U.S. equities are trading at all time highs this morning after the United States and China agreed to hold off on additional tariffs. While both sides have agreed to resume talks, major news outlets are reporting that the two sides remained as far apart as they were when talks broke up in May. One of the primary sticking points is the United States’s insistence that China agree to codify intellectual property protections and other changes in Chinese law.

Larry Kudlow, the director of the White House National Economic Council, said that no timetable existed for completing negotiations. Kudlow hopes to pick up where talks broke down in May, which the administration characterized as 90 percent of the way there. “That 90 percent number is fair, although the last 10 percent could be the toughest,” Mr. Kudlow said on Fox News Sunday. “The rest of it is going to go on for quite some time frankly.”

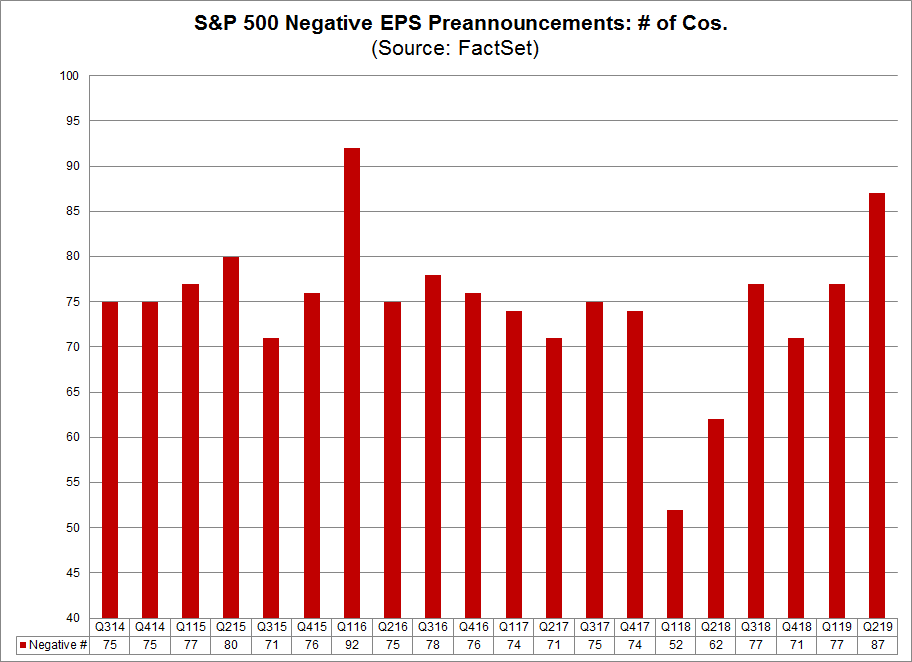

Markets are trading at all-time highs despite softening economic data and lower corporate profit expectations. As of last week, 87 S&P 500 companies have issued negative Earnings Per Share (EPS) guidance* for the quarter. If 87 is the final number for the second quarter, it will mark the second highest number of S&P 500 companies issuing negative EPS guidance for a quarter since FactSet began tracking this data in 2006 (trailing only Q1 2016 at 92).

Historically, markets have tended to perform well during the earnings season itself when preceded by large numbers of preannouncements. This makes sense intuitively. The more companies reduce expectations before earnings season, the greater the chances that companies can beat lowered expectations.

*The term “guidance” (or “preannouncement”) is defined as a projection or estimate for EPS provided by a company in advance of the company reporting actual results. Guidance is classified as negative if the estimate provided by a company is lower than the mean EPS estimate the day before the guidance was issued.