Last Week:

- U.S. equities finished positive for the week: The Dow Jones Industrial Average (Dow) gained 439 points, or rose 1.73%, to 25,764. The Standard & Poor’s (S&P500) index increased 48 points, or rose 1.70% to 2,860. The Nasdaq closed 2.21% higher at 7,816, while the 10-year Treasury ended the week at 2.39%.

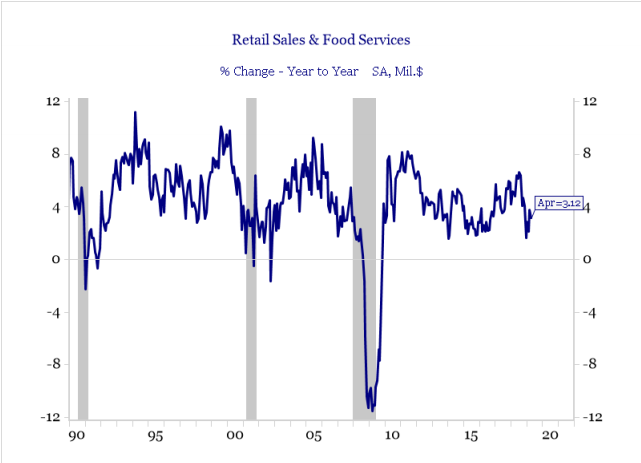

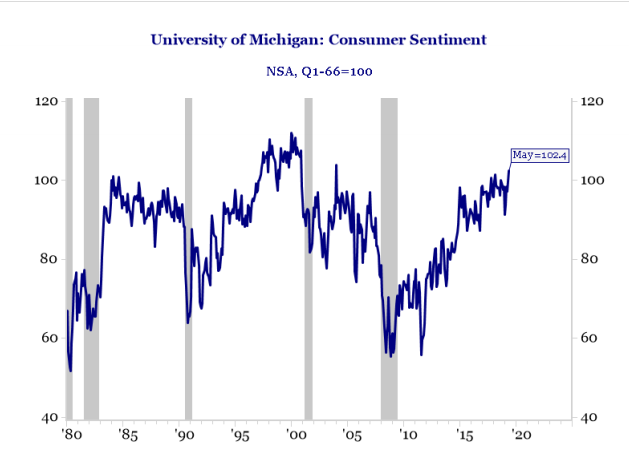

- Key Economic Data Recap: Last week, the U.S. Census Bureau reported retail sales (a measure of purchases at stores, restaurants, and online) for the month of April slid -0.2% from the March reading, coming in below economists’ expectations for a modest increase. The weak April number follows a strong +1.7% gain (revised from +1.6%) in March and was driven by lower spending on vehicles and electronics, among others. During the month, auto-related sales, which make up about 20% of retail sales, declined -1.1%, while consumer spending at the pump rose +1.8% as gas prices continued to rise. Compared to the same period a year ago, retail sales were up +3.1% during the month. The American consumer remains stronger than ever, with the University of Michigan Consumer Sentiment survey hitting 102.4 in early May, up from April’s 97.2, marking the highest level in 15 years. Though the survey’s Chief Economist, Richard Curtin, warned that the gains were recorded “mostly before the trade negotiations with China collapsed, and [before] China responded with their own tariffs.” As we continue into the second quarter, expectations are for a strong recovery in retail sales as consumer confidence remains high, and the job market remains strong with continued rising wages.

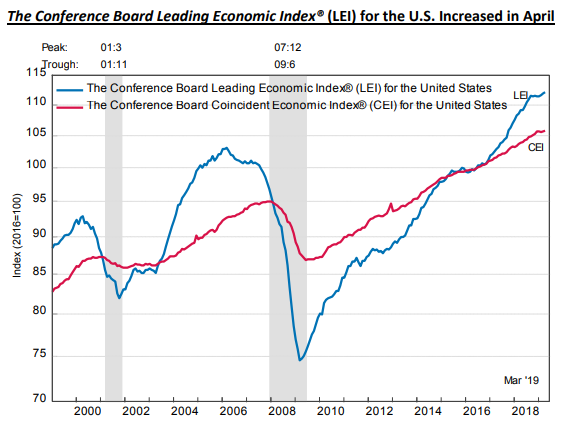

- During the week, we also saw the Conference Board’s Leading Economic Indicators Index for the United States, which increased +0.2% in April, following a +0.3% increase in March and a +0.2% increase in February. The April gain brought the growth of the index over the last 12 months to +2.8%, modestly slower than March’s +3.1% reading. A majority of the components rose during the month, with strength in stock prices, financial conditions, and consumers’ outlook on the economy all solid contributors, partially offset by weakness in the manufacturing sector. The Board’s Coincident Economic Index (CEI), a measure of current economic activity, increased +0.1%, with the Lagging Economic Index also declining +0.1% during the month. Bottom-line, although the coincident data appears weak, the leading indicator data remains strong. The Conference Board expects economic growth to moderate toward 2% by year-end, with the current expansion entering its 11th year in July, becoming the longest expansion in U.S. history.

Source: U.S. Commerce Department, Strategas Research Partners

Source: University of Michigan, Strategas Research Partners

Source: The Conference Board

Look Ahead:

- The corporate calendar will slow down this week as first quarter earnings season continues to wind down. Notable reporters include AutoZone, Home Depot, Nordstrom, TJX Companies, Toll Brothers, Advance Auto Parts, Lowe’s Companies, Target, L Brands, Ross Stores, and Medtronic, among others. There will also be a number of broker conferences and investor meetings during the week.

- On the economic calendar, we will see the Chicago Fed data, Existing Home Sales, Federal Open Market Committee (FOMC) Minutes, Jobless Claims, New Home Sales, Kansas Fed Manufacturing data, and Durable Goods data. The U.S.-China trade negotiations should continue to generate headlines during the week as well.