Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

Consumers Brush Aside Need for Additional Stimulus

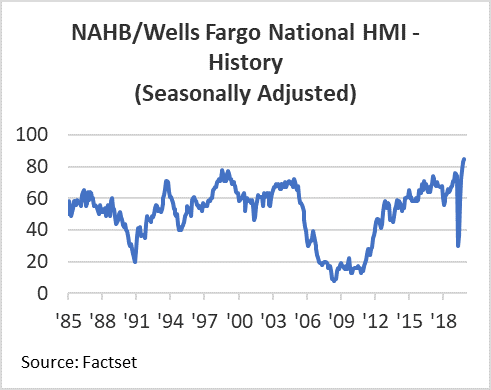

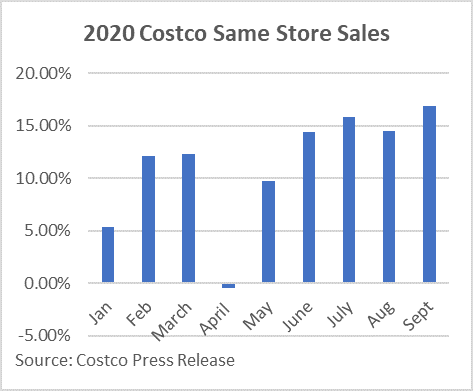

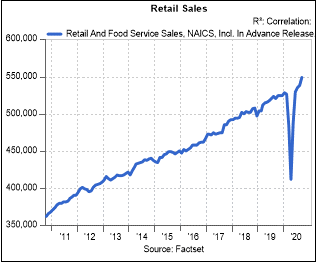

The S&P 500 declined by 1.6% on Monday, October 19 as markets came to realize that a pre-election Covid-relief bill was out of reach. It is obvious that the political calculus of both Senate Majority Leader McConnell and House Speaker Pelosi stands in the way of a compromise, which should be appalling to anyone who says they care about those who have been hardest hit by the economic lockdown. But the markets and consumers are lending no sense of urgency to the debate. The charts below show that consumers are spending more now than they did a year ago. Home improvements are replacing vacation spending and slashed dining-out budgets are making the way for Costco trips. The economic fall and resurrection of 2020 is stunning.

Home Builders Can’t Build Houses Fast Enough

Restaurants’ Loss is Costco’s Gain

Total Retail Sales are up 5x%

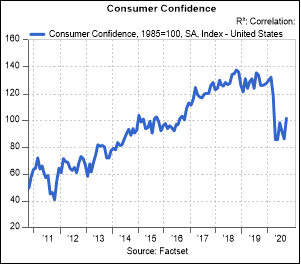

Consumer Confidence is Not as Strong as Retail Sales Indicate

Last week ushered in a good start to the earnings season; forty-two out of the fifty S&P 500 constituents reporting results beat earnings expectations. The second week of the earnings season will bring a slew of new economic information for investors to digest.

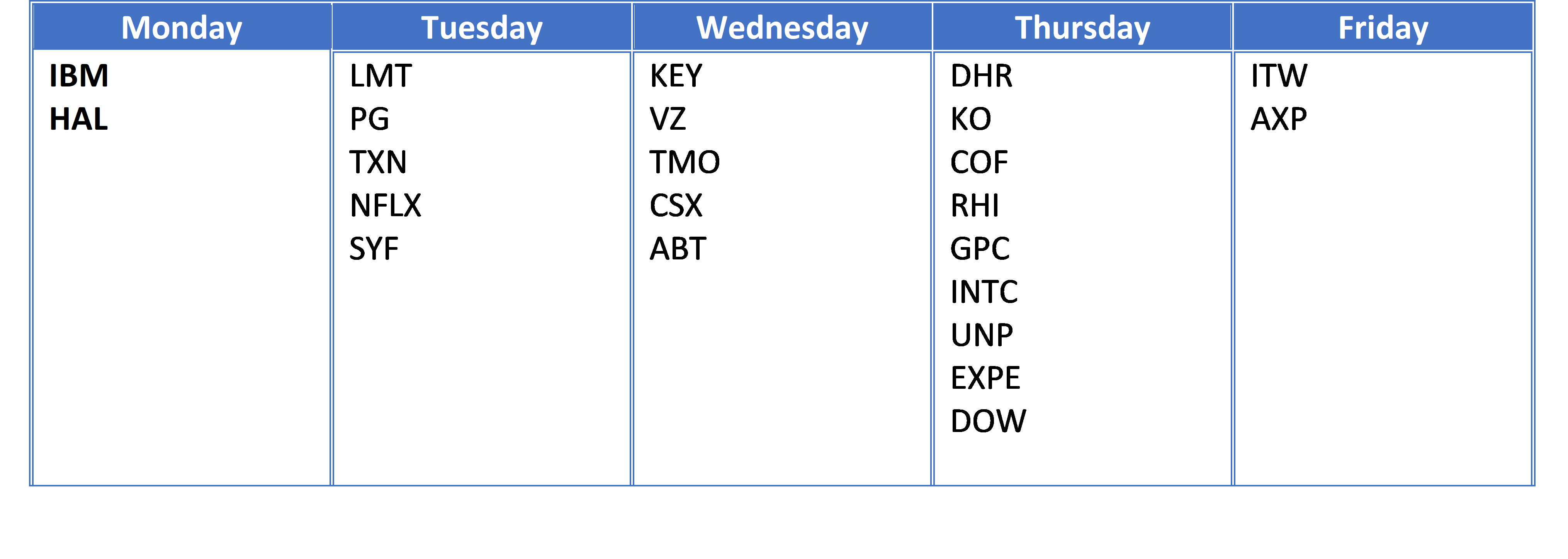

Selected S&P 500 Companies Reporting this Week