Last Week:

- U.S. equities finished positive for the week: Last week, the Dow Jones Industrial Average (Dow) gained 12 points, or rose less than 0.1%, to 25,463. The Standard & Poor’s (S&P500) index increased 21 points, to 2,819. The Nasdaq closed 1.0% higher at 7,812, while the 10-year Treasury ended the week at 2.95%.

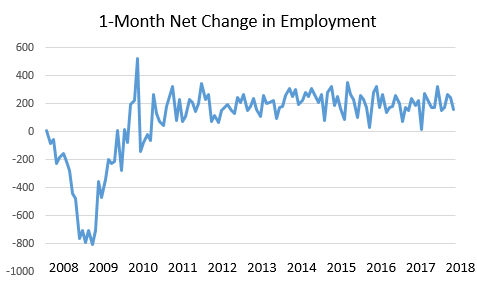

- Jobs Growth: The Bureau of Labor Statistics reported that the U.S. economy added 157,000 jobs in July, below expectations of 193,000. Although the figure came in lower than expected, net revisions to the previous two months showed an impressive increase of 59,000 jobs. The unemployment rate dropped to 3.9% and manufacturing payrolls increased by 37,000, which highlights the continuing strength of the U.S. labor market.

Source: Bureau of Labor Statistics

Look Ahead:

- Second quarter earnings will begin to wind down this week, with earnings releases expected from Disney, AMC, and Fox, among others. There will be a handful of brokerage conferences during the week, including the Cowen Communications Conference, Jefferies Global Industrial, JP Morgan Auto, and Canaccord Genuity Growth Conference, to name a few.

- On the economic calendar, important data releases include U.S. Consumer Price Index (CPI) and Producer Price Index (PPI). Abroad, we will see China FX reserves and trade balance.