Tim Hoyle, Chief Investment Officer

thoyle@haverfordquality.com

Stocks Extend Their Gains in Post Election Rally

The U.S. election results were accompanied by a strong stock market rally as political uncertainty was replaced by the prospects of lower corporate taxes and a more benign regulatory regime, albeit accompanied by a host of more risky policy initiatives such as universal tariffs. That said, it is not as if the uncertainty of the election was dragging down equity performance. Even prior to the post-election bounce, equities were enjoying their best election-year performance since the 1930’s. Before exploring how policy may unfold over the next several years, now is opportune time to revisit the economic conditions currently underpinning the equities bull market, which we believe are likely to remain in place throughout 2024 and well into 2025.

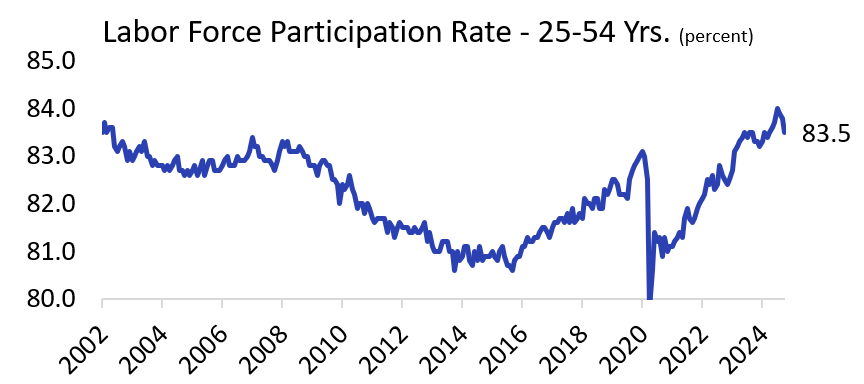

Full Employment: Despite a recent uptick in the unemployment rate and the concerns it has sparked, data continues to evidence a strong jobs market. Labor participation of workers aged 25-54 is another bellwether indicator of the job market’s health, and its latest reading of 83.5% is healthy with all indications that it will remain so.

Labor Force Participation Rate

Source: FRED.org

Tame Inflation: Prices as measured by the Consumer Price Index (CPI) have increased moderately at 2.4% year-over-year as of October. We believe inflation will continue to trend at a rate below 3% throughout 2025.

Stimulative Policy: The Fed Funds Rate is expected to decline towards 4.0% next year. We anticipate additional forms of stimulus as the Federal Reserve slows and eventually ceases its quantitative tightening cycle (e.g., reducing the Fed’s balance sheet) and the Treasury provides excess liquidity when the debt ceiling is reached in January. In addition to these monetary factors, there is no appetite to address the Federal deficit and debt. If and when this occurs it will be a drag on economic growth, but until then it continues to provide economic stimulus.

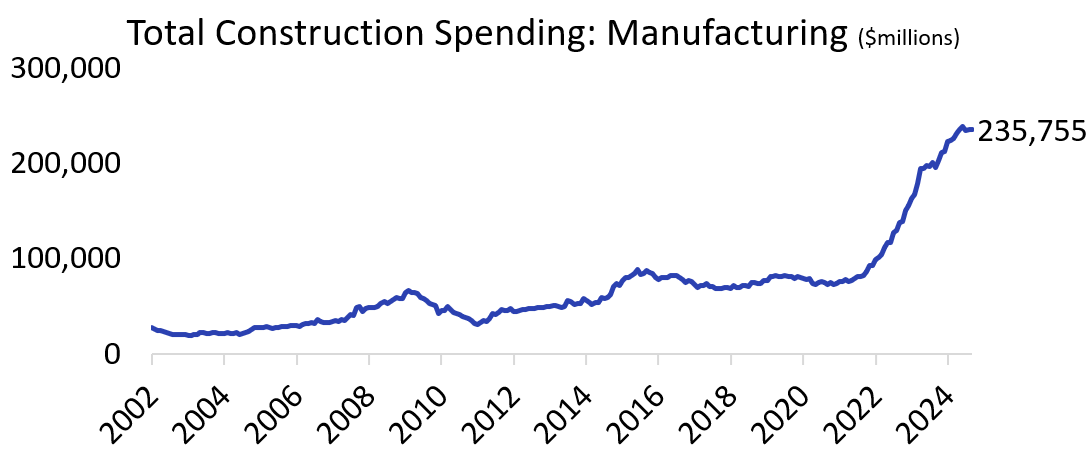

De-globalization: Populist trends have continued to grow since the 2016 Brexit vote. We have seen meaningful reshoring of U.S. manufacturing activity during the Biden administration. This return of manufacturing to American soil combined with spending on energy and data centers has led to a surge in construction spending likely to persist throughout 2025.

Total Construction Spending

Source: FRED.org

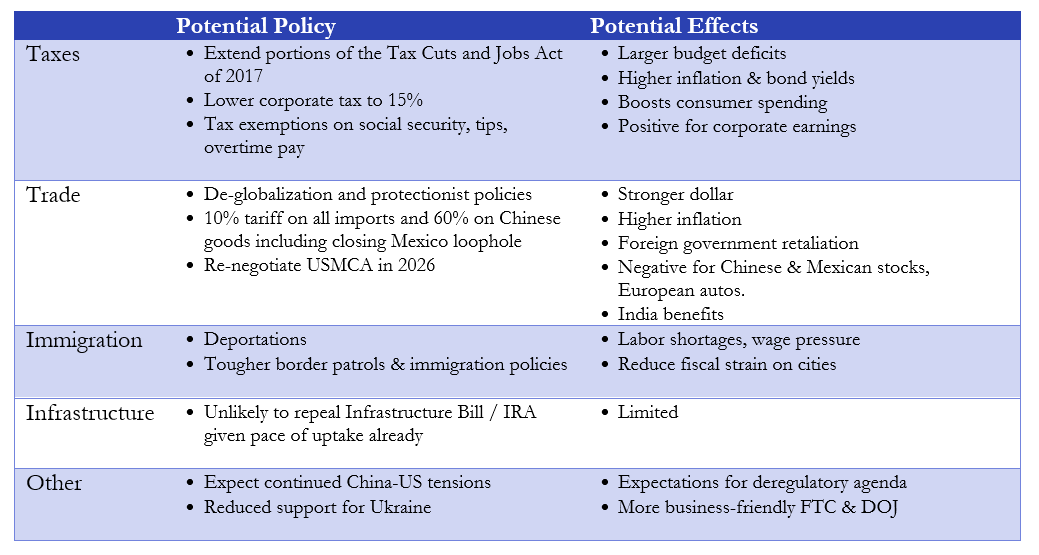

Republican control of both chambers of Congress (potentially) and the White House should allow the President to enact more of his economic agenda. Potentially significant policy changes include tax cuts (or at least maintaining them at current levels), deregulation, and higher tariffs. These policies could result in higher inflation, higher interest rates, and higher growth. In the following table we have summarized several of the campaign’s most noteworthy policy issues and potential implications under the Trump 47 administration.

Stock markets go up and down for every resident of the White House, but for investors it’s important to remember the trend is up. Investors should not underestimate the strength and dynamism of the U.S. economy. As President Biden stated in his post-election address to the nation on Thursday, “You know, we’re leaving behind the strongest economy in the world.” As President Biden would say, that’s no joke.

Media Inquiries

Veronica McKee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value