Tim Hoyle, Chief Investment Officer

thoyle@haverfordquality.com

Post-Election Optimism

As we approach the Thanksgiving holiday, markets are riding a wave of post-election optimism and surprisingly strong economic data has kept the S&P 500 trading near all-time highs. News about the makeup of Trump's economic team and the balancing of the economic agenda between higher tariffs, lower taxes, and deregulation are being taken in stride. The recent nomination of Scott Bessent to head the U.S. Department of the Treasury and optimism for what the "Department of Government Efficiency" (DOGE) could accomplish are two more positive data points underpinning the market through the early holiday season.

We are cautiously optimistic that the President-elect's economic agenda could bend the fiscal curve slightly towards a more sustainable path. However, we fear that DOGE will not be able to find enough efficiency, nor will tariffs raise enough revenue, to pay for lower taxes. Additionally, attaining a 3% economic growth target while simultaneously reducing the federal workforce will be difficult to achieve without a plan to increase immigration. It is also important to note that improvements will not be immediate, even though markets may sometimes react instantaneously.

Bessent, the founder of the macro hedge fund Key Square Group, has said he strongly supports Trump's tariff, tax cut, and deregulatory agenda, but investors expect him to prioritize market stability over politics. [1]

[1] Elon Musk and Vivek Ramaswamy: The DOGE Plan to Reform Government – WSJ

Scott Bessent's 3-3-3 policy framework.

Secretary-elect Bessent has advised Trump to pursue a policy he calls 3-3-3, inspired by former Japanese Prime Minister Shinzo Abe, who revitalized the Japanese economy in the 2010s with his "three-arrow" economic policy. Bessent's "three arrows" include cutting the budget deficit to 3% of gross domestic product by 2028, spurring GDP growth of 3% through deregulation and producing an additional 3 million barrels of oil or its equivalent a day.[2]

While Bessent will take up the mantle for tax cuts, another Wall Street veteran and Trump appointee to Commerce, Howard Lutnick, will likely lead the fight on tariffs. Meanwhile, the newly formed DOGE plans to focus on the third leg of Trump's economic agenda, regulatory reform, but it is unknown how successful they will be in dismantling the "plethora of current federal regulations[3]" that exceed Congressionally granted authority.

DOGE plans to focus on five key areas:

- Remove regulations that Congress never explicitly authorized, using recent Supreme Court decisions as legal backing.

- Cut the number of federal workers through workforce reductions.

- Stop federal spending that wasn't authorized by Congress, with estimates exceeding $500 billion per year.

- Improve cost efficiency in government procurement by conducting large-scale audits of old contracts.

- Address waste at the Department of Defense, which has a budget of more than $800 billion and has failed seven consecutive audits.

DOGE plans to make these changes using presidential powers granted under existing legislation rather than trying to pass new laws through Congress, with a goal to complete this overhaul by July 4,2026.

[2] Scott Bessent Sees a Coming 'Global Economic Reordering.' He Wants to Be Part of It. – WSJ

[3] Elon Musk and Vivek Ramaswamy: The DOGE Plan to Reform Government – WSJ

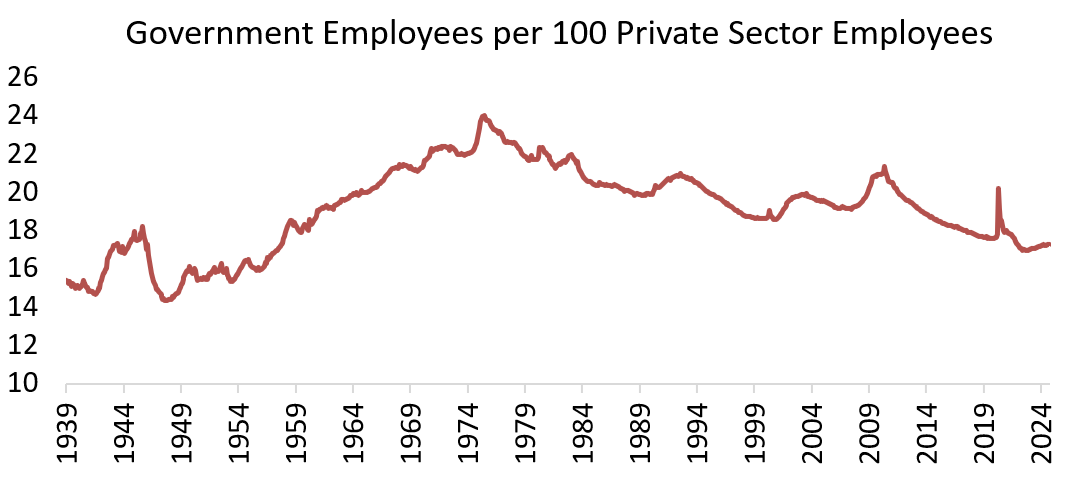

Government Employees per 100 Private Sector Employees

Source: FRED & Haverford | Note: Government employment covers only civilian employees; military personnel are excluded. Employees of the Central Intelligence Agency, the National Security Agency, the National Imagery and Mapping Agency, and the Defense Intelligence Agency also are excluded. Postal Services are included.

As campaigning turns to governing and these policies begin to take shape, they are sure to spark debate, uncertainty, and market volatility. As always, our goal is to navigate these uncertainties with a focus on long-term growth, quality, predictability, and stability. These core principles of our investment philosophy enhance the chances of successfully meeting long-term goals regardless of what is happening in Washington D.C.

We wish all our clients and their families a healthy and happy Thanksgiving holiday. Thank you for putting your trust in The Haverford Trust Company.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value