What a difference a week makes. On Wednesday, July 24, the S&P 500 closed at an all-time high of 3,019. Last week the index suffered its worst weekly loss of 2019, down 3.1%.

Frustrated by Chinese delay tactics, President Trump again escalated the trade war by threatening a 10% tariff on the remaining $300 billion of Chinese imports not already affected by tariffs. This is potentially a big deal because these tariffs will directly hit consumer goods from the iPhone to apparel. At Haverford, we were early in our prediction of “peak-tariff” in 1Q2019. The market does not care that we were wrong and closed the week within 3% of all-time highs. Easing monetary policy and adequate corporate earnings have lifted markets throughout 2019. Falling yields have also provided a tailwind to fixed income valuations. It is going to be difficult for stock prices to move meaningfully higher without a de-escalation of trade tensions.

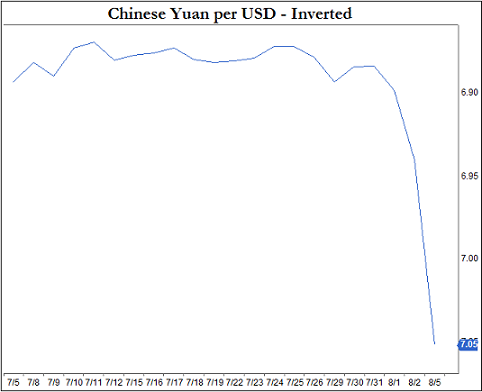

Unfortunately, as of Monday morning the trade war appears to be escalating. The Chinese Yuan has tumbled to its weakest level in over a decade, trading at 7 Yuan per U.S. Dollar. Chinese state-owned companies have been asked by their government to suspend imports of U.S. agricultural products. President Trump has responded this morning by accusing China of currency manipulation. And then asking, “Are you listening Federal Reserve?” The chances of another rate cut in September are quite high.

Source: FactSet Research Systems

According to reports, everyone in the President’s inner circle, save for Peter Navarro, dissented to Thursday’s tariff announcement. Reasonable people on both sides of the aisle agree that the U.S. should take steps to level the playing field with China, but the mechanism to effect change is more difficult to agree upon. We anticipate that the administration will temper the latest rhetoric. In the tariff pronouncement, the President provided a relatively low bar by which to postpone the levy. However, the damage has been done to the markets, which are down over 3% in early Monday trading.

Bottom line: it will take time to rebuild confidence and we expect market volatility to climb. It is hard to make the case for an immediate move higher in the S&P 500, but the just ended second quarter earnings season and accommodative monetary policy should provide support to the market.