Last Week:

- U.S. equities finished positive for the week: In another volatile week where the S&P500 moved by more than 1.5% in three out of the four trading days, stocks ended the week up 2%. The narrative remains largely unchanged with the market still grappling with global trade fears, monetary policy, and technology headwinds, among others. On the week, the Dow Jones Industrial Average (Dow) gained 570 points, or rose 2.42%, to 24,103. The Standard & Poor’s (S&P500) index gained 53 points, or rose 2.03%, to 2,641. The Nasdaq closed 1.01% higher at 7,063, while the 10-year Treasury ended the week at 2.74%.

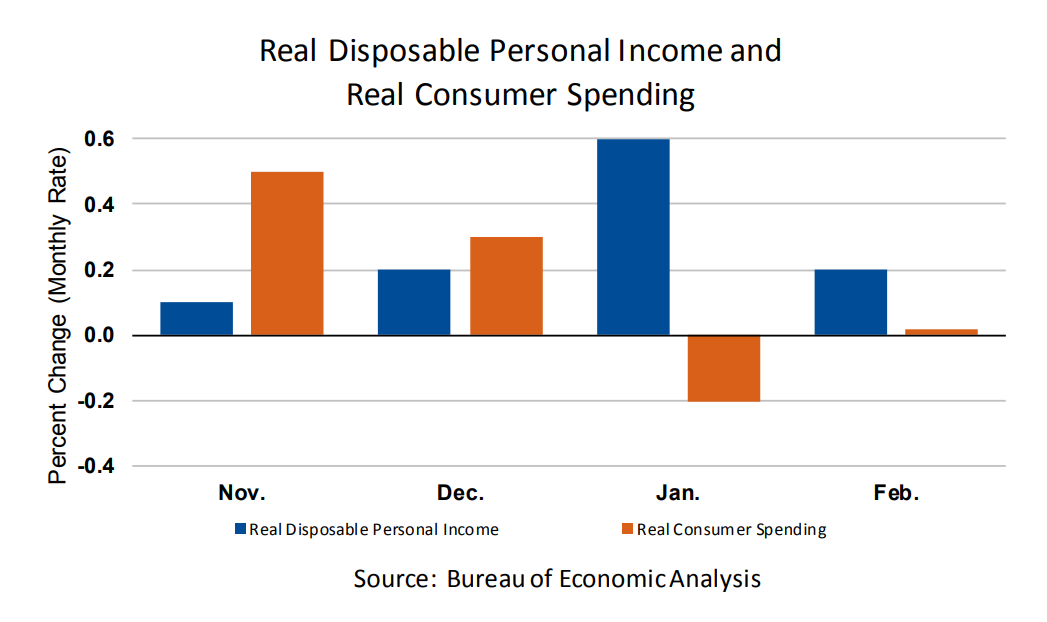

- U.S. Consumer: Last week, the Bureau of Economic Analysis released consumer spending data largely in line with market expectations. Consumer spending which accounts for more than two-thirds of U.S. economic activity rose 0.2% in February after a similar gain in January. U.S. Personal income also rose 0.4% in February (similar to January), driven largely by wages and salaries (+0.5%), with households boosting savings to a 6-month high of 3.4% as a percentage of Disposable Personal Income. Investors were mainly focused on the Personal Consumption Expenditures (PCE) price index (the Fed’s preferred inflation measure), which rose 1.6% year over year, in line with expectations and still below the Fed’s 2% target since mid-2012.

Source: Bureau of Economic Analysis

Look Ahead:

- There is not a lot of company-specific news on the calendar this week. Samsung and Tesla should provide preliminary updates for the first quarter this year.

- On the economic front most of the focus will be on Manufacturing PMIs (Purchasing Manager’s Index) in U.S. and China on Monday and Euro-zone on Tuesday. In the back half of the week, we will start to see Jobs report numbers for March culminating with the U.S. Jobs report on Friday morning along with consumer credit data. Consensus estimates are for an increase of 180,000 jobs, with unemployment down to 4.0%. Average hourly earnings are expected to rise 2.7% year over year, a modest uptick from the 2.6% increase in February. Also of note, Fed Chair Jerome Powell will give a speech on the economic outlook on Fri 4/6 at 1:30pmET.