Last Week:

- U.S. equities finished positive for the week: Markets remained volatile during the week, moving on tariff fears, White House Economic Adviser Gary Cohn’s resignation and the strong jobs report on Friday. The Dow Jones Industrial Average (Dow) gained 798 points, or rose 3.25%, to 25,336. The Standard & Poor’s (S&P500) index gained 95 points, or rose 3.54%, to 2,787. The Nasdaq closed 4.17% higher at 7,561, while the 10-year Treasury ended the week at 2.89%.

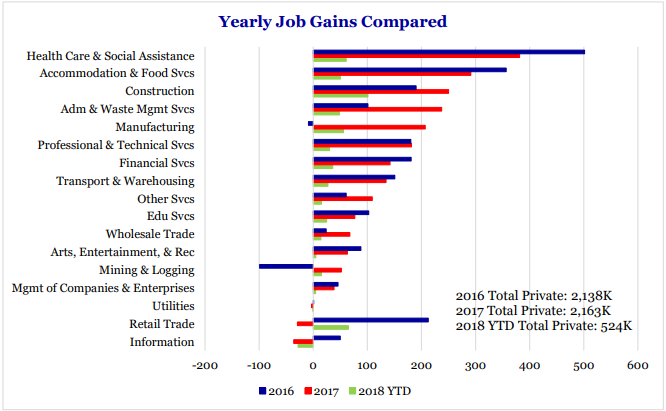

- Strong Jobs Report: Last week, the Bureau of Labor Statistics reported total nonfarm payroll employment rose by 313,000 (vs expectations of 195,000) in February, marking the largest monthly gain since July 2016. Employment rose in construction, retail trade, professional and business services, manufacturing, financial activities, and mining. During the month, 806,000 Americans joined the labor force, the largest one month increase since 1983 bringing the labor force participation ratio to 63%. Despite the large number of jobs added, the unemployment rate remained unchanged at 4.1% because of the increase in the labor pool, also slowing down wage growth for the month. Investors were closely watching the wage growth number, which came in at +2.6% (vs expectations of +2.8%) year over year, below last month’s +2.9%. Inflation fears were slightly eased by this month’s job report with the market expecting the Fed to stay on schedule with the planned rate hikes for the year.

Source: Strategas Research Partners

Look Ahead:

- The week ahead will be relatively quiet on the earnings front with a bulk of the volume on Thursday morning. There are some notable brokerage conferences this week with the Roth Conference throughout the week, as well as the Cowen and Barclays Healthcare conference, and the JP Morgan Aviation, Transportation, and Industrial conference.

- This will be a muted week for the economic calendar. We will see U.S. February Consumer Price Index (CPI) numbers on Tuesday as well as China’s February economic data which will be out Tuesday night / Wednesday morning. In Europe we will see Euro-zone CPI on Friday.