Last Week:

- U.S. equities finished negative for the week: Last week, disappointing European manufacturing data coupled with a “dovish” Fed drove equities down as fears of a global economic slowdown increased. We saw the spread between the 2-year and 10-year treasury yields narrow to the lowest level since 2007, while the 3-month/10-year yields inverted for the first time since 2007, raising concerns of a recession (despite positive economic fundamentals, albeit slowing). On the week, the Dow Jones Industrial Average (Dow) lost 347 points, or fell 1.34%, to 25,502. The Standard & Poor’s (S&P500) index decreased 22 points, or fell 0.77% to 2,801. The Nasdaq closed 0.60% lower at 7,643 while the 10-year Treasury ended the week at 2.45%.

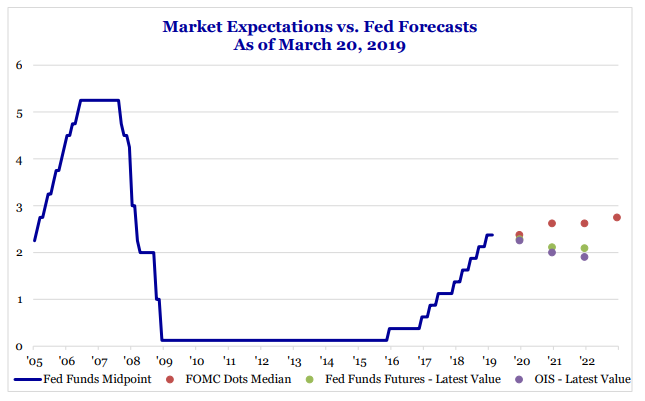

- Fed Recap: During the week, the Federal Open Market Committee (FOMC) decided to leave the Federal Funds Rate unchanged at 2.25-2.50% in a widely anticipated move and signaled no hikes for the remainder of 2019, with one hike in 2020. The sharp “dovish” turn comes three months after the Fed had signaled two hikes for 2019, after raising rates four times in 2018. The Fed also announced that it will slow the pace of its balance sheet roll-off program in May 2019 and eventually end the reduction in September 2019, exactly two years after it began. The move came with an acknowledgment of weaker coincident economic conditions and a subsequent downward adjustment of GDP and inflation expectations, while modestly adjusting unemployment expectations higher. Officials now forecast GDP growth of 2.1% in 2019, down from the 2.3% estimate in December, unemployment rate up to 3.7% from 3.5%, and inflation down to 1.8% from the previous 1.9% target (although core PCE was left unchanged).

Source: Strategas Research Partners, Federal Open Market Committee (March 2019)

Look Ahead:

- The corporate calendar will be relatively quiet this week, with a handful of companies reporting earnings. Notable reporters include, Red Hat, Cronos Group, McCormick, Lululemon, Paychex, Accenture, and CarMax, among others. There will also be a number of broker conferences during the week.

- On the economic calendar, domestically we will see housing data released throughout the week, with housing starts and FHFA (Federal Housing Finance Agency) Home Price Index on Tuesday, mortgage apps on Wednesday, and new home sales on Friday. We will also see consumer confidence data on Tuesday, U.S. trade balance on Wednesday, revised GDP estimates on Thursday, and Chicago Purchasing Managers Index (PMIs) and personal income data on Friday. Outside the United States, it will be a fairly quiet week with Chinese industrial production numbers out on Tuesday, as well as news flow around continuing U.S./China trade talks.