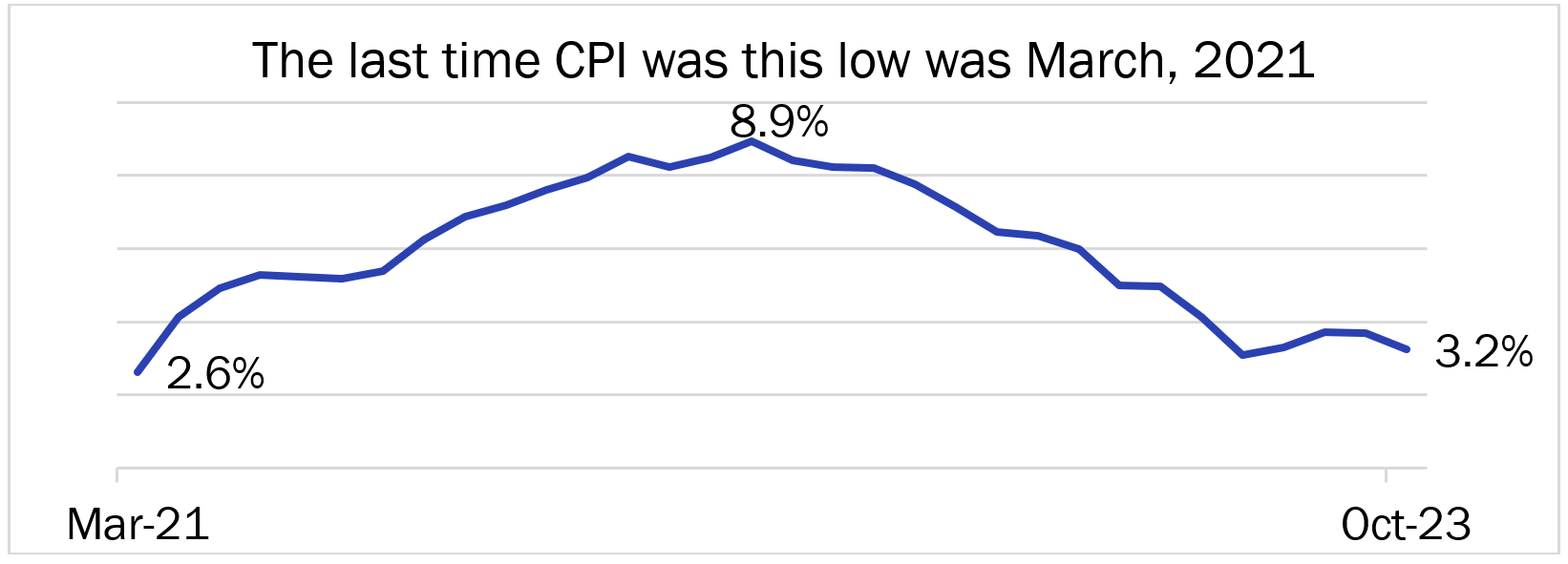

The markets have been given a genuine reason to be thankful due to a handful of benign economic data points following a less than stellar third quarter earnings season. Almost everywhere we look, we see prices dropping. Oil prices are down over 20% from their recent peak. Producer prices are falling, and Wal-Mart cited deflationary pressures during last week’s earnings call. Wal-Mart also cautioned they are seeing “potential weakness or wobbling among the consumer.” The most recent CPI reading showed that year-over year prices rose by 3.2%, down from 3.7% last month.

Source: FactSet

The combination of softening growth expectations, cooling inflation, and cautious commentary from corporate America has led to a 60 basis point decline in the 10-year Treasury yield since closing near 5% less than a month ago. Equity traders cheered lower rates; the S&P 500 has advanced 10% from its closing price on Oct 27, while small cap stocks have also rallied 10%. Investors can be thankful that the market’s recent gains have been broad based, which often portends a more durable rally.

Like the day after a night spent with family and friends you haven’t seen in too long, there is a potential hang-over to the recent euphoria of lower rates. Rates have fallen in part because growth expectations have fallen, and in the long-run growth is what fuels price appreciation. The markets are embracing a narrative that the Fed has not just finished their hiking cycle (which we believe is correct), but that we are going to see substantial cuts next year without a recession (which may be overly optimistic.) The Fed was late to the inflation-fighting party and will likely stay well past last call.

Even though the Fed will likely not move as rapidly to cut rates as markets now believe, recent developments are still positive and increase the odds of an economic soft-landing.

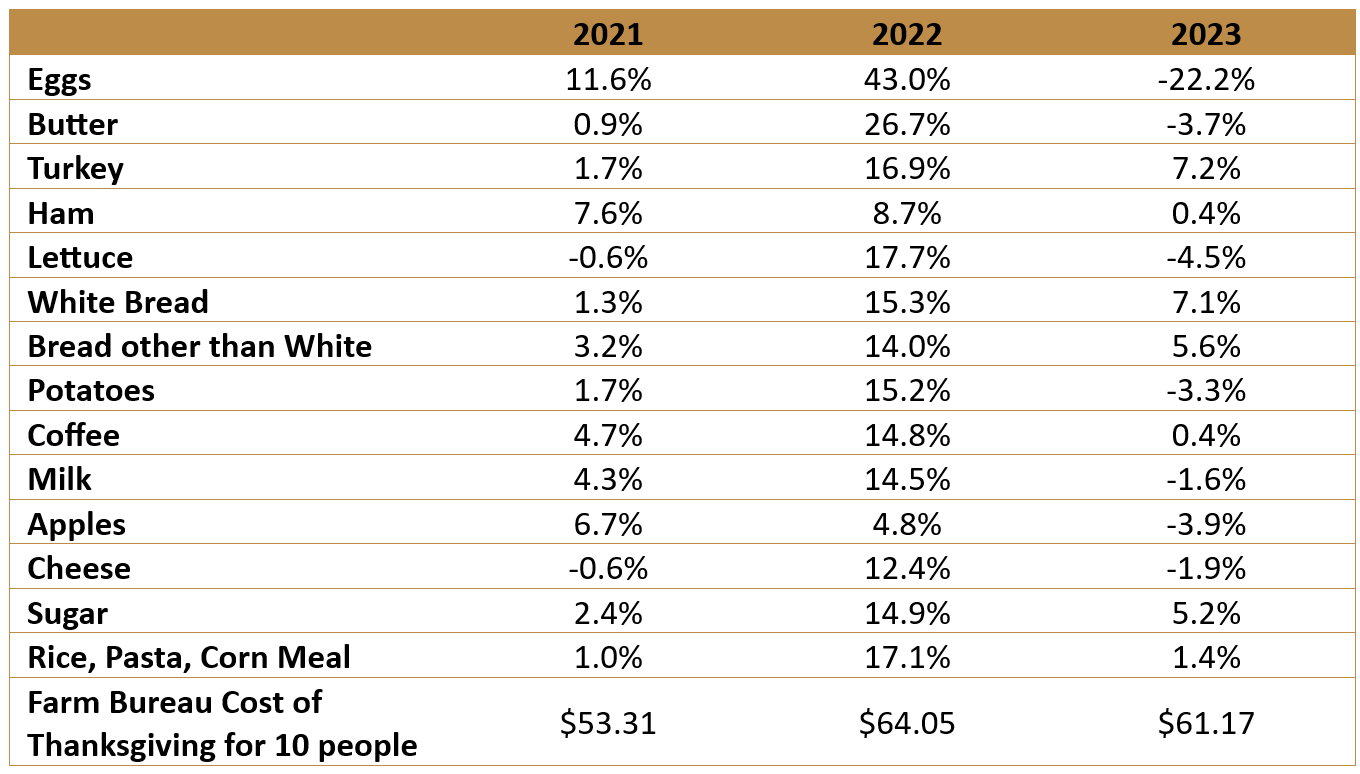

The Thanksgiving holiday this Thursday means a short trading week. During this time off we are given time to pause, reflect, and express gratitude with family and friends over a meal. The American Farm Bureau Federation estimates that it will cost $61.17 to feed 10 people on Thanksgiving Day. I believe my bountiful grocery bill will be multiple times higher than that, as yours may be as well. While costs are down 4.5% from last year, they remain 25% higher than five years ago. Below are the one-year change in prices for select food items we are likely to buy this week.

Source: FactSet

We here at Haverford Trust send our appreciation for the continued opportunity to work toward fulfilling the financial goals you’ve set for you and your family. Happy Thanksgiving!