Last Week:

- U.S. equities finished negative for the week: Following four weeks of strong gains, the market posted the biggest weekly drop since January 2016, with all the major indexes falling more than 3.5%. The Standard & Poor’s (S&P500) index lost 111 points, or fell 3.86%, to 2,762. The Dow Jones Industrial Average (DJIA) closed 1096 points lower, or fell 4.12% to 25,521. The Nasdaq closed 3.53% lower at 7,241. The 10-year Treasury ended the week at 2.8%.

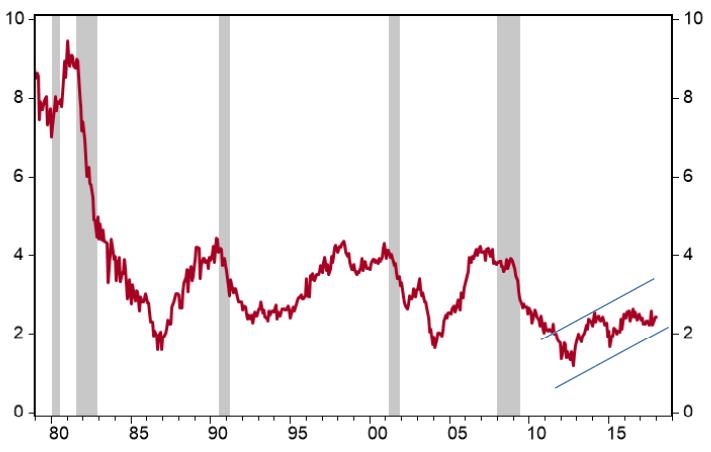

- Strong jobs report: Last week, the Bureau of Labor Statistics reported total nonfarm payroll employment rose by 200,000 in January, with major gains in construction, food services and manufacturing. The unemployment rate remained unchanged at 4.1%, a 17-year low. However, the most impactful number was the average hourly earnings, which rose 2.9% year over year, the strongest wage growth since June 2009. The sluggish wage growth during this expansion has befuddled economists, making this uptick particularly encouraging for the economy. However, for financial markets, rising wages potentially signals firming inflation ahead, which could make the Fed more aggressive with rate hikes this year.

Average Hourly Earnings (year over year % change, seasonally adjusted)

Source: U.S. Bureau of Labor Statistics (2018)

Look Ahead:

- Fourth quarter earnings will continue this week, with earnings releases expected from CVS, Disney, Expedia, Tapestry, Philip Morris and GlaxoSmithKline among others.

- The Economic calendar will start the week with U.S. Service Institute for Supply Management and European Purchasing Managers Index data on Monday, followed by U.S. Trade Balance and German factory orders on Tuesday. The calendar will shift some focus to Asia in the back half of the week, as we will see China trade balance on Thursday, and Consumer Price Index and Producer Price Index on Friday.