Last Week:

- U.S. equities finished negative for the week: Last week, the Dow Jones Industrial Average (Dow) lost 116 points, or fell 0.47%, to 24,715. The Standard & Poor’s (S&P500) index lost 16 points, or fell 0.54%, to 2,713. The Nasdaq closed 0.66% lower at 7,354, while the 10-year Treasury ended the week at 3.067%.

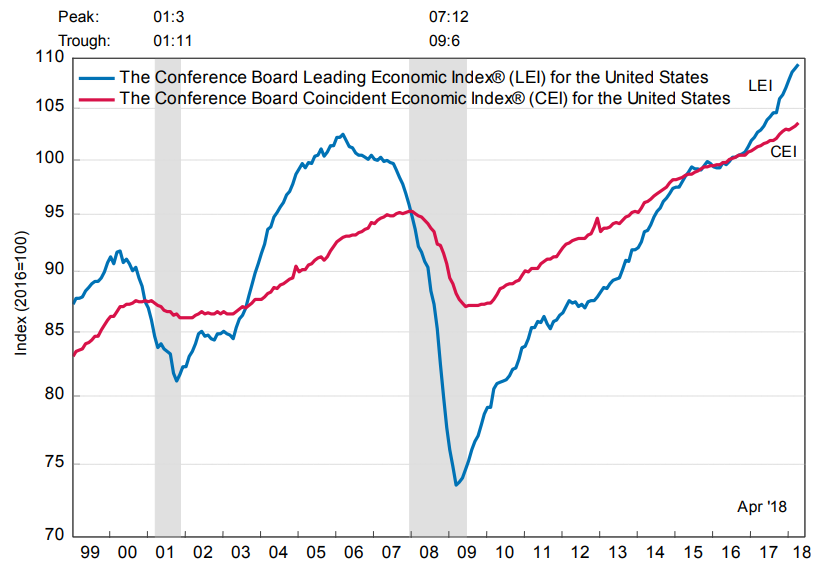

- U.S. Leading Economic Indicators: The Conference Board’s Leading Economic Indicators Index for the U.S. rose 0.4% during the month of April, following March’s 0.4% increase, and February’s 0.7% increase. Although the six-month growth rate recently moderated, suggesting growth is unlikely to accelerate, the strong April numbers continue to point to a solid second half of 2018 for the U.S. economy. The Board’s Coincident Economic Index (CEI), a measure of current economic activity increased 0.3%, and the Lagging Economic Index increased 0.2% in April.

U.S. Composite Leading Economic Indicators Index (2016 = 100)

Source: The Conference Board (April 2018)

Look Ahead:

- Earnings reports will pick up this week with notable reports from Advance Auto Parts, Lowe’s, Target, TJX Companies, Medtronic, and Gap among others. On the economic calendar, domestically, we will see Fed speakers on Monday; the Richmond Fed meeting on Tuesday; Flash Purchasing Managers Index (PMIs) and minutes from the May Federal Open Market Committee (FOMC) meeting on Wednesday; and New and Existing Home Sales, U.S. Durable Goods data, and Michigan Consumer-sentiment towards the end of the week. Outside the U.S., we will see Euro-zone Flash PMIs.