Last Week:

- U.S. equities finished positive for the week: On the week, the Dow Jones Industrial Average (Dow) gained 563 points, or rose 2.40%, to 23,996. The Standard & Poor’s (S&P500) index increased 64 points, or rose 2.54% to 2,596. The Nasdaq closed 3.45% higher at 6,971, while the 10-year Treasury ended the week at 2.72%.

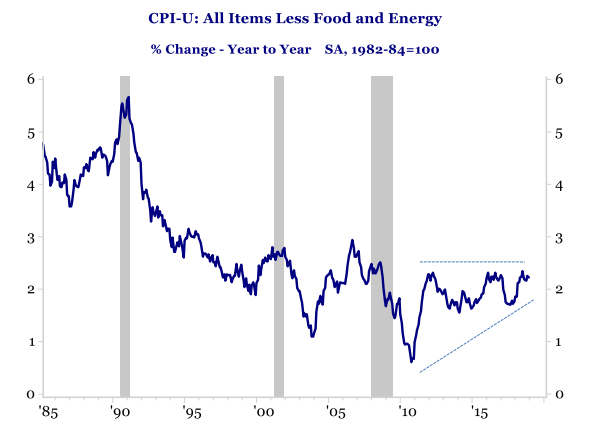

- Economic Data Summary: Last week, The Bureau of Labor Statistics reported U.S. inflation as measured by the Consumer Price Index (CPI) fell -0.1% in December, with the trailing 12-month rate slowing to +1.9%—the first time the 12-month change has been under 2% since August 2017. A sharp decline in the gasoline index (down 7.5%) was responsible for the CPI decline during the month, offsetting advances in the indexes for shelter, food, and other energy components. Core CPI (CPI ex-food and energy) actually increased +0.2% during the month, and rose +2.2% over the last 12 months, right in line with November’s +2.2% reading. Although inflation outside of energy rose during the quarter, it appears to be a manageable increase, right within the Fed’s comfort zone (around 2% target) and hence does not signal a need to be aggressive with hikes.

- During the week, we also saw some other important macro data points. The National Federation of Independent Business (NFIB) reported their Small Business Optimism Index dipped slightly in December, though still elevated at 104.4, suggesting sentiment hasn’t significantly deteriorated. We also saw the non-manufacturing Purchasing Managers Index for December at 57.6, which shows a decline from Novembers 60.7, but remains comfortably within expansionary territory (above 50).

Source: Bureau of Labor Statistics, Strategas Research Partners

Look Ahead:

- The corporate calendar will see a pickup as fourth quarter earnings season gets underway, led by Banks and Financial institutions. Notable releases include Citigroup, J.P. Morgan Chase & Co., UnitedHealth Group, U.S. Bancorp, Wells Fargo, Charles Schwab, and Fastenal, among others. The ICR conference will take place from Monday through Wednesday and will generate some news flow with pre-announcements.

- On the economic calendar, we will see Producer Price Index (PPI) data on Tuesday, Import/Export data and National Association of Home Builders (NAHB) Housing data on Wednesday, the Philly Fed Outlook, Housing Starts and Completions data on Thursday, and the Michigan Consumer Sentiment survey and Industrial Production data on Friday. Outside the United States, we will get China Import/Export data late Sunday-early Monday, followed by the Euro-Zone trade balance data on Tuesday.