Tim Hoyle, co-Chief Investment Officer thoyle@haverfordquality.com

Josh Giacalone, Corporate Sustainability Analyst jgiacalone@haverfordquality.com

Last week, the World Economic Forum hosted the world’s most elite and powerful in the Swiss ski resort of Davos to deliberate on the world’s most demanding problems. The irony of this annual gathering in the “age of populism” is a topic for later discussion. The most prevalent topic at this year’s confab was sustainability and the role of corporations in tackling environmental, social, and governance (ESG) issues. Regardless of your view on climate change, diversity, inclusion, pay gaps, or minimum wage, investors should be aware of how these issues may affect the companies they own. It is for this reason that Haverford added a sustainability analyst to the team in 2019. It is a just a coincidence that we chose this week to discuss the topic of corporate sustainability below in our series on the past decade and potential implications for investors in the future.

Before we get to that topic, here are Seven Themes of the 2020 World Economic Forum Annual Meeting:

The paragraphs below represent the third installment of a series on the past decade and potential implications for investors in the future. Click here to read the previous installment.

Haverford Insights 2020: More Than Profits, or More Profits?

Open up your preferred news source and you’ll likely encounter an age old reporting bias: Bad news sells papers. Whether you’re reading about the economy, politics, or your local community, stories tend to focus on negative developments more often than positive ones.

News coverage of corporations is no different. In the past decade, BP’s Deepwater Horizon drilling rig spilled 4.9 million barrels of oil into the Gulf Coast, hackers exposed the personal information of 147 million Equifax customers, and Facebook’s CEO testified in congress amid questions about the social media platform’s role in shaping our democracy. Concurrently, corporate profits soared, leaving many to question how a just capitalist economy could seemingly reward such corporate misdeeds. Many have gone so far as to say that capitalism is broken. We disagree. These controversies were undoubtedly worthy of the headlines, but on their own do not fully reflect the work companies are doing to improve society.

Despite lasting and profound impact, most corporate sustainability initiatives over the last ten years have received little attention. For instance, Apple has committed to giving back to its home state of California by pledging $2.5 billion to expand affordable housing and programs to fight homelessness. Abroad, Mastercard has worked to expand access to electronic payments to underserved communities in emerging economies. Microsoft positioned itself as an environmental leader by launching a first-of-its-kind internal carbon pricing program to become carbon neutral and has plans to go carbon negative by the end of this decade. Due in part to the development of improved cancer therapies such as Merck’s Keytruda, the United States experienced the largest single-year drop in cancer mortality from 2016 to 2017i. And the list could go on.

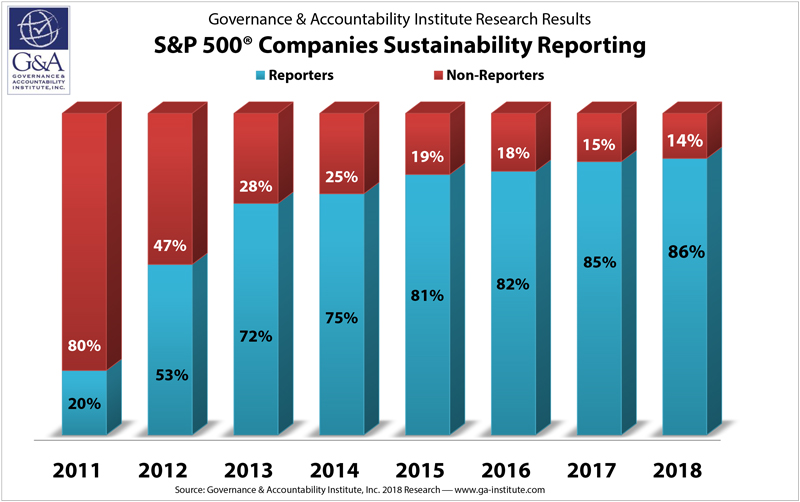

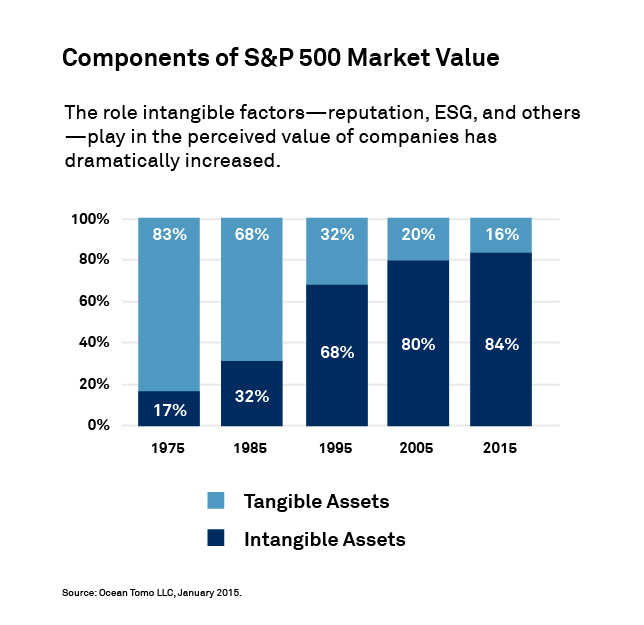

As investors, we shouldn’t let negativity bias obfuscate corporate progress. In fact, we should be particularly encouraged that the trend toward sustainability is so widespread: at least 86% of companies in the S&P 500 now report sustainability metrics, compared to just 20% in 2011. That transparency is critical for investors to accurately value a business in today’s market. Intangible assets–those that don’t show up on the balance sheet, such as a brand’s reputation–now comprise a significant majority of the S&P 500’s perceived market value. In response, investors are increasingly incorporating ESG (Environmental, Social and Governance) into their processes in an attempt to mitigate non-balance sheet risk.

ESG disclosures are an invaluable tool for gaining insight into those intangible factors. They enable investors to more accurately gauge a company’s risks, opportunities, and even quality of management by revealing whether a company is efficiently managing its resources, planning for the long term, or maintaining its social license to operate. A growing body of research suggests that as a company’s ESG performance improves, profits growii.

A New Paradigm

Given these shifts, we believe the most adept management teams will make ESG a strategic priority in the coming decade. They are already off to a strong start: business leaders in Davos last week released a framework for standardizing sustainability metricsiii. Having comparable ESG data across different industries would be a monumental change, allowing investors to reward the companies that are best managing the ESG factors that impact their businesses. That means capital will be more efficiently allocated—not just to companies making a lot of money, but to those doing so responsibly.

Finally, some good news.

i https://immuno-oncologynews.com/2018/04/13/keytruda-increases-lung-cancer-patients-survival-better-than-chemo/, https://www.wsj.com/articles/u-s-cancer-death-rate-drops-by-largest-amount-on-record-11578484809

ii https://www.morningstar.com/blog/2019/03/12/esg-investing-perfor_0.html, https://www.tandfonline.com/doi/full/10.1080/20430795.2015.1118917

iiihttps://www.ft.com/content/91773438-3d07-11ea-a01a-bae547046735