Last Week:

- U.S. equities finished mixed for the week: Last week, the Dow Jones Industrial Average (Dow) gained 393 points, or rose 1.6%, to 25,451. The Standard & Poor’s (S&P500) index increased 17 points, to 2,819. The Nasdaq closed 1.1% lower at 7,737, while the 10-year Treasury ended the week at 2.96%.

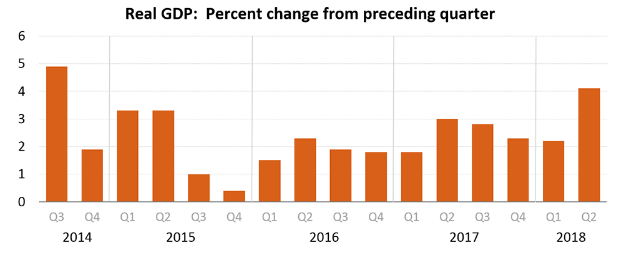

- Strong U.S. Economy: According to the Commerce Department, U.S. Gross Domestic Product (GDP) grew by 4.1% in the second quarter, marking the strongest gain since 2014 and the fourth best quarter of the current expansion (since 2009). The main drivers of the strong GDP growth number were robust consumer spending, strong business investment, and higher exports during the quarter. Consumer spending in particular, which accounts for about 70% of GDP, was exceptionally strong, growing 4%, almost double last year’s average of 2.4%. The strong GDP report makes it likely the Federal Reserve will continue on its tightening path to prevent the economy from overheating. As the Federal Open Market Committee (FOMC) meets this week, investors expect no changes to the fed funds rate, followed by two more hikes for the remainder of the year.

Source: Bureau of Economic Analysis, Seasonally Adjusted at Annual Rates

Look Ahead:

- This week will again be largely dominated by second quarter earnings releases, especially Wednesday going into Thursday morning. Notable reporters include American Tower, Eaton, Johnson Controls, Apple, ADP, Becton Dickinson, DowDuPont, and Kraft Heinz among others.

- The economic calendar will also be very busy this week; we will see Bank of Japan, Bank of England, and the FOMC rate decisions, along with inflation numbers with U.S. Employment Cost Index and Eurozone Consumer Price Index for July. Lastly, on Friday we will get the U.S. July Jobs Report.