Last Week:

- U.S. equities finished negative for the week: Last week marked a turbulent week for stocks, following years of relative tranquility, with the major indexes falling more than 5%. The Dow and S&P500 both entered correction territory during the week – a fall of more than 10% from their highs two weeks ago. On the week, the Standard & Poor’s (S&P500) index lost 143 points, or fell 5.16%, to 2,620. The Dow Jones Industrial Average (DJIA) closed 1,330 points lower, or fell 5.21% to 24,191. The Nasdaq closed 5.06% lower at 6,874, while the 10-year Treasury finished the week at 2.83%.

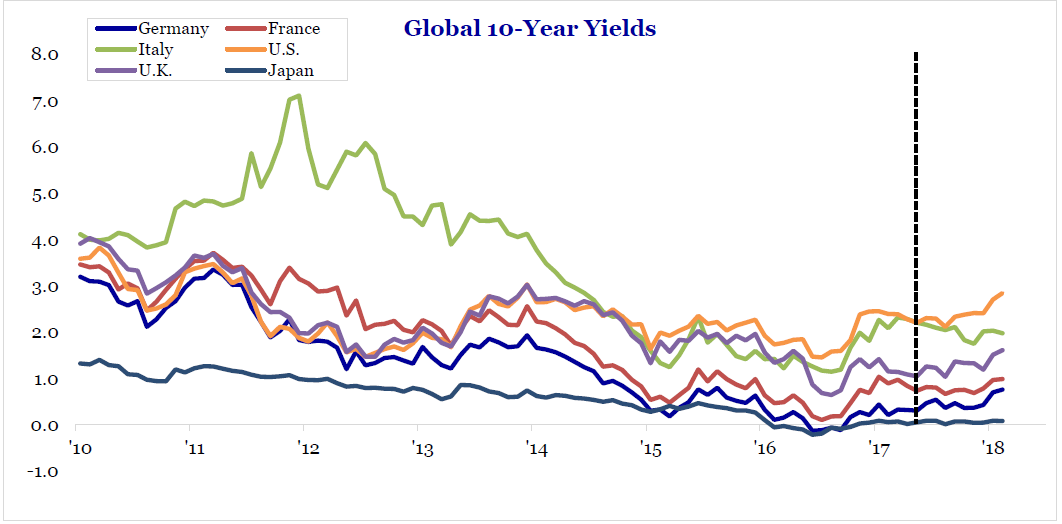

- Last week’s market downdraft ended a streak of 404 trading days without a 5% drop in stock prices from the previous high – one of the longest streaks in market history. Most market commentators have alluded to inflation fears and the potential for the Federal Reserve to tighten monetary policy much faster than anticipated, as reasons for the market pullback. With expectations of stronger economic growth globally, and unemployment at these low levels, it is not surprising that the market is concerned about higher inflation. Recently, global inflation has been ticking up modestly from its low levels, with expectations for a continued upward march, moving yield expectations higher. Nonetheless, economic fundamentals remain strong with the OECD’s (Organization for Economic Co-operation and Development) Leading Economic Indicators continuing to indicate economic activity for the next 6 months will not be different from the last six in most G7 countries.

Source: Strategas Research Partners (2018)

Look Ahead:

- Fourth quarter earnings will begin to wind down this week, with earnings releases expected from Cisco, Pepsi, Coca-Cola and Kraft-Heinz among others.

- There will be a handful of brokerage conferences during the week including the Credit Suisse Energy Summit, Goldman Sachs Tech and Internet conference, and the Leerink Global Health Care conference to name a few.

- Shifting to the economic calendar, the big catalyst this week is likely to be the January Consumer Price Index numbers on Wednesday. Consensus estimates are +1.9% vs prior year and +1.7% for core CPI (CPI ex-food & energy). The second look at Euro-zone Q4 Gross Domestic Product and Industrial Production data will also be out on Wednesday. U.S. Producer Price Index for Jan and U.S. Industrial Production data, as well as Euro-Zone trade balance will be out on Thursday. On Friday, U.S. Housing Starts and the Michigan Consumer sentiment data will be out.