Last Week:

- U.S. equities finished the week mostly unchanged: The S&P 500 advanced 0.4% to 2651, matching the percentage gain of the Dow Jones Industrials. Both indexes are at all-time highs. The Nasdaq finished down slightly.

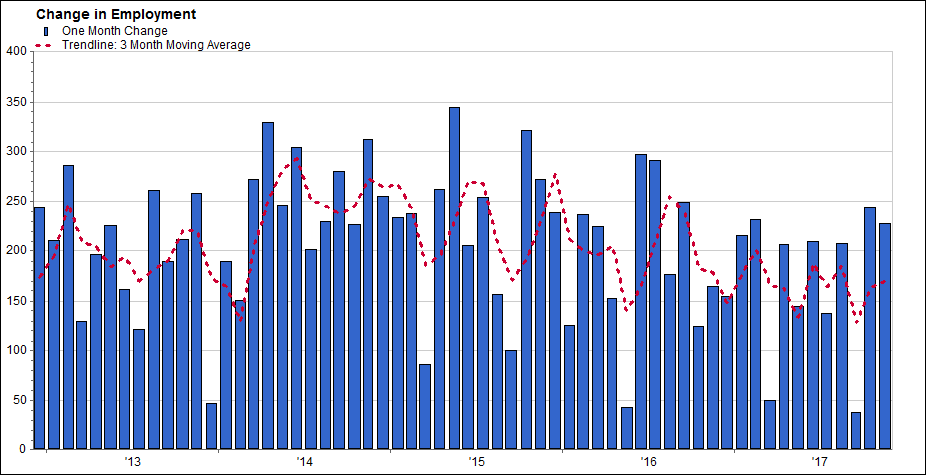

- U.S. employment rises: Employment rose by 228,000 in November, slightly above the consensus estimate of 195,000. Average hourly earnings increased by 2.5%, less than projected. The jobless rate held constant at 4.1%. The job market continues to surprise economists with job creation, but befuddles expectations of wage growth. The lack of sustained wage growth will be a major factor in the pace of Fed’s expected tightening in 2018.

Source: FactSet

Look Ahead:

- The coming week will be filled with important news items and likely set the tone through the end of 2017. The Federal Open Market Committee meets on Wednesday while the Bank of England and European Central Bank meet Thursday. The Fed is widely expected to increase rates 25 basis points to 1.25-1.50%, while the BOE is expected to follow suit with a ¼ point as well. No change is expected out of the ECB. Likely more important than possible rate hikes, the markets will also be looking for any additional commentary asset purchases. Bloomberg predicts that monthly asset purchases by Central banks will drop from $126 billion this September to $18 billion in 4Q 2018.Also on the calendar this week are important December flash PMI figures and November China economic data, both due out on Thursday. On the political front, we will know the results of the Alabama senate race on Wednesday morning and it’s possible that reconciliation wraps up with a tax bill on the President’s desk by Friday.