Swapping One Geo-Political Risk for Another

Investors’ respite from macro concerns was very short-lived. Returning from the New Year’s holiday last Thursday, the market was celebrating the pending signing of a phase-one trade deal with China. Less than 24 hours later, the macro landscape changed dramatically following the airstrike on Major General Qassem Soleimani, leader of the foreign wing of Iran’s Islamic Revolutionary Guard Corps. What do we believe some of the implications of renewed Mideast tensions could be and how should investors respond?

- Global risk premia will increase. This is a fancy way of saying P/E multiples could fall if investors are willing to pay less for a dollar of companies’ earnings. It’s cliché to say the markets were priced to perfection, but following last years’ gains and particularly the S&P 500’s 10% 4th quarter advance, the market’s P/E multiple (18.5x consensus 2020 earnings) had become stretched. The paradox of risk is that when little risk is priced in, investors are most at risk of being blindsided. We now have a risk to focus on, which can be healthy.

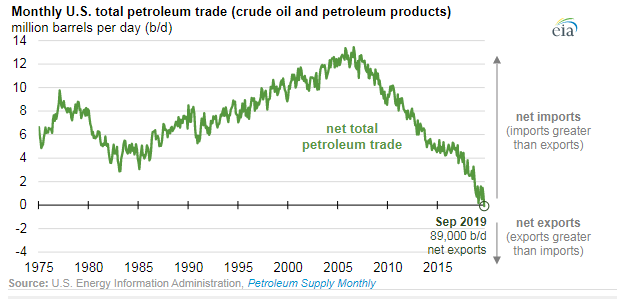

- Earnings should not be much affected. Despite the geopolitical and human ramifications, we don’t believe heightened tensions in the Gulf will bring down corporate earnings. Analysts’ consensus expect calendar year 2020 S&P 500 earnings to rise close to 9%, to $177. In Haverford’s estimation, earnings were never set to rise that much, coming in closer to $170 (+5%). One reason earnings should be resilient, is that the U.S. economy is no longer as captive to foreign oil as it once was.

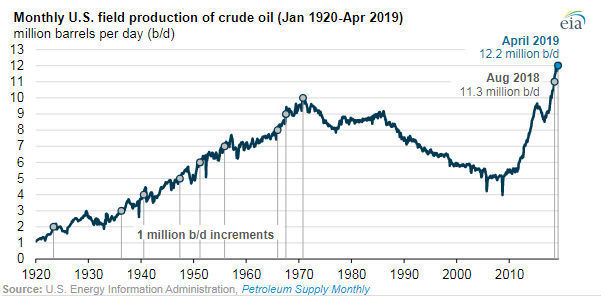

- The threat from higher oil prices is not the menace it once was. The United States is a leader in energy production and we have an economic base levered to natural gas. Significantly higher oil prices will only entice more domestic production. That said, we cannot be cavalier regarding the risk of rising commodity prices.

- Higher inflation expectations could put a damper on things. We pointed out in the 2020 Outlook that the expectation for low inflation has provided the Federal Reserve and other central banks room to maneuver. Central banks have been able to ease monetary policy and provide ample liquidity, which is beneficial to markets and economic activity. Any type of inflation scare, which we don’t expect though the possibility has risen, would pressure the markets.

- Investors have dealt with Mideast turmoil for generations. Unfortunately, the Persian Gulf and surrounding region have been a tinderbox since before modern map lines were drawn. We are optimistic that despite the United States response to the attack against our embassy in Iraq, with a targeted strike against the Iranian General, cooler heads will prevail and a larger conflict can be avoided. President Trump is mercurial, but one thing that both detractors and supporters will likely agree on: President Trump campaigned on not being a War Hawk. The President is extremely hesitant to increase “foreign entanglements.” Regardless of domestic politics, the Mideast will remain a risk and that is just the reality investors will have to deal with.

The threat from higher oil prices is not the menace it once was.