Last Week:

- U.S. equities finished mixed for the week: Last week, the Dow Jones Industrial Average (Dow) lost 49 points, or fell 0.20%, to 24,263. The Standard & Poor’s (S&P500) index lost 6 points, or fell 0.24%, to 2,663. The Nasdaq closed 1.26% higher at 7,210, while the 10-year Treasury ended the week at 2.946%.

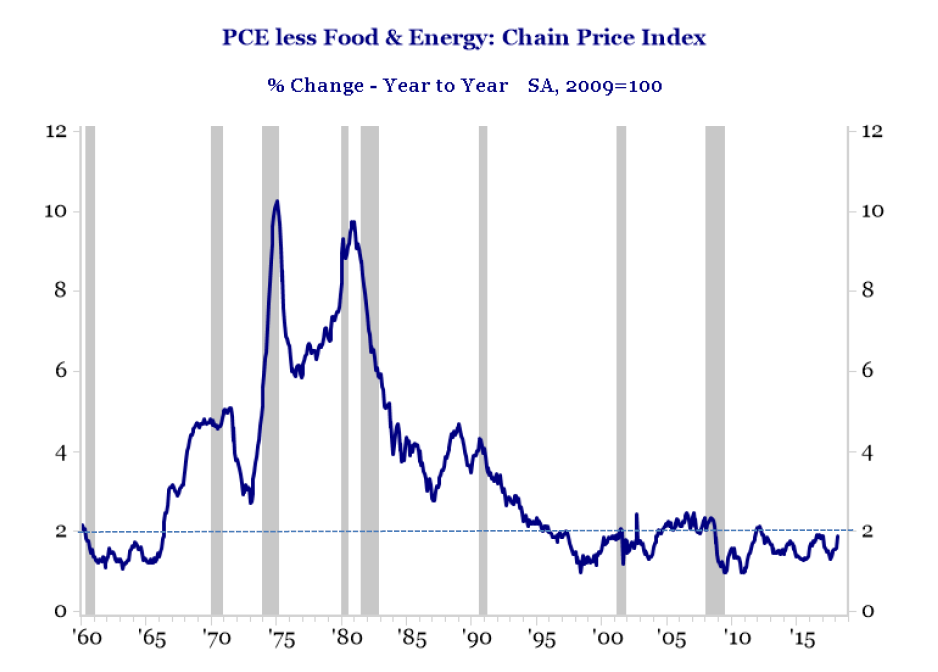

- U.S. economy still strong: Last week, the Bureau of Labor Statistics reported U.S. employers added 164,000 jobs (vs. expectations of 190,000) during the month of April, with the unemployment rate ticking down to 3.9% (first time since 2000). During the month, average hourly earnings rose modestly although below expectations, bringing the annualized rate to 2.6%, below last month’s 2.7%. During the week, we also saw the Fed hold interest rates steady as widely expected, while acknowledging both the health of the overall economy and firming inflation. The Fed’s preferred inflation measure, core PCE (Personal Consumption Expenditures – less food and energy) for March came in at 1.9% y/y, in line with economists’ expectations, but continuing to approach the Fed’s 2% target.

Source: Bureau of Economic Analysis, Strategas Research Partners

Look Ahead:

- First quarter earnings season will continue with notable reports from, Sysco, Disney, Perrigo, Twenty-First Century Fox, AMC, and News Corp among others. On the economic calendar, the week will be relatively slow with China Imports/Exports on Tuesday morning, and a Bank of England rate decision and U.S. Consumer Price Index (CPI) numbers on Thursday morning.