Last Week:

- U.S. equities finished negative for the week: The market continued to sell off last week driven by a slew of narratives – trade war fears, a seemingly hawkish Fed, and Facebook’s privacy concerns among others. The Dow Jones Industrial Average (Dow) lost 1,413 points, or fell 5.67%, to 23,533. The Standard & Poor’s (S&P500) index lost 164 points, or fell 5.95%, to 2,588. The Nasdaq closed 6.54% lower at 6,993, while the 10-year Treasury ended the week at 2.826%.

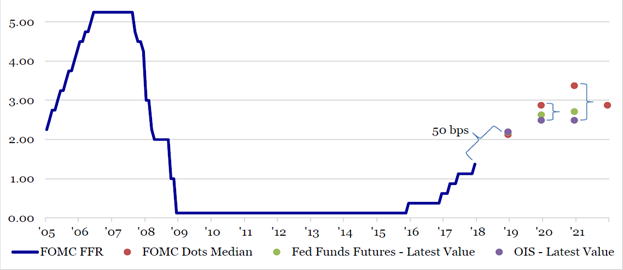

- Fed raises rates: As anticipated by the market, the Federal Open Market Committee (FOMC) announced a 25bps increase to the fed funds rate to a range of 1.50% to 1.75%. The Fed statement acknowledged a strengthening of the economic outlook in recent months, but suggested that the growth in household spending and business fixed investment have moderated from 4th quarter readings. Going into this meeting, the market had been focusing on the updated dot plot for 2018-2020 with expectations for a more hawkish Fed. Although the projected rate hikes for 2018 remained below four (perceived as “dovish”), the 2020 projection rose from 3.1% to 3.4%, which is a more hawkish tightening path.

Market Expectations vs. Fed Forecasts (As of March 21, 2018)

Source: Strategas Research Partners. OIS – Overnight Indexed Swap, FFR – Fed Funds Rate

Look Ahead:

- The week ahead should be relatively quiet. We will see steady earnings volume including a handful of retail stocks. Notable reporters include Paychex, Lululemon, Walgreens, and Constellation Brands among others. Meanwhile on the economic calendar, we will see consumer confidence numbers on Tuesday and February Core Personal Consumption Expenditures (PCE) index on Thursday morning. U.S. Markets will be closed on Friday for the Good Friday holiday.