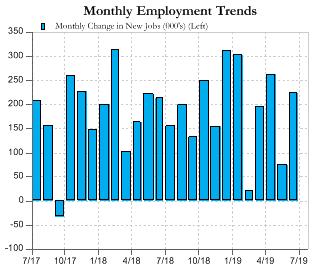

“Good news is bad news” was the market’s initial reaction to Friday’s strong jobs number. The U.S. Labor Department reported that the economy added 224,000 jobs during the month of June, well ahead of expectations for 165,000 new jobs and far pacing 72,000 new jobs in May. A strong jobs number calls into question the chance of a rate cut when the FOMC meets in late July, which the market has been anticipating with the utmost certainty. Now the market must decide whether it prefers weak data that supports a series of rate cuts or strong data and a continuing expansion. We vote for continued expansion, even though asset prices may not react as favorably in the near-term. Also, we should not lose sight that both the Dow Jones and S&P 500 closed at all-time highs on Wednesday.

Corporate earnings season (the period following calendar quarter-end when most companies report their results and provide guidance) will be kicked off this week by Pepsico. According to Factset Earnings Insight, analysts are projecting a decline in earnings of -0.5% in Q3 and revenue growth of 3.8%. For the full year, analysts still expect earnings to grow, albeit at the tepid rate of 2.6%. Since earnings will be flat to down through the first three quarters of 2019, this year’s projections are a perfect example of “back end loaded” with earnings per share growth expected to accelerate to 6.3% in the fourth quarter.

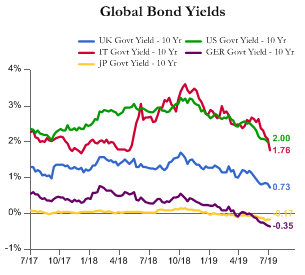

The collapse in global bond yields is a massive and noteworthy development as we survey the macro landscape. A combination of anticipated central bank easing, reduced fiscal risk in Italy, and sluggish economic growth (the U.S. June jobs number notwithstanding) have caused bond yields to crater. According to JP Morgan research, Europe is the key source of downside yield pressure with three key events playing a major role in spiking bond prices: Mario Draghi’s dovish speech on June 18th, Christine Lagarde’s appointment to succeed Draghi as head of the ECB on July 2nd, and the possible truce between E.U. deficit hawks and Italian populists on July 3rd. Any action the U.S. Fed takes on interest rates has to be viewed in light of this global backdrop.