Tim Hoyle, CFA, Chief Investment Officer

thoyle@haverfordquality.com

Fall 2021 Outlook: The Great Wall of Worry

Last quarter, we highlighted the potential peaking of many market tailwinds. Many of those items have become building blocks in the market’s ubiquitous “wall of worry.” The allegory teaches us that financial markets have a tendency to surmount negative factors, especially over long-term time horizons. There is no reason to believe this time will be any different; the wall may appear to be unscalable in the near-term, but long-term history has shown us, it becomes just a speed bump. There is no shortage of stones to place upon the wall of worry today.

Inflationary Pressures are Proving Resilient

“Transitory” inflation is turning out to be longer than originally expected. Supply chain bottlenecks are likely not to get fully resolved until the second half of 2022 and wage pressures remain, though they should abate as the Covid-19 virus de-escalates. Corporate earnings will be increasingly pinched by inflation and a strained supply chain.

Source: FactSet Earnings Insights

Monetary Policy is Set to Tighten

The Federal Open Market Committee (FOMC) is set to reduce asset purchases during the fourth quarter and has brought forward their estimate of an interest rate hike to 2022. Despite marginal changes in policy, the monetary backdrop should remain exceptionally dovish in 2022.

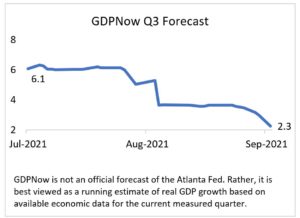

Economic Growth is Slowing

GDP growth slowed in the back half of the summer as the Delta variant intensified. If this variant continues to fade, economic growth should re-accelerate this fall, although not to the same pace that we experienced in the spring.

Source: Federal Reserve Bank of Atlanta

Tax Policy Remains Highly Uncertain

Handicapping the size and scope of the reconciliation bill (social infrastructure) currently under legislative debate, and the accompanying tax increases, seems futile at this point. We expect higher taxes, but not as broad and high as once feared earlier this year. We also expect the debt ceiling to be raised but not without brinksmanship. These uncertainties and political antics should result in more market volatility this fall.

Equity Markets Stalled During the Third Quarter

Market valuations remain above average, but a sideways market allows fundamentals a chance to catch-up to high prices. We have yet to see a meaningful market pullback in 2021, yet the reasons for a possible correction appear numerous. Be prepared for a correction, but don’t be paralyzed by mounting risks. We believe that this wall too, will be scaled.