Last Week:

- U.S. equities finished mixed for the week: Last week, the Dow Jones Industrial Average (Dow) lost 118 points, or fell 0.48%, to 24,635. The Standard & Poor’s (S&P500) index gained 13 points, or rose 0.49%, to 2,735. The Nasdaq closed 1.62% higher at 7,554, while the 10-year Treasury ended the week at 2.85%.

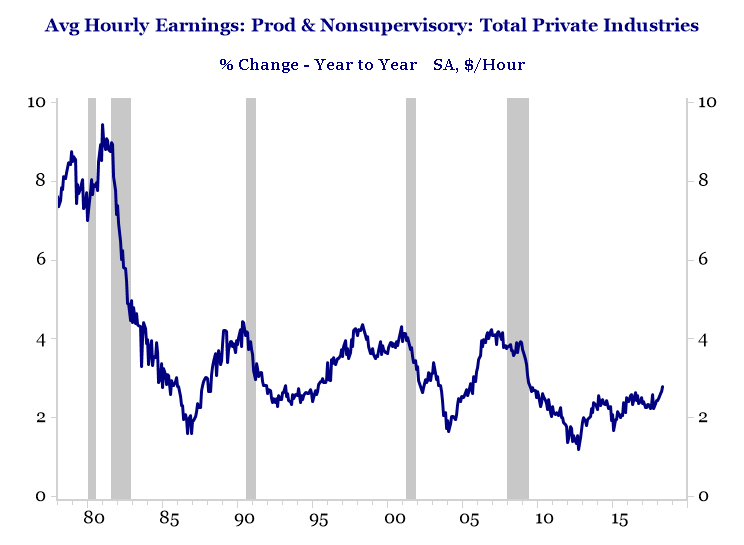

- Another Strong Jobs Report: Last week, the Bureau of Labor Statistics reported U.S. employers added 223,000 jobs (vs. expectations of 190,000) during the month of May, with the unemployment rate ticking down to 3.8% from 3.9% in the previous month. During the month, average hourly earnings rose modestly (+0.3%) in line with expectations, bringing the annualized rate to +2.7%, compared to last month’s +2.6%. The U-6, which measures underemployment, also ticked down to 7.6%, with the labor force participation now at 62.7%. As the unemployment rate continues to tick down, investors will continue to closely monitor wage inflation as it is bound to pick up at some point.

Source: Strategas Research Partners, Bureau of Labor Statistics

Look Ahead:

- The earnings calendar will be relatively slow this week with reports from Broadcom and United Natural Foods, among others and a handful of brokerage conferences including Jefferies Global Healthcare and Raymond James Best ideas, among others. On the economic calendar, we will see U.S. Purchasing Manager’s Index (PMIs), U.S. Trade Balance, Chinese Trade Balance and Currency Reserves towards the end of the week. Germany Factory Orders will be out on Thursday and German Trade Balance with be released on Friday.