Tim Hoyle, CFA, Co-Chief Investment Officer

thoyle@haverfordquality.com

Welcome Back…to What is Traditionally the Toughest Month for the Markets

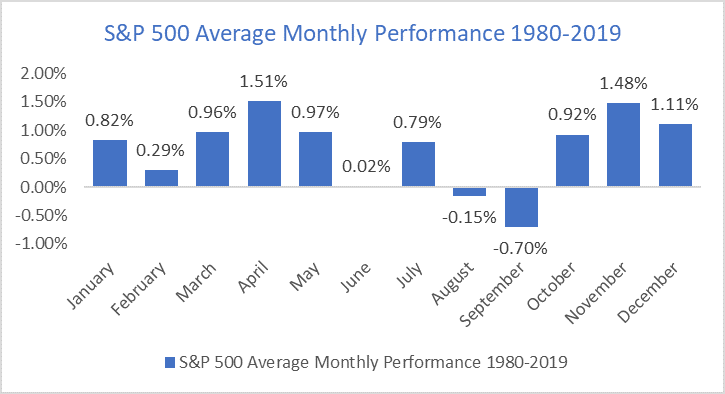

Labor Day Weekend is often a time to change mindsets. The unofficial end of summer, back to school, back to work (sort of), and election season. September has also historically been the worst month for stocks and the best explanation for why, according to Investopedia, is seasonal behavior bias. Shorter days do matter. The September Effect has seen the Dow Jones Industrial Average decline, on average, 0.8% since 1980, while the S&P 500 has averaged a 0.7% decline during the month of September. This phenomenon is not exclusive to the U.S., as evidence suggest markets worldwide struggle this month. As of Tuesday afternoon, the markets are following the playbook of Septembers past.

Assuming the market’s recent pullback is not due to seasonal affective disorder, one need look no further than August’s run-up and reporting from several news outlets that SoftBank pumped up tech stocks through massive option purchases. These types of market moves, stories of market “whales,” and the constant need to find rational explanations for every stock move reminds us of Benjamin Graham’s admonition, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Market prices are continually teetering between voting and weighing; everyday a new set of ballots are cast. Fortunately, our political leaders are voted on, the outcome is known, and power is transferred. Unfortunately, this year’s mail-in ballot procedures may result in not knowing the election’s outcome in a timely manner. This is one scenario that could prove a stumbling block for markets during November and December, which are typically seasonally stronger months.

Known catalysts and identifiable risks are many times not the reason for sudden market moves. It is often the unknowable that jars markets, such as SoftBank’s options positions. Of course, this does not stop us, or anyone else, from looking to the horizon for possible market affecting events.

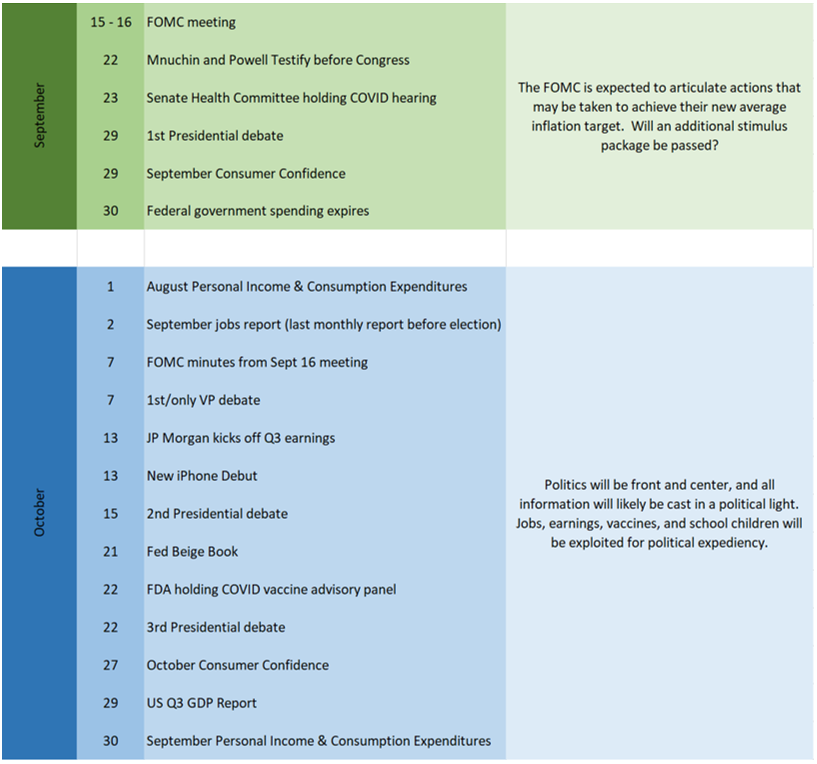

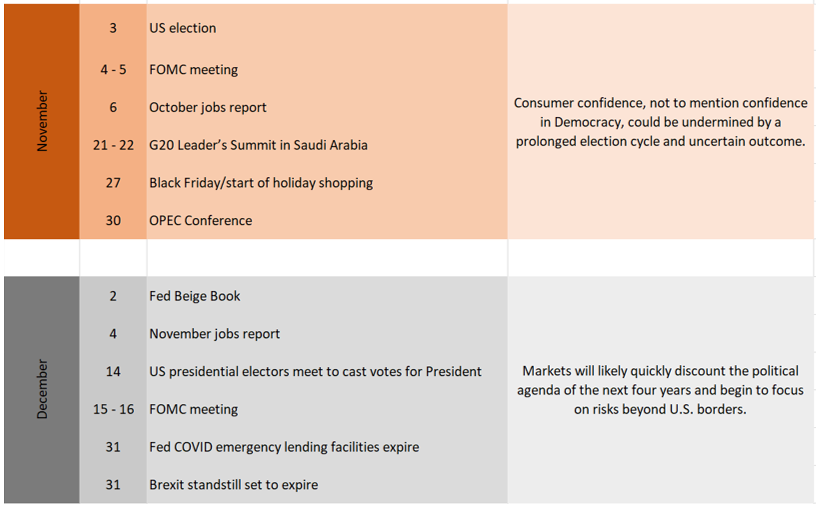

A list of important dates between now and New Year’s Day.