Bryan Tracy, CFA, CFP®

Vice President & Director of Wealth Planning

Higher inflation is cause for some positive updates for 2023 financial planning. The U.S. Treasury is set to make adjustments to tax brackets, standard deductions, and estate tax exemptions, as well as retirement contribution limits, in an effort to absorb some of the impact from soaring inflation and keep more money in taxpayer wallets. Understanding these updates is important as they could mean adjusting your current tax, retirement, and estate planning strategies for the year to come.

Tax Brackets & Standard Deductions

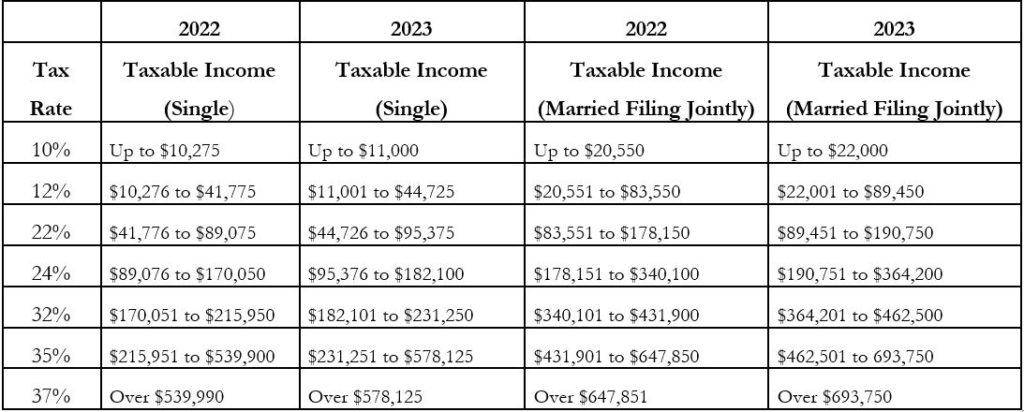

Tax brackets move with the inflation rates, so the amount of tax paid on income gradually shifts over time to account for the overall increase in the price of goods and services. However, given the persistently high inflation consumers have been facing is atypical for recent history, tax brackets are moving up to offset that drastic change. While the tax rates ranging from 10% – 37% are not actually changing, the income breaks across the tax brackets are being reconfigured to account for inflation. If the tax brackets move up – meaning the thresholds to move into the next tax bracket increase – there is a chance that some taxpayers may drop down into a lower tax bracket – or at least not move up to a higher one. The chart below shows the updates to the tax rate thresholds.

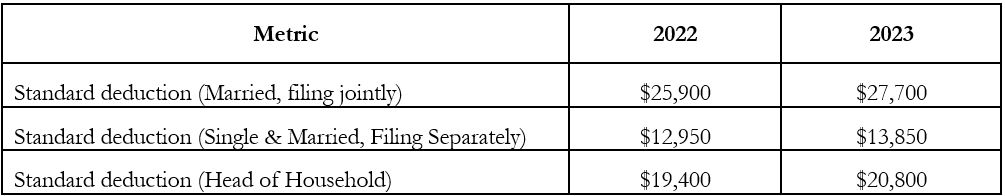

The standard deduction across taxpayer metrics is set to increase approximately 7% and the bracket taxable income thresholds will increase 7.1%. This is following the recent 8.7% annual cost of living adjustment (COLA) set forth by the Social Security Administration, the largest one-time increase since 1981. The standard deduction for married couples filing jointly for the 2023 tax year rises to $27,700, up 6.9% from 2022. For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850, another 6.9% increase; and for heads of households, the standard deduction will be $20,800, a 7.2% increase. The income thresholds for tax rate brackets have increased 7.1% across all levels.

Estate and Gift Tax Exemption

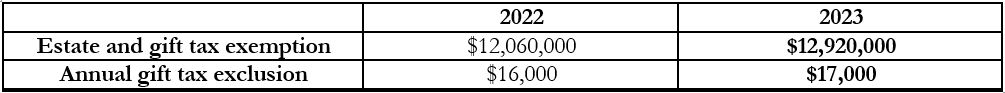

Other notable updates for 2023 planning include the estate and gift tax exemption (unified credit) which will increase $860,000 to $12,920,000 in 2023. Although the federal estate and gift tax exemption amount is currently $12.92 million, the exemption is set to fall back to lower levels in 2026. The annual exclusion for gifts will increase to $17,000 for calendar year 2023, up from the 2022 amount of $16,000.

Retirement Contributions

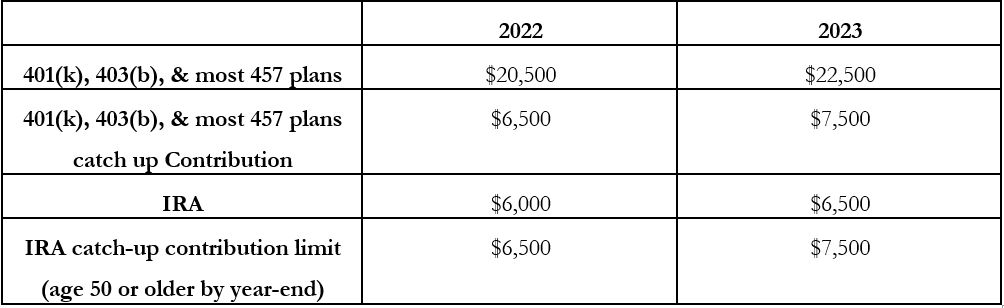

2023 adjustments to retirement contribution limits may provide added opportunities for your retirement planning and savings strategies. The higher-than-average inflation caused the IRS to increase the contribution limits on popular retirement accounts such as 401(k), 403(b), most 457 plans, and IRAs. The IRS also adjusted phase-out ranges and income limits, so consult your team of trusted advisors to confirm what vehicles you are eligible to contribute to in 2023 as that could have changed from the previous year.

Your Relationship Management team will be sure to address these updates and opportunities specific to your unique retirement, estate, or financial strategy in your next portfolio review meeting.

The information provided is not intended to be and should not be construed as legal or tax advice. Haverford does not provide legal or tax advice. You should consult with your legal or tax advisor regarding your specific tax situation prior to taking any action based upon this information.