Investors often use the terms wealth management and financial planning interchangeably. Yet, they each have specific purposes and benefits.

Wealth management is the activity focused on identifying and using the right investments. A wealth management advisor works to ensure each investor has the proper asset allocation to gain the best chance at reaching their goals, while considering their appetite for risk.

Financial planning is the process of looking comprehensively at a person’s current financial situation and building a specific plan that serves as the roadmap to reach their goals. At the start of the planning process, a person’s lifestyle wants and needs are identified, including cash flow, retirement and legacy objectives. The information gathered during a planning meeting can then be used to build the investment strategy and other drivers for reaching those goals.

Investors need both, said Bryan Tracy, vice president and director of wealth planning for Radnor-based investment management firm The Haverford Trust Company. “Integrating those different aspects creates a comprehensive financial picture. It takes the context from cash flow analysis and modeling future scenarios and makes it actionable, tying it together with the strategic investment management experience.”

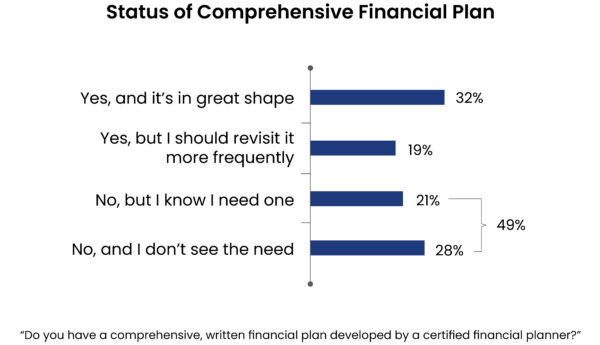

Half of investors lack a comprehensive financial plan

Despite the benefits, half of all investors in a recent Philadelphia Business Journal survey said they don’t have a comprehensive financial plan. Haverford Trust sponsored the research, which included 216 participants.

The survey showed that six out of 10 investors work with a wealth manager and say their wealth manager oversees just under half of their investable assets.

Which types of services do these investors hire a wealth manager to handle? The most frequently used services are portfolio management, financial planning and diversifying investments.

Navigating family dynamics

Tracy said a comprehensive approach toward wealth planning is especially helpful for investors who are navigating family dynamics. He recently met with a multigenerational family. “For the longest time, we had focused more on the investment side, especially under the guidance of the patriarch of the family who was the architect of the wealth plan,” Tracy said. “When he recently passed away, we became engaged in a process of helping the family to see the full picture and implications of their wealth.”

The Haverford team called in their portfolio managers and trust experts to strategically facilitate discussions and plans designed to ensure the family’s wealth will continue to serve not just the next generation, but also rising generations of grandchildren, great-grandchildren and, potentially, beyond. “An important part of the comprehensive financial plan is the ongoing and evolving nature of it,” Tracy said. “We went through all of this with the patriarch and it will be continued with the family.”

Adjusting when life takes a turn

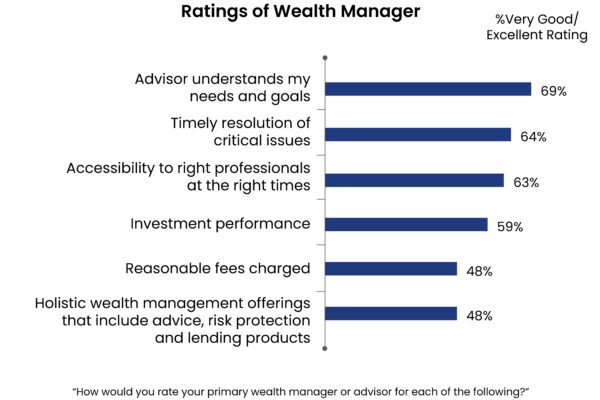

Investors’ needs and goals change over time, said Binney Wietlisbach, Haverford Trust’s president. In the survey, most investors said their wealth manager is doing a good job understanding this and they also gave positive marks for resolving critical issues in a timely manner and for being accessible.

“All of my meetings start out with asking how my client is doing,” Wietlisbach said. “We want to hear an update about the individual or the family. What we’re listening for are cues as to changes that may be happening for them.”

Most of those surveyed agreed their advisor provides customized advice, reviews performance on a consistent basis and communicates frequently and proactively. Most investors also say their advisors bring new ideas and insights to them and leverage the latest technology for support. The facilitation of conversations, formal schedule of reviewing the plan and the portfolio, and the strategic insights are the true difference between doing it yourself and having a professional team and tools in place, according to Wietlisbach.

Guidance to stay the course

Customized advice sometimes means giving clients difficult news. Wietlisbach said she has had two clients close accounts in the past 30 years when she cautioned them that their spending was outpacing their wealth plan.

“I make it very clear with clients; it’s absolutely your money, and you can spend as much as you want, but understand that if you continue to spend at the rate you’re spending, you will not have a portfolio left in five years,” she said. “Sometimes people don’t want to hear that.”

When it comes to creating a comprehensive financial plan, total honesty with your advisor is the best policy, Wietlisbach said. Take the time to ensure your wealth manager has a complete picture of your goals and your budget.

“Most people underestimate how much money they spend,” Wietlisbach said. “That makes a dramatic difference when you are putting together a financial plan.”

Ongoing communication is important, too. Life changes, and investors need to adjust their financial plans accordingly.

“It’s like when you use GPS to plan a road trip; you put in your destination, get part way along your trip, and sometimes it says ‘recalculating’ because there was a detour you didn’t expect,” Wietlisbach said. “The great thing with financial planning is knowing where your destination is, seeing the options to get to your destination and providing you an opportunity to figure out another route when that unexpected detour comes along your way.”

This content was published in partnership with Philadelphia Business Journal. To see the original article, click here.