Josh Giacalone, Corporate Sustainability Analyst

jgiacalone@haverfordquality.com

Electricity: The New Eggs?

U.S. electricity prices have surged over the past year, outpacing inflation and highlighting structural challenges in the power sector. National costs are up 5% year-over-year on average, although this figure masks that some regions are feeling the pain more than others. Prices in New Jersey, for example, have risen 22% in the past year. The surge has led utility bills to become a primary topic in the state's ongoing Governor's race. According to the New York Times, "electricity is the new eggs".

Picture1

Source: NextEra Energy

What is driving these price increases and what can be done to mitigate them? With a growing number of power-hungry data centers set to come online in the coming years, the answer may have profound implications for the future of the economy. Let's examine the impacts of demand, supply, and policy on power prices.

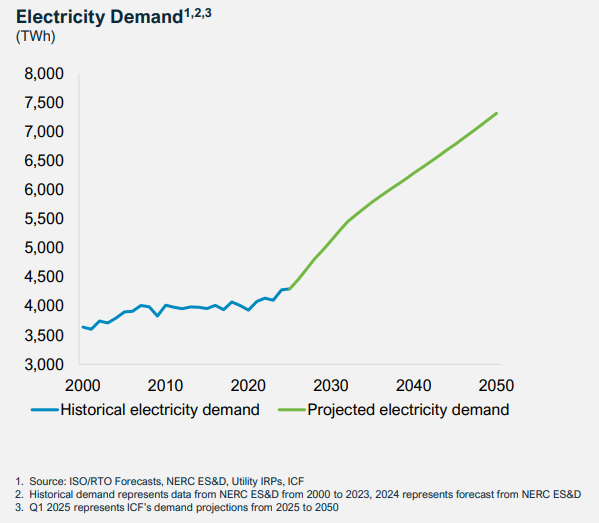

Over the past several decades, demand for electricity has been relatively flat. Although the economy and population grew, this was offset by energy efficiency gains and the shift from heavy industry toward the service sector, which is generally less energy intensive. Now analysts are forecasting meaningful growth in power demand as a result of the data center buildout to support Artificial Intelligence. We've already seen the impact of higher demand translate directly to higher prices. The auction price for power at PJM, a local regional transmission organization, was up 22% this year from last year's record highs due primarily to skyrocketing data center demand.

At the same time, the US is grappling with numerous challenges on the supply side, including the time it takes for a new source of power to be connected to the energy grid. The interconnect queue, as it's called, hovers around a 5-year wait time.

The grid itself is also presenting challenges as outdated networks of poles and wires, some nearly a century old, need to be replaced by utility companies. That's a significant investment on the part of utility companies to ensure the grid can meet demand, the cost of which is then passed along to consumers, plus a small margin to generate profits. The cost of energy itself is merely passed on to customers without any upcharge. So even though gas prices have come down, the rising cost of materials and labor related to these upgrades has driven gas and electric utility bills higher. As NPR explains,

"In 1984, about two-thirds of gas utility bills paid for the gas, and one-third covered infrastructure, utility costs and taxes, according to the Energy Information Administration. Now that has flipped. In 2024, less than a third of customer bills went to gas, and about two-thirds went to the other costs."

One possible antidote to limited supply would be to simply drill for more natural gas, but that may be easier said than done. After two decades of the shale boom, producers say that we're running out of the most productive wells. Analysts think prices will need to go back up to encourage producers to drill in riskier or more expensive areas, potentially offsetting the price benefits of growing supply.

Smarter public policy could be a solution, but addressing challenges on the demand side is difficult. With AI representing an outsized portion of economic growth and potentially ushering in a new era of productivity growth, governments may be hesitant to slow its development. Companies, on the other hand, appear to be voluntarily cautious about overbuilding data centers. Microsoft and others have recently cancelled three major data center projects that would have covered nearly 800 acres due to local pushback and practical utility constraints like access to power or water.

On the supply side, the government may be moving in the wrong direction. Despite all the rhetoric supporting an "all of the above" strategy for energy, which would utilize all available forms of energy, recent policy changes have made it harder to bring the fastest and often cheapest form of energy online: renewable solar and wind. The latest congressional budget bill phases out tax credits for renewables more quickly than the industry had anticipated. The federal government has also cancelled several solar and wind projects that were already under construction.

Picture2

Source: NextEra Energy

Renewables aren't a silver bullet. But as an Apollo senior executive recently noted, "the gap between what AI is demanding and what we have everywhere in the world on the grid in terms of generation and transmission is huge and will not be closed in our lifetime." In other words, we need all the help we can get in adding new generation capacity.

Looking ahead, we are encouraged to see some utility companies identifying new ways to insulate themselves and their residential customers from risks associated with these data center customers; mainly in the form of large load tariffs, which are agreements that require data center customers to commit to buying a minimum amount of power. They also often contain other provisions to ensure residential utility customers are not subsidizing the infrastructure or reliability costs associated with serving large customers. While efficiency gains in AI could potentially offset data center power needs, it is unclear exactly when that may happen. As we continue to evaluate opportunities we remain diligent, focused and committed to our core principles.

Media Inquiries

Veronica Mckee, CMP

Direct Phone: 610.995.8758

Email: vmckee@haverfordquality.com

Katie Karsh

Direct Phone: 610.755.8682

Email: katie@gobraithwaite.com

Disclosure

These comments are provided as a general market overview and should not be relied upon as a forecast, research or investment advice, and is not a recommendation, offer, or solicitation to buy or sell any securities or to adopt any investment strategy. Opinions expressed are as of the date noted and may change at any time. The information and opinions are derived from proprietary and non-proprietary sources deemed by Haverford to be reliable, but are not necessarily all-inclusive and are not guaranteed as to accuracy. Index returns are presented for informational purposes only. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly.

Investments in Securities are Not FDIC Insured · Not Bank Guaranteed · May Lose Value