Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

No Need to Fear Wage Growth, Yet

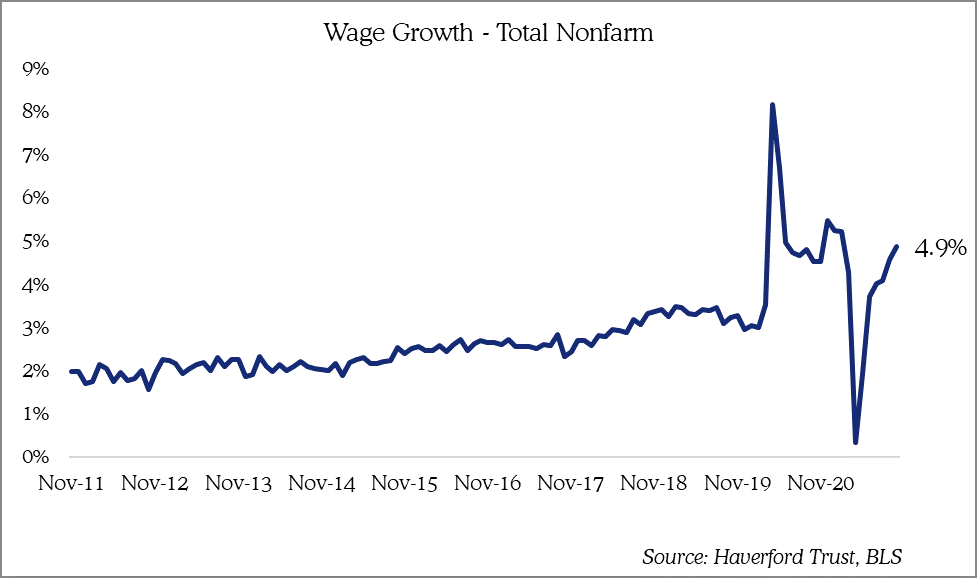

The October jobs report showed strong gains in October payrolls – an increase of 531,000 — upward revisions of 235,000 to prior months, and average hourly earnings that grew 4.9% year over year. Following several decades of lackluster wage growth, we expect labor to have the upper hand in pay negotiations for several years to come.

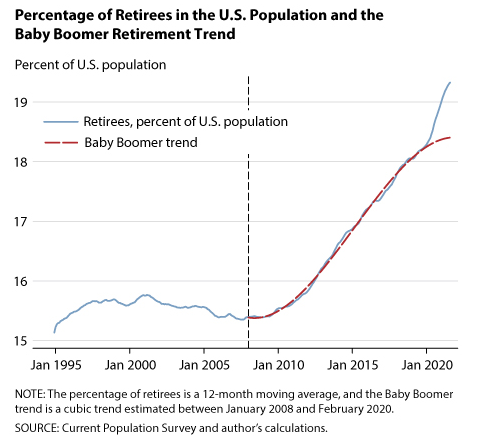

It is simply a matter of supply and demand, as Miguel Faria e Castro, of the Saint Louis Fed points out: “As of August 2021, there were slightly over 3 million excess retirements due to COVID-19, which is more than half of the 5.25 million people who left the labor force from the beginning of the pandemic to the second quarter of 2021.”1

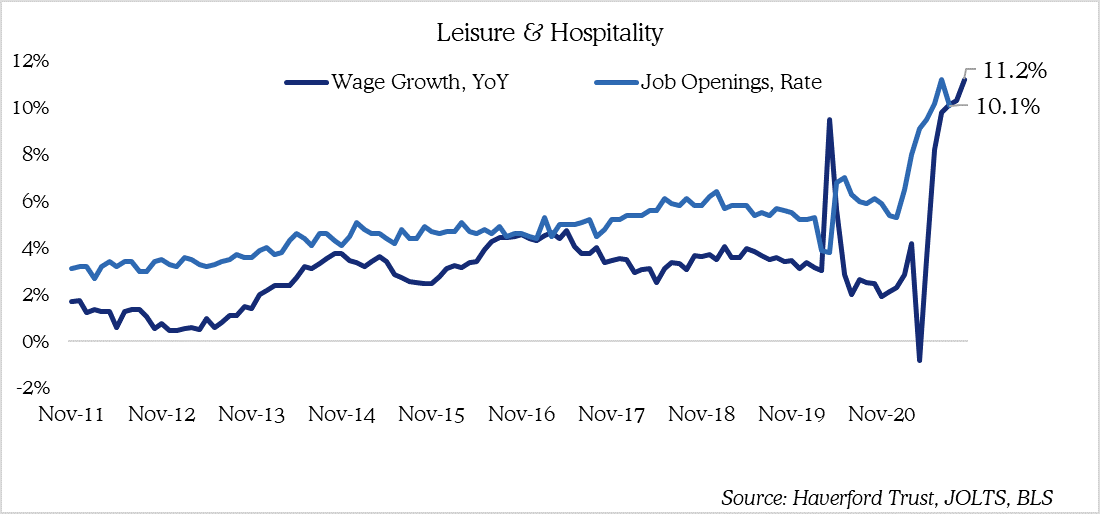

The percentage of retirees in the U.S. population is now 19.3%. This is up from 15.5% in 2008, the year the oldest baby boomer turned 62. Assuming these retirees do not reenter the workforce, there is much less slack in the labor market than one might expect. This trend is most obvious in the leisure and hospitality industry, where there is one job opening for every 10 workers, and wages are increasing at a double-digit rate.

We don’t believe investors need to fear higher levels of wage growth, at least not yet. Higher wages should entice some marginalized workers back into the workforce. And one person’s wages eventually becomes another’s investment or spending. Wage growth will have to remain at or above current levels for several more years, without a commensurate increase in productivity (which is unlikely due to globalization and technological advancements), before there is a risk of eroding corporate profits. We believe this scenario of sustained wage growth above 5% is unlikely.

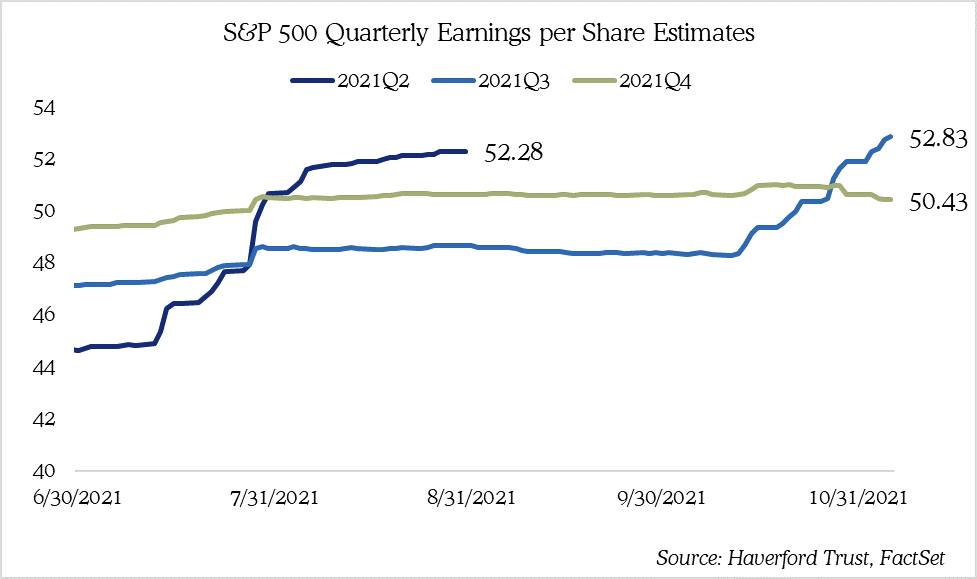

In the near-term, supply chain bottlenecks pose a much larger risk to corporate profits than do increasing wages. It appears that the consensus expectation among economists and investors is that we are at “peak bottleneck,” although we expect potentially empty shelves to be the focal point of Black Friday news coverage. Now that the 3rd quarter reporting season is almost over, we have a much better picture of supply chain woes and their effects. As the accompanying chart shows, 3rd quarter S&P 500 profit expectations increased close to 10% as companies have exceeded expectations. Meanwhile, expectations for the 4th quarter are only down a fraction of a percent.

If you think we are painting too rosy a picture of jobs, wages, bottlenecks, and corporate profits, you may be right. There is a possibility the Federal Open Market Committee is “behind the curve” and allows inflation expectations to untether, unleashing a domino effect of higher prices, higher rates, and stagflation. However, we think it much more probable that productivity continues to allow growth with muted inflation and the private sector remains adept at evolving business models to maximize value. If we are wrong, we can always fall back on the “robot strategy,” as the Longhorn Village assisted living center near Austin, TX has done.2

[1] https://research.stlouisfed.org/publications/economic-synopses/2021/10/15/the-covid-retirement-boom

[2] https://www.kxan.com/news/local/austin/robot-moves-into-austin-assisted-living-center-serves-residents-meals-amid-worker-shortage/