Bryan Tracy, CFA, CFP®

Vice President & Director of Wealth Planning

Congress recently passed a bill that will make retirement saving more accessible for more Americans. The SECURE Act 2.0 builds on the SECURE Act, which was originally approved by Congress in 2019. The acronym SECURE stands for “Setting Every Community Up for Retirement Enhancement,” and the SECURE 2.0 Act is designed to do just that. The legislation creates incentives and provisions to encourage long-term savings while allowing more flexibility to access funds in the event of financial emergencies. The provisions create more savings opportunities for more people, with a focus on lower income individuals and small business practices.

Some of the main points of the SECURE 2.0 Act include:

1. Extension Of Age for Required Minimum Distributions (RMDs)

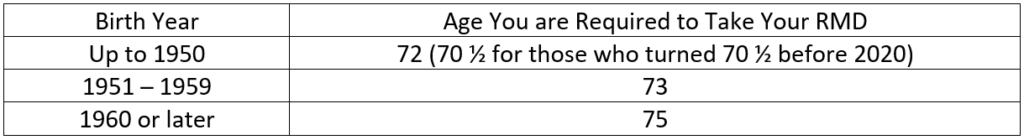

Starting in 2023, this new legislation increases the age at which individuals must begin taking RMDs from their retirement account from age 72 to 73, starting in 2023.That age is then set to adjust to 75 starting in 2033. The chart below shows when you are required to take your RMD based on year of birth.

2. Increased Catch Up Contributions

In 2023, people 50 and older will be able to contribute an extra $7,500 annually to their employer retirement plan. Starting in 2025, for individuals between age 60 and 63, employer retirement plan catch-up contributions rules will allow people to save up to the greater of $10,000, or 150% of the regular catch-up contribution amount (indexed for inflation). Beginning in 2024, IRA catch-up contribution currently at $1,000 will start being indexed for inflation.

3. New Rules for Qualified Charitable Distributions (QCDs) from an IRA

Beginning in 2024, the QCD limit will change for the first time ever as it will be linked to inflation. Beginning in 2023, taxpayers may take advantage of a one-time opportunity to use a QCD to fund a Charitable Remainder Unit trust (CRUT), Charitable Remainder Annuity Trust (CRAT), or Charitable Gift Annuity (CGA). The maximum amount that can be moved in this once-in-a-lifetime distribution is $50,000 and the vehicle must be funded solely with the qualified charitable distribution.

4. Roth-Related Modifications

The SECURE 2.0 Act enacts many changes for Roth retirement accounts. Some of these changes include:

- Starting this year, this legislation allows for the creation of both SIMPLE Roth accounts and SEP Roth IRAs. Previously, these types of assets were only allowed to include pre-tax funds.

- Employers are permitted to deposit matching and non-elective contributions to employees’ Roth retirement accounts. The amounts deposited will be included in the employee’s income in the year of the contribution is made.

- Higher wage earners are now mandated to use a Roth option for catch-up contributions. This Roth restriction on catch-up contributions imposed by SECURE Act 2.0 applies to those who have wages in excess of $145,000 for the previous calendar year. This new rule applies to catch-up contributions for 401(k), 403(b), and governmental 457(b) plans, but not to catch-up contributions for IRAs, including SIMPLE IRAs. It is not confirmed at this time if the legislation would apply to self-employed individuals.

- In limited circumstances, individuals may be permitted to move funds from a 529 plan directly into a Roth IRA. While this may be a beneficial strategy for some, there are many stipulations around the transfer to ensure it is valid. Some of these conditions include the 529 plan must have been maintained for at least 15 years, and any funds contributed or earnings collected within the last 5 years are not eligible to be transferred.

5. Mandatory Automatic Enrollment in Retirement Plans

The SECURE 2.0 Act will require employers to automatically enroll employees into newly created workplace 401(k) or similar style retirement plan accounts. It will then be up to the employee to opt out, should they not want to participate. This provision is set to go into effect in 2025. The list of exempt employers, however, is long and includes employers less than 3 years old, church plans, governmental plans, SIMPLE plans, and employers with 10 or fewer employees.

6. Emergency Funding

The SECURE 2.0 Act includes several provisions to make it easier for Americans to access emergency funds from their retirement plans. This is intended to encourage more Americans to contribute to their retirement savings if they do not have to fear they are unintentionally locking away funds that they will not be able to access without the threat of heavy penalties.

One such provision allows employees to save up to $2,500 in a Roth retirement account, although employers can set lower limits. Contributions and employer matches would be invested in principle-protected investments such as cash or other interest-bearing assets. When an employee taps into this rainy-day emergency fund, the money would be distributed free of taxes and forego the standard 10% penalty that people under age 59 ½ typically owe. Employees defined as “highly-compensated” meaning they own more than a 5% interest in the business, received more than $135,000 in compensation in the previous year, or are in the top 20% of compensation at the employer are not eligible to contribute to this rainy-day emergency fund.

Beginning in 2024, a participant in an employer plan may make a withdrawal up to $1,000 per year from their retirement account for certain emergencies. The withdrawal will be taxable and may be repaid within three years, but it will not be subject to the typical 10% penalty for early withdrawals. Only one withdrawal is permitted per the three-year repayment period if the first withdrawal has not been repaid.

7. Small Business Incentives

The legislation creates a revised and simplified retirement plan that small businesses can take advantage of that includes only employee salary deferrals related to the annual IRA contribution limit amounts.

For small businesses with up to 50 employees, the law allows for a start-up tax credit up to 100% of startup administrative costs for the first three years that a plan is established, with a $5,000 per year maximum. This is a change from the previous 50% credit paid for startup costs. For larger companies with 51-100 employees, the 50% credit remains.

8. Extra Benefit for those Impacted by Student Debt

The new rule will allow people to save for their retirement while paying student loan debt. The new student loan repayment match allows employers to help employees who are paying off student loans. An employer can make a matching contribution on behalf of the employee in a retirement plan with respect to qualified student loan repayments. The provision will help people take advantage of their employer’s retirement match even if they don’t have the capacity to save for retirement as they are paying down student loans.

9. Savings Support for Part-Time Workers

Part-time workers currently will now be allowed to participate in a workplace retirement plan if they have two years of service and work at least 500 hours a year, as opposed to the current rule of three years of service.

These points are just some of the highlights of the comprehensive SECURE Act 2.0. Please reach out to your Portfolio Management team or Wealth Planning team should you have specific questions about how these updates may impact your financial strategy.

The information provided is not intended to be and should not be construed as legal or tax advice. Haverford does not provide legal or tax advice. You should consult with your legal or tax advisor regarding your specific tax situation prior to taking any action based upon this information.