Last Week:

- U.S. equities finished negative for the week: Last week, the Dow Jones Industrial Average (Dow) lost 309 points, or fell 1.26%, to 24,271. The Standard & Poor’s (S&P500) index lost 37 points, or fell 1.33%, to 2,718. The Nasdaq closed 2.37% lower at 7,510, while the 10-year Treasury ended the week at 2.85%.

- U.S. Banks – Capital Raises following Fed “Stress Tests”: Last week, the U.S. Federal Reserve cleared capital plans for most large banks as part of the second round of their annual “stress test”. This year’s stress test was harsher than in recent years, testing the banks’ ability to weather more extreme conditions, including a 10% unemployment rate, a 7.5% decline in GDP, and a steep stock market decline. The results were fine overall and the banks can now increase dividends and pursue buybacks.

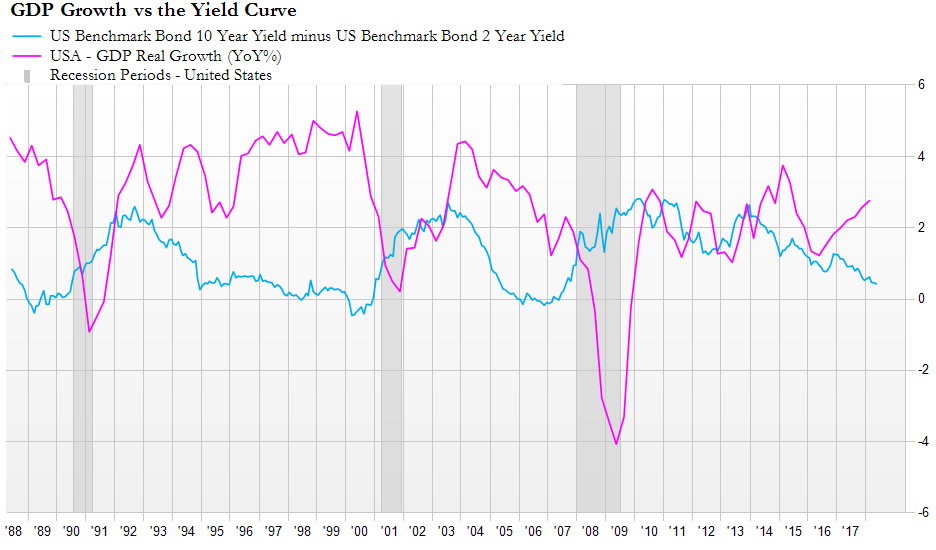

- Yield Curve: Over the last several weeks, investors (especially equity investors) have been worried about a possible yield curve inversion, as it has historically been a strong signal of a recession 18 months out. The current spread between the 2 year and 10 year rates is 32 basis points, the lowest of this cycle. Although the 2-10 year spread has been the main investor focus, in our opinion, for a true inversion (defined as short-term rates above long-term rates), 3 month rates would have to be above 10 year rates, which currently appears to be a long way out. With respect to stresses from an inverted curve, every single borrower; individual, company, local government, etc. has extended the term of their debt. They all have as low an exposure to short-term debt as in any modern cycle. The rise in shorter rates should have much less of an impact than in prior cycles.

Source: FactSet, June 2018

Look Ahead:

- On the economic calendar, the holiday shortened week should be relatively busy with a slew of reports including, The Institute for Supply Management (ISM) manufacturing index on Monday (expected to drop slightly), U.S. factory orders on Tuesday, minutes from the June 13th Federal Open Market Committee (FOMC) meeting that raised rates on Thursday, and the June jobs report on Friday. Expectations are for 200k new jobs for the month, with the unemployment rate remaining at 3.8% (2nd lowest level since 1969) and hourly earnings increasing by 0.3%. Additionally on Friday, the U.S. tariffs imposed on $34 billion worth of Chinese goods goes into effect. Internationally, we expect to see Chinese Purchasing Managers Index (PMIs), the Euro-zone May unemployment, and Germany factory orders. U.S. markets are closed on Wednesday – Happy Independence Day!