Last Week:

- U.S. equities finished positive for the week: Last week, the Dow Jones Industrial Average (Dow) gained 563 points, or rose 2.3%, to 25,019. The Standard & Poor’s (S&P500) index increased 41 points, or gained 1.5%, to 2,801. The Nasdaq closed 1.8% higher at 7,826, while the 10-year Treasury ended the week at 2.83%.

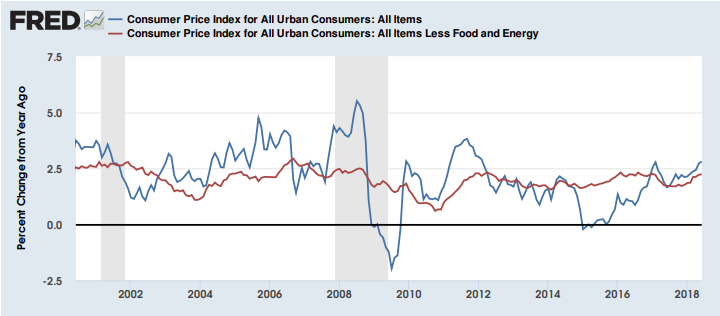

- Inflation Softens in the U.S.: Last week, The Bureau of Labor Statistics reported U.S. inflation as measured by the Consumer Price Index (CPI) increased +0.1% in June and +2.9% year over year, marking the biggest gain since February 2012. Core CPI (CPI ex food and energy) increased +0.2% in June and +2.3% in the last 12 months. Other data points, such as the soft June wage number and the Michigan inflation expectations, which fell short, are right in line with this trend. Although the underlying trend remains a steady buildup in inflationary pressure (although not runaway inflation), it appears inflation pressures eased a bit in the June reports. In theory, slowing inflation could help move 2-year yields lower, decreasing the possibility of a yield curve inversion.

CPI vs Core CPI Over the Last Two Decades (% change year over year)

Source: U.S. Bureau of Labor Statistics, fred.stlouisfed.org

NB: Shaded areas indicate recessions

Look Ahead:

- The week will be busy as second quarter earnings season picks up. Notable reporters include Bank of America, BlackRock, Johnson and Johnson, United Health, U.S. Bancorp, BB&T, Philip Morris International, Genuine Parts (NAPA), Microsoft, Schlumberger, General Electric, and Honeywell.

- On the economic calendar, China will report second quarter GDP on Monday, and Tuesday we will see Fed Chair Jerome Powell’s Senate testimony. With the spread between the U.S. 2-year and 10-year yields down to 25 basis points, raising fears of yield curve inversion, investors will be closely watching Powell’s testimony. On Thursday, we will see the U.S. leading economic indicators for June.